- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- REAL ESTATE TAXES PAID INDIVIDUALLY - TURBO TAX WOULD NOT LET ENTRY OF AMOUNTS PAID - WHY NOT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

REAL ESTATE TAXES PAID INDIVIDUALLY - TURBO TAX WOULD NOT LET ENTRY OF AMOUNTS PAID - WHY NOT?

While inputting numbers, I skipped entering real estate taxes from my financial institution holding my mortgage because the institution did not pay the taxes - no escrow account. Instructions say to enter taxes if you paid yourself into cell asking about real estate taxes paid, but several attempts to enter number were unsuccessful. Prior years there was a drop-down box to enter individual items that made up the total - i.e. county & state (medical was also set up to list various appointments, tests, prescriptions, etc.).

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

REAL ESTATE TAXES PAID INDIVIDUALLY - TURBO TAX WOULD NOT LET ENTRY OF AMOUNTS PAID - WHY NOT?

If you would like to enter 2020 real estate taxes paid, you can follow these steps in TurboTax:

- Open your return.

- Search for real estate taxes with the magnifying glass tool at the top of the page.

- Click the Jump to real estate tax link at the top of the search results.

- Answer yes to the question Did you pay property or real estate taxes in 2020?

- Fill in the property taxes paid in 2020.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

REAL ESTATE TAXES PAID INDIVIDUALLY - TURBO TAX WOULD NOT LET ENTRY OF AMOUNTS PAID - WHY NOT?

Hi Lena - I did try to enter when I got to the screen in the deductions section and could not type as the field would not accept. When I followed your instructions, I ended up at the same screen and it still would not let me enter anything. I finally clicked on forms and found the form for Schedule A and was able to type directly into the form. Because the standard deduction has been raised and itemized deductions are not being used as they had been, I have found it more difficult to enter the information for that schedule. The only reason I like to be able to enter information for the itemized deductions, for anyone who is wondering, is because it is a good habit to get into should medical expenses rise, etc., and it is a good gauge to measure from year to year to help remember what items need to be recorded. P.S. I also have long-term care insurance premiums that are deductible on the NYS tax return and if they don't carry over from the Federal, I have to input myself onto the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

REAL ESTATE TAXES PAID INDIVIDUALLY - TURBO TAX WOULD NOT LET ENTRY OF AMOUNTS PAID - WHY NOT?

The program allows two ways to enter property tax, but there is a specific order to do this.

- The first is to enter it directly under Property (Real Estate) Taxes; however, you must do this before you post the 1098 for your mortgage.

- If you have a 1098 for your mortgage you can enter under Mortgage Interest and Refinancing (Form 1098) at the bottom of the input screen. This will be posted to your summary page as Property Taxes.

After this is posted the "Property Tax" inputs will be limited to Additional State Income & Sales Tax and foreign taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

REAL ESTATE TAXES PAID INDIVIDUALLY - TURBO TAX WOULD NOT LET ENTRY OF AMOUNTS PAID - WHY NOT?

Putting them directly on the Sched A in Forms Mode is not a good idea...it can have other unintended consequences. It actually is supposed to go on line 2a of the Tax & Int Wks (Tax and Interest Deductions Worksheet) if in Forms Mode. But they are better entered properly in the Interview.

IF you are in the interview for Property Taxes, and you see a "$0" that won't let you enter anything in the field....then there is a "Supporting Details" sheet attached to that field. Double-click on the field, and the S.D. worksheet will pop up... There are a number of areas where this can occur...especially if you used one last year for that field/entry spot.

This only occurs in the Desktop software, and only for fields with a "$0" that don't allow you to change them, and not a simple"$"

Try to remember that for future years.

______________________________________

Once the S.D. sheet pops up, you can either use it, or delete it entirely (big red X at the top of the sheet).

_______________________

If the double-click doesn't work, post back here, there are other ways to get it to show up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

REAL ESTATE TAXES PAID INDIVIDUALLY - TURBO TAX WOULD NOT LET ENTRY OF AMOUNTS PAID - WHY NOT?

Very easy. Just need to know the double click trick! Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

REAL ESTATE TAXES PAID INDIVIDUALLY - TURBO TAX WOULD NOT LET ENTRY OF AMOUNTS PAID - WHY NOT?

Cl

Never had this problem in previous years! Have used Turbo tax for years................time for a change.

Also had this problem in several other areas

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

REAL ESTATE TAXES PAID INDIVIDUALLY - TURBO TAX WOULD NOT LET ENTRY OF AMOUNTS PAID - WHY NOT?

