- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: TurboTax Says I Can Claim a Spouse as a Deduction? (But Then Won't Let Me Add Them...)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

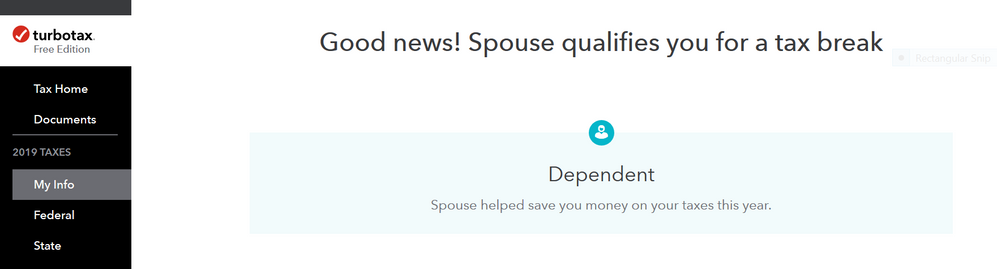

TurboTax Says I Can Claim a Spouse as a Deduction? (But Then Won't Let Me Add Them...)

Received the following message while preparing my taxes (married filing separately, in regards to my non-working / non-filing spouse.)

I understand that in the past, you could never claim a spouse as a dependent - has this changed? FWIW, it wouldn't let me put in my spouse on the 'dependents' page, so there's definitely conflicting messages in the software either way!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Says I Can Claim a Spouse as a Deduction? (But Then Won't Let Me Add Them...)

One question, why are you filing Married - Filing Separately? If your spouse is not working then they will not be filing their own return. It would make more sense to File Jointly. That is how I have been doing it since my wife and I got married, regardless of whether she was working or not that tax year (she had not worked in 10 years now due to health reasons, but even then, we still file Jointly.

I believe the reason you are having a problem with the program is that you are trying to add him/her dependent and not as a spouse. Yes, I know, even though he/she is your spouse, she is dependant on you to support, but the software makes a complete different distinction between a spouse and a dependent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Says I Can Claim a Spouse as a Deduction? (But Then Won't Let Me Add Them...)

I have my personal reasons for choosing the Married Filing Separately status (trust me, there are very good reasons that I don't want to entangle finances that way.) My question here is that the software is saying that I can claim as a dependent and get a tax break (as per the screenshot above), yet there seems to be no option to do this further along in the software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Says I Can Claim a Spouse as a Deduction? (But Then Won't Let Me Add Them...)

The law has not changed, you can still not claim a spouse as a dependent.

In the old days, you could claim your spouse’s exemption on your married filing separately return, if the spouse had no gross income, could not be claimed by someone else as a dependent and was otherwise not required to file a return.

But personal, dependent and spousal exemptions were eliminated, effective 2018, so there is no loner a deduction to give you, even though your spouse "qualifies".

I've brought this to the attention of TurboTax.

It appaers that

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Says I Can Claim a Spouse as a Deduction? (But Then Won't Let Me Add Them...)

The message that you received seems to imply that you entered someone named "Spouse" as a dependent.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

fillini00

Level 2

jcanalesr92

New Member

Tax_Lego

New Member

Keppy

Level 1

anon30

Level 3