- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Where to input federal and state rollover amounts from previous year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to input federal and state rollover amounts from previous year

I am doing our 2019 taxes and it is the first year I am using the online version of TurboTax. Where do I enter the Federal refund amount my husband and I rolled over from 2018 into 2019? And, where do I enter it for our State refund amount we also rolled over?

I have been trying to find an answer to my question for close to an hour now and wish TurboTax was more helpful. I've tried searching for this answer with at least 20 different worded questions.

Thanks!!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to input federal and state rollover amounts from previous year

Don't know why you can't find it. I'll try to post a screen shot.

Make sure you enter it on your return. It will show up on 1040 schedule 3 line 8 which goes to 1040 line 18d. It will either add to your refund or reduce your tax.

If it didn't transfer over from last year then enter a refund from last year that you applied to this year here. BUT first make sure it's not already there. You don't want to apply it twice.

Federal on left

Deductions and Credits at top

Then scroll way down to Estimates and Other Taxes Paid

Other Income Taxes - Click the Start or Revisit

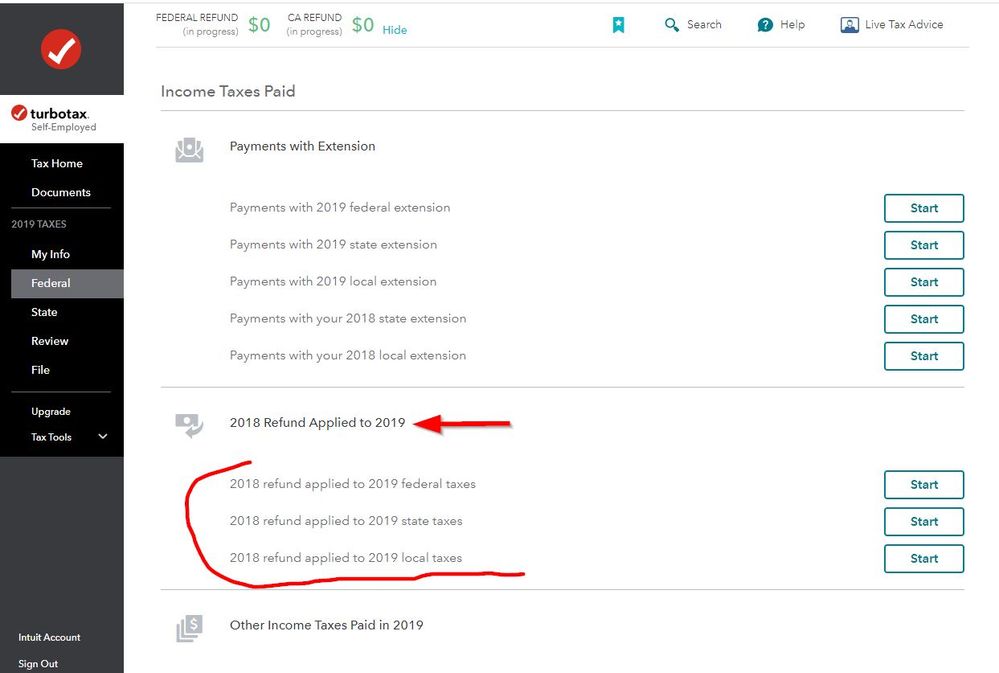

Next page scroll down to 2018 Refund Applied to 2019

Click Start or Update by the tax you applied

NOTE: When you enter a 1099G for a state refund under income there is a box to check and then fill out the amount of state refund you had applied to next year's estimated taxes. If you filled that in then do not fill it in again under Deductions and Credits. It won't show that amount in Deductions but if you enter it again it will be doubled.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to input federal and state rollover amounts from previous year

Well if you had transferred the 2018 tax file that information would have transferred automatically ... so if you did not ...

To enter your 2018 refund that was applied to 2019 taxes follow the steps below.

- Sign into TurboTax Online.

- Continue your return by click Taxes > Tax Timeline > Continue your return.

- Go to the Federal Taxes tab (Personal tab in TurboTax Home and Business).

- Click on Deductions and Credits.

- Click on Jump to full list.

- Scroll down until you see the Estimates and Other Taxes Paid section and click Show More.

- Find Other Income Taxes and click Start/Revisit.

