- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Recovery Rebate Credit -- IRS says we owe them extra money.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit -- IRS says we owe them extra money.

I never skip sections and answered that I had received payments. I’ll check my IRS account.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit -- IRS says we owe them extra money.

The way it was designed, everything went through without checking that federal review button and answering the screens that came up when you selected federal review.

Your return could be e-filed without that step and many people did just that. Not exactly skipping. Just an easy thing to do and made it look like people were getting a much bigger refund than expected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit -- IRS says we owe them extra money.

TT showed we were entitled to $650 RRC and entered in on line 30, and the IRS disagrees and now they want us to pay it back. Income & stimulus payments were entered correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit -- IRS says we owe them extra money.

There was one more step that you needed to do before you e-filed that would have removed the overpayment. Many people had the same thing happen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit -- IRS says we owe them extra money.

Just checked IRS account online and apparently we were supposed to get 2nd stimulus and did not. Now filing Form 3911 to trace the missing payment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit -- IRS says we owe them extra money.

Tracing the missing payment is the correct thing to do. I hope this is resolved for you quickly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit -- IRS says we owe them extra money.

Hi Opus 17, I filed with no stimulus for 2020 for a refund of ~$6K, about a week later It jumped ~$1.7K without any input from me. I waited several months before the IRS sent the refund for both the refund plus stimulus. I didn't know it was a stimulus until I got the letter. I assume the 1.7k was put in by TurboTax. Where on line can I get these 1444-1444b letters? How do I engage the audit defense, I only have the # and the cost but don't know how to contact. My letter from the Christian attacking IRS implies an audