- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Why is Stimulus amounts being included in income while calculating the tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Stimulus amounts being included in income while calculating the tax return?

I see that the tax calculator software is adding the Stimulus amounts in income and increasing the tax return. Why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Stimulus amounts being included in income while calculating the tax return?

In some cases TurboTax is starting the return and assuming that no stimulus payments have been received. It adds the amount of the stimulus payments to the refund or as a credit against any taxes due.

When you tell TurboTax that you received the stimulus payments, then it deducts that amount from the tax credit and gives you the actual amount of refund or taxes due.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Stimulus amounts being included in income while calculating the tax return?

Thank you for your response. The amounts are shown as credit after answering as Yes, I received the stimulus checks and provided the amounts I received.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Stimulus amounts being included in income while calculating the tax return?

No, the stimulus payments only show as a refundable credit if you have not received them.

They are not taxable income.

TO GET TO THE STIMULUS SECTION OF TURBOTAX:

Go into your account and click "Tax Home"

On that screen click "Other Tax Situations"

When the drop-down opens, click "Let's Get Started" or "Review/Edit" to move forward

There may be a delay when opening to this next screen

Scroll to the bottom of this screen and click "Let's keep going"

The next screen should read "Let's make sure you got the right stimulus amount" (If not, click continue to move forward until you do get to that screen)

Scroll down and click "Continue"

The next screens will ask if you received the stimulus, which ones and how much.

The software will calculate a credit if applicable.

TO VIEW THE RECOVERY REBATE CREDIT:

Click Tax Home

Click Review if necessary to get Tax Tools on the left side-bar

Click Tax Tools on the left side-bar (you may need to use the scroll bar for the left side-bar to see this)

Click Tools on the drop-down list

Click View Tax Summary on the Tools Center screen

When you do this, Preview my 1040 appears on the left side-bar

Click Preview my 1040 on the left side-bar

Scroll down and look at line 30 on the 1040 for your “Recovery rebate credit”

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Stimulus amounts being included in income while calculating the tax return?

Hi,

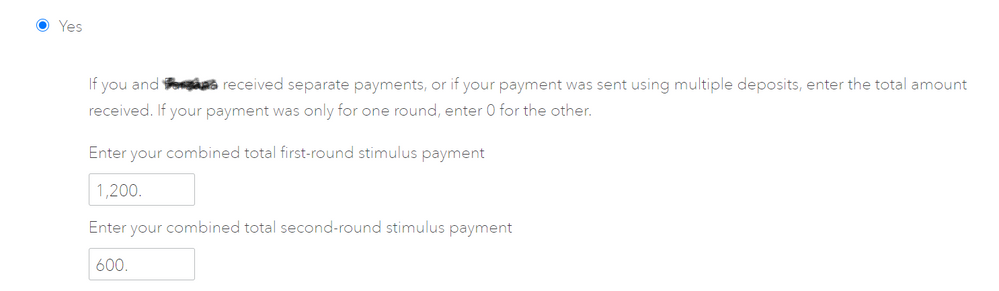

Thank you for your response. I have cross checked again and I have answered correctly. I have selected "Yes" and provided amounts of $1200 and $600.

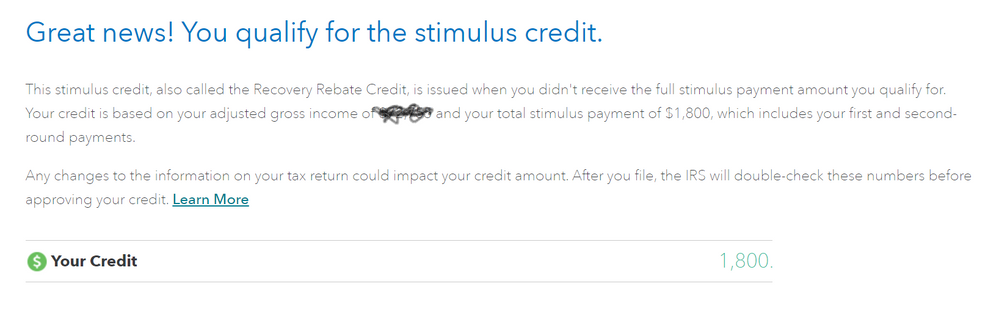

But on the next screen it shows as Credit of $1800.

