- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: TurboTax Business 2020: Where do I enter my mileage deduction?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2020: Where do I enter my mileage deduction?

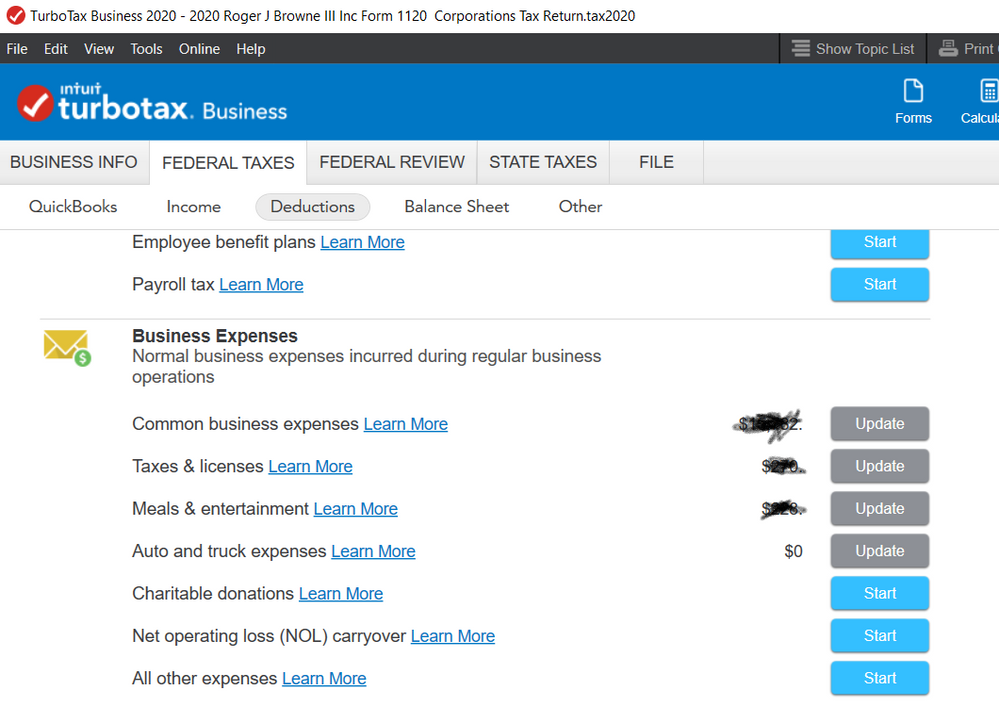

In TurboTax Business 2020: Where do I enter my mileage deduction?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2020: Where do I enter my mileage deduction?

Your C corp can reimburse employees at a standard rate or use actual expenses for corp owned vehicles.....the corp can't use the standard rate for vehicles it owns as it must use actual expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2020: Where do I enter my mileage deduction?

Your C corp can reimburse employees at a standard rate or use actual expenses for corp owned vehicles.....the corp can't use the standard rate for vehicles it owns as it must use actual expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2020: Where do I enter my mileage deduction?

I will report this expense to the C corp as the personal use of business vehicles and include it as an employee benefit amount in W-2 wages.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ahmad-hashem-net

New Member

helloTT102

New Member

emnem

New Member

mjmoor60

New Member

burner718

Level 2