These taxes are part of the itemized deductions if you have more expenses than the standard deduction.

- The standard deduction for married couples filing jointly for tax year 2021 rises to $25,100, up $300 from the prior year.

- For single taxpayers and married individuals filing separately, the standard deduction rises to $12,550 for 2021, up $150, and

- For heads of households, the standard deduction will be $18,800 for tax year 2021, up $150.

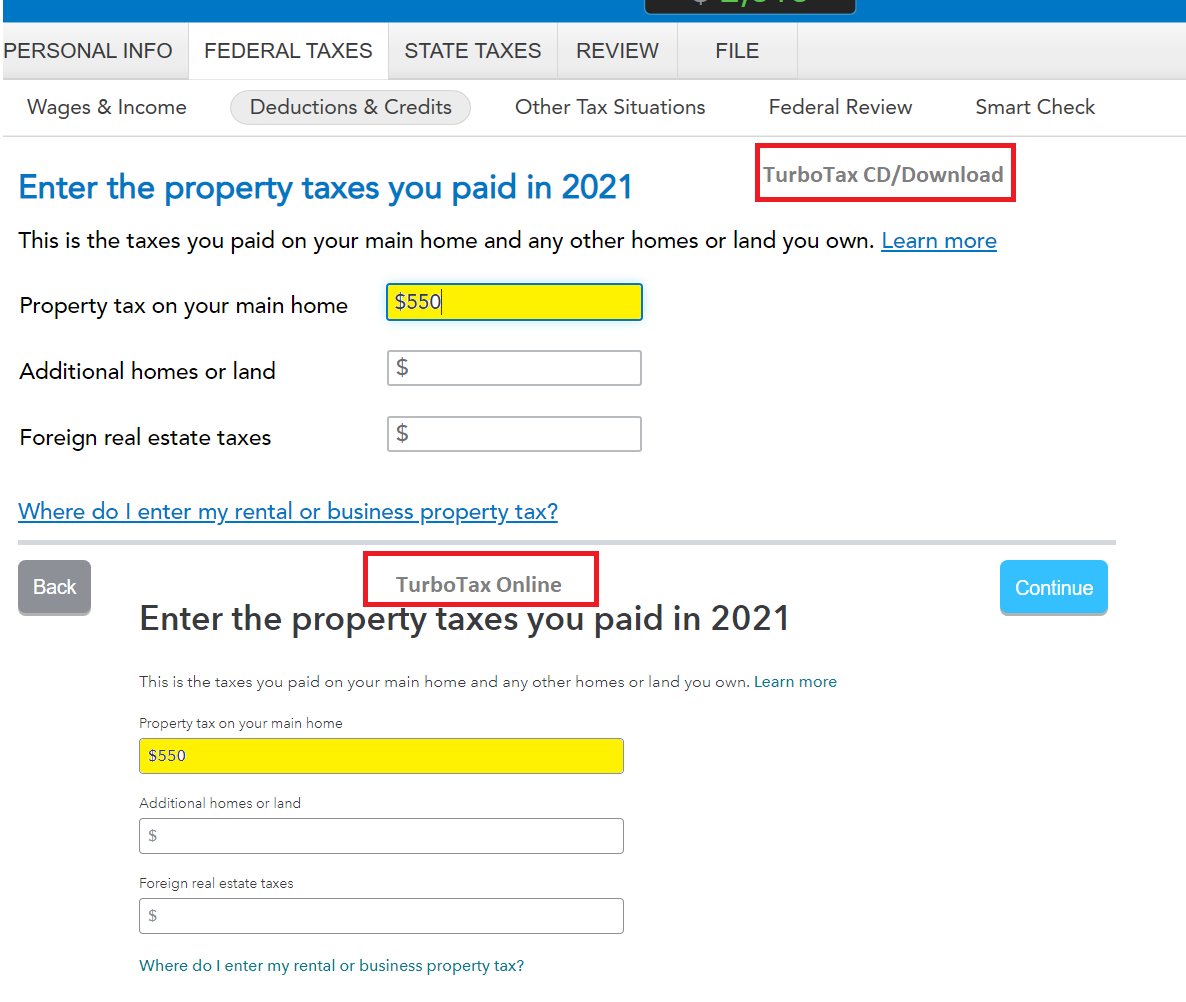

The real estate taxes can be entered through a Form 1098 with mortgage interest or separately under Deductions & Credits, Your Home, Property Taxes (TurboTax Online or TurboTax CD/Download).

See the images below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

dbow58

Returning Member

jastilley

Returning Member

makeit easier

Level 1

ddubs82

Level 2

Brostman

New Member