- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Sold our home and adjoining vacant lot. IRS pub 523 says "treat as a single transaction" we r...

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold our home and adjoining vacant lot. IRS pub 523 says "treat as a single transaction" we received 2 form 1099-S. How do you enter in TurboTax as one transaction?

Topics:

posted

April 2, 2020

8:54 AM

last updated

April 02, 2020

8:54 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Best answer

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold our home and adjoining vacant lot. IRS pub 523 says "treat as a single transaction" we received 2 form 1099-S. How do you enter in TurboTax as one transaction?

It doesn't matter that you received two 1099-S forms, just add the values together. There is not an actual 1099-S entry form in TurboTax. You can enter the sale of your home (and vacant lot) using these steps:

- On the Wages & Income screen, in the Less Common Income section, click the Start box next to Sale of Home.

- On the Sale of Your Main Home screen, select Yes.

- On the Sold a Home screen, note the information you'll need to answer and click Continue.

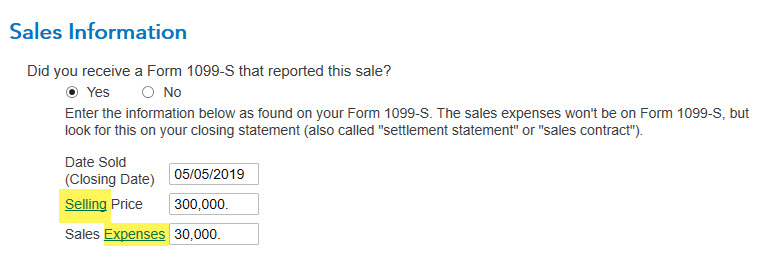

- Continue through the screens, answering the interview questions. As you go through the screens, you can get additional help by clicking on the blue links that appear. [See screenshot #1 below.]

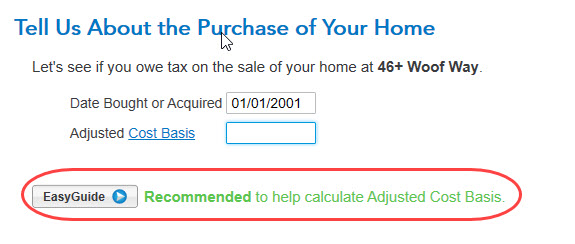

- On the Tell Us About the Purchase of Your Home screen, we recommend you click on the Easy Guide box to help you calculate the Adjusted Cost Basis of your home. [See screenshot #2.]

April 2, 2020

9:40 AM

360

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold our home and adjoining vacant lot. IRS pub 523 says "treat as a single transaction" we received 2 form 1099-S. How do you enter in TurboTax as one transaction?

It doesn't matter that you received two 1099-S forms, just add the values together. There is not an actual 1099-S entry form in TurboTax. You can enter the sale of your home (and vacant lot) using these steps:

- On the Wages & Income screen, in the Less Common Income section, click the Start box next to Sale of Home.

- On the Sale of Your Main Home screen, select Yes.

- On the Sold a Home screen, note the information you'll need to answer and click Continue.

- Continue through the screens, answering the interview questions. As you go through the screens, you can get additional help by clicking on the blue links that appear. [See screenshot #1 below.]

- On the Tell Us About the Purchase of Your Home screen, we recommend you click on the Easy Guide box to help you calculate the Adjusted Cost Basis of your home. [See screenshot #2.]

April 2, 2020

9:40 AM

361

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

amhm8990

Returning Member

babbo3648

Level 2

eevonderahe

New Member

stripes95

New Member

nclason40

New Member