- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Unemployment tax exemption

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax exemption

How do I manually modify the schedule1 adjustment to unemployment income and then efile my return?

When the desktop version update of the new relief bill will be available?

Does the manual update download include the new relief bill?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax exemption

The program will do this automatically for Federal. Just enter the entire 1099-G. See this re state:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax exemption

@SweetieJean automatic adjustment may be only in the online version. I check for updates everyday for my Desktop version and no update for the unemployment exemption amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax exemption

@10Kosmo Other have reported that, but TT says it is up to date. Maybe your income is too high?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax exemption

or maybe your software is not updated?

enter the 1099-G as it is stated on your document. DO NOT manually adjust; that invalidates the Turbo Tax guarantee. Also, it may not give you the right result depending on other items of your tax return.

if your income is over $150,000 without consideration of the unemployment income, it won't change the result as you are not eligible.

I have the desktop version and the adjustment is working correctly, so either check your software is up to date or consider that your income is too high to have an impact.

that stated, are you married? if your combined income is too high, it might be worth filing separate - normally not a good strategy but the unemployment rules motivate exactly that outcome.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax exemption

Thanks for posting your reply. Income limit is below 25K so it is fine. My desktop software (windows) is up to date. But it does not walk through to enter the exemption amount. Where do you enter $10,200 exemption in Turbo Tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax exemption

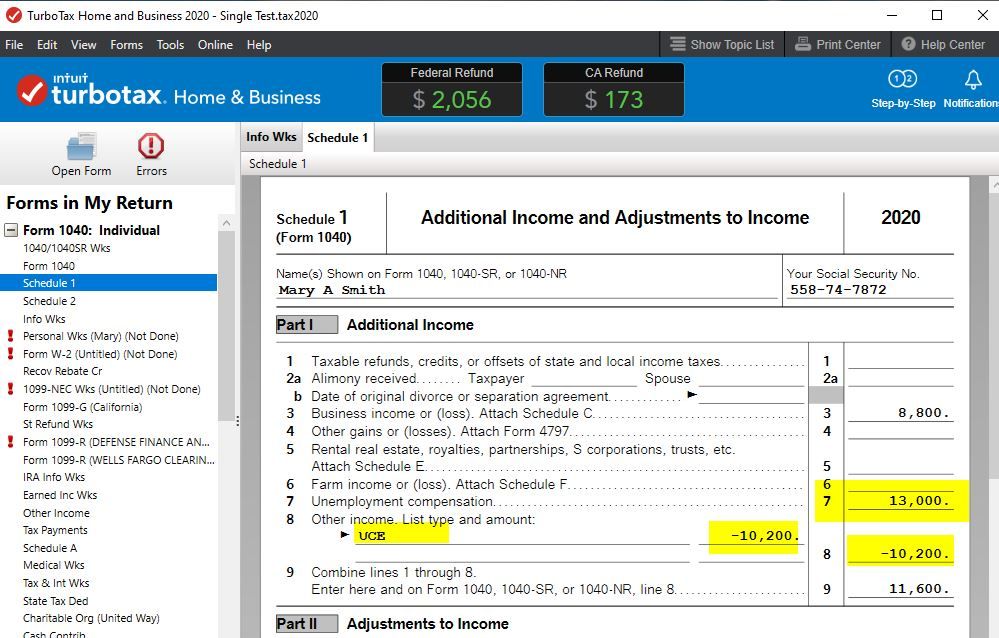

you don't enter the $10,200 - it is calculated automatically -

look at Schedule 1 line 8 and then Line 14 on Form 1040 is already reduced by $10,200

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax exemption

I also downloaded manual update file. Then entered full 1099-G amount under Wages & Income > Unemployment. Sch 1 line 8 show no amount and 1040 line 14 shows full unemployment amount. This so annoying and frustration.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax exemption

what version of TT do you have? I have deluxe and the $10,200 deduction works fine.

sounds like you clicked Online on the toolbar and checked for updates and received confirmation that the software is up to date?

ps... TT updates weekly over Wed night into Thurs mornings.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax exemption

I am using 2020 TT Premier Windows CD/desktop and the software update was installed upon starting TT today. But no update on unemployment tax exemption.

I suppose, I must call TT for help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax exemption

Does your unemployment show up on Schedule 1 line 7? Maybe you entered it in the wrong place. There are 2 other places to enter a 1099G for other things.

If it says your program is up to date, try doing a Manually update for Windows

https://ttlc.intuit.com/community/updating/help/manually-update-turbotax-for-windows-software-basic-...

If updating doesn't help then delete the 1099G and re enter it.

If your modified AGI is $150,000 or more, you can’t exclude any unemployment compensation. Your unemployment compensation will be on Schedule 1 line 7. The exclusion will be on Schedule 1 Line 8 as a negative number. The result flows to Form 1040 Line 8.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax exemption

Desktop software updates for unemployment have been available for several weeks now. Check again--look in Forms mode at your schedule 1 line 8---what do you see there?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax exemption

I just made a screen shot from my Windows Desktop Home & Business program. It automatically gave me the 10,200 exclusion. You don't have to do anything special. Just enter the 1099G.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

hollysmith174

New Member

arthuraguirre53

New Member

c-mbrooks

New Member

jrajh1966

New Member

Jdavis95106

New Member