- 2018 Refund Applied to 2019 and choose Start/Revisit to appropriate section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to input federal and state rollover amounts from previous year

Look for this section in the state interview as well ... usually toward the end of the state interview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to input federal and state rollover amounts from previous year

FYI ... not sure why you are using the more expensive inferior online version ... so if you want to purchase the downloaded version now and finish in that version you can (if you have not paid for the Online version yet). At this time of the year you can find bargains from reputable resellers ... you can use the Deluxe program and save a lot of money.

To continue in the desktop version see this…….

https://ttlc.intuit.com/questions/1901476-how-do-i-switch-from-turbotax-online-to-the-turbotax-softw...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to input federal and state rollover amounts from previous year

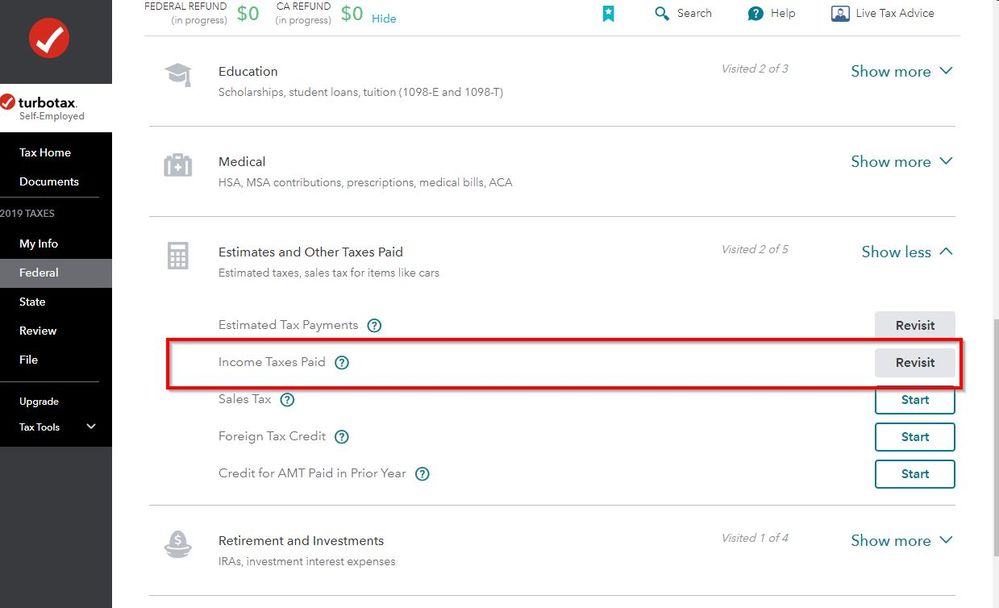

I followed your instructions and get to the section, Estimates and Other Taxes Paid - Show more, but these are the only things listed:

Estimated Tax Payments

Income Taxes Paid

Sales Tax

Foreign Tax Credit

Credit for AMT Paid in Prior Year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to input federal and state rollover amounts from previous year

Don't know why you can't find it. I'll try to post a screen shot.

Make sure you enter it on your return. It will show up on 1040 schedule 3 line 8 which goes to 1040 line 18d. It will either add to your refund or reduce your tax.

If it didn't transfer over from last year then enter a refund from last year that you applied to this year here. BUT first make sure it's not already there. You don't want to apply it twice.

Federal on left

Deductions and Credits at top

Then scroll way down to Estimates and Other Taxes Paid

Other Income Taxes - Click the Start or Revisit

Next page scroll down to 2018 Refund Applied to 2019

Click Start or Update by the tax you applied

NOTE: When you enter a 1099G for a state refund under income there is a box to check and then fill out the amount of state refund you had applied to next year's estimated taxes. If you filled that in then do not fill it in again under Deductions and Credits. It won't show that amount in Deductions but if you enter it again it will be doubled.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to input federal and state rollover amounts from previous year

Sorry about that. They must have changed the name and dropped the "Other...." Yes click on Income taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to input federal and state rollover amounts from previous year

Yeah! I finally found it with your help and also ended up speaking with someone on the phone. What tripped me is indeed the re-wording that they did for this year. Thanks so much for your help. I am not sure why it's so difficult to determine how to get to this section. None of the searches I did were even remotely close to helping.

Greatly appreciated to both @VolvoGirl and @Critter-3 and I am hoping this helps others as well. You have made my day.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

titdblff

New Member

kiks_722

Level 1

april15comingsoo

Level 1

mashantam

New Member

TheresaZ

New Member