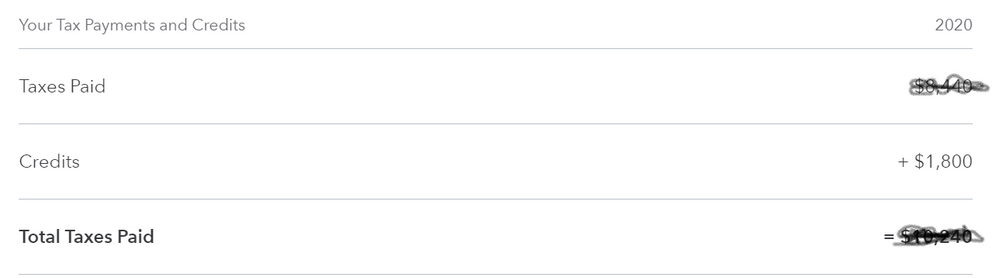

And then its added to the Taxes Paid as below:

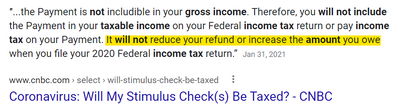

However, when I googled, I found that this Stimulus amount should not be added to the taxes as credit:

Please let me know how does this Stimulus Checks increase my Tax Return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Stimulus amounts being included in income while calculating the tax return?

You are correct. As you highlighted, the stimulus payments will not "reduce" your refund or "increase" the amount of taxes you owe.

The stimulus payment on your 2020 tax return is called the Recovery Rebate Credit. If eligible, the credit will "increase" your refund or "lower" the amount of taxes you owe.

It appears from your post that you may be filing a joint 2020 return. The Recovery Rebate Credit is based on the information entered in your 2020 return. That would make the total eligible credit for you, $3600 (2400 and 1200).

The stimulus payments in rounds one and two were advances on the Recovery Rebate Credit. So, you have already received 1800 of your total eligible amount, so the remaining credit (1800) is added to your return as a refundable credit on line 30 of your 1040.

Here is a link with more information on the Recovery Rebate Credit eligibility and calculations.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Stimulus amounts being included in income while calculating the tax return?

The Stimulus checks were based on last year's (2019)'s tax return filing. At that time I had filed as Single.

This year (2020) my family arrived in the USA on the last week of September so its hardly 4 months in the USA. Will I still be eligible for $3600 credit since I'm filing for "Married filing jointly" ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Stimulus amounts being included in income while calculating the tax return?

It depends.

The stimulus payment amounts issued in 2019 or in January 2020 were based upon your 2018 or 2019 income tax returns filed.

The amount of the Rebate Recovery Credit is based upon your actual 2020 income tax return you file. Therefore, if you meet the criteria for the credit, you will receive it when you prepare your 2020 income tax return.

Please see the attached link for more information on who can claim the credit.

Recovery Rebate Credit eligibility

When you prepare your 2020 income tax return, be sure to do the following to ensure the credit is calculated correctly on your income tax return.

In the Federal section, select the Federal Review interview section at the top of the screen.

This will take you to the input section for the Recovery Rebate credit.

Be sure to indicate the actual amount of each stimulus payment you received on the page that asks if you received a stimulus payment. There will be two boxes and both need to be completed. If you did not receive any stimulus payments, please indicate We didn't get a stimulus payment by checking that box.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Stimulus amounts being included in income while calculating the tax return?

Thanks for your response. Yes, I have provided this information already in my previous response. Please check.

Question - Is Stimulus check based on filing status or based on SSN holder? This year, though I'm filing "Married filing jointly", my spouse is not having SSN but applying for ITIN. Will this affect the eligibility for Stimulus checks and Recovery Rebate Credit ?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

meggmeyers

New Member

Mandy17

New Member

novice23

New Member

Rseandoyle

New Member

ResidentReturn

Level 1