- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Refundable and Nonrefundable Tax Credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refundable and Nonrefundable Tax Credit

How are refundable and nonrefundable tax credits applied to your tax liability if together they exceed your tax liability.

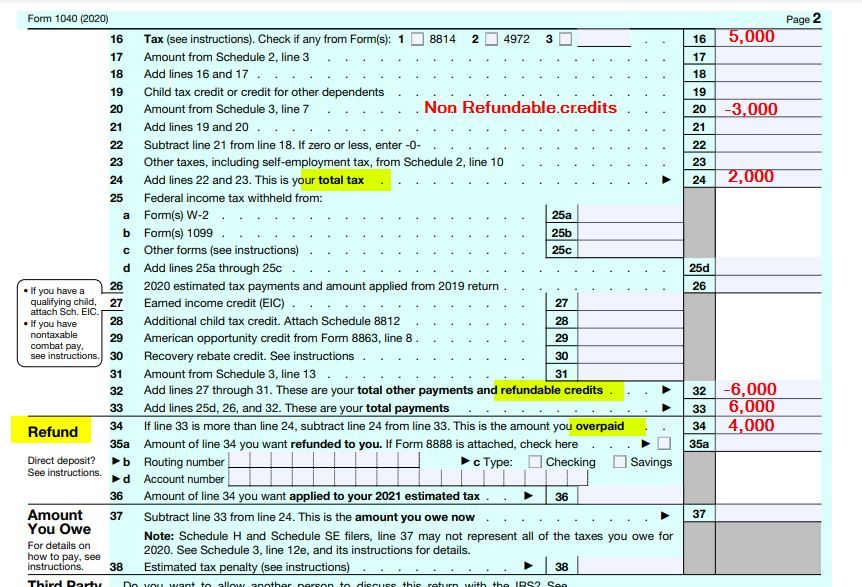

For example, let's say my tax liability is $5000 and I have a $6000 refundable credit and $3000 nonrefundable credit. Is the nonrefundable tax credit applied first, lowering tax liability to $2000, and then I would receive a refund of $4000? Or, is the refundable credit applied first, and then I wouldn't receive the non refundable credit?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refundable and Nonrefundable Tax Credit

@ANGLER123 , non-Refundable credits can only reduce your tax liability and on the form 1040 they appear before determining your final tax liability. In contrast Refundable credits are similar to estimated/ withholding payments-- On form 1040 these credits appear after withholdings, estimated payments etc.

This in your particular case ( modified )-->

Tax computed --$5000; Taxes withheld --$1000; Non-Refundable Credit --$6000; Refundable Credit --$2000.

Taxes --- $5000

Less Non-Refundable Credit --- $6000

1. Final Tax Liability -- 0 ( 5000 Less 6000 but not less than zero )

2. Withholdings : --- $1000

3. Refundable Credits --- $2000

Final Refund --- $3000.

Does this clear up your query ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refundable and Nonrefundable Tax Credit

@pk I think you reversed his refundable and non refundable credits (and used the wrong amounts too). His example is right.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refundable and Nonrefundable Tax Credit

Will this help? Here's the 1040 page 2. Print out a blank 1040 and follow the math You also need schedule 3

1040 https://www.irs.gov/pub/irs-pdf/f1040.pdf

Sch 3 https://www.irs.gov/pub/irs-pdf/f1040s3.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refundable and Nonrefundable Tax Credit

Also understand that the CTC has a non refundable portion and a refundable portion in the form of the ACTC so it is not a straight forward calculation in some cases. Also some non refundable credits can be carried forward so that also has to be taken into consideration. And then for tax year 2021 some usually non refundable credits will be refundable so that will put a monkey wrench into the works next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refundable and Nonrefundable Tax Credit

@VolvoGirl you are right -- i used different figures to show how Non-Refundable credit only quenches the tax liability i.e. no negative allowed while refundables add to the refund. Sorry for the confusion

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

32724328b51d

New Member

melvinpettit

New Member

romanhokie

Level 1

meldavidson4

New Member

dennis_e

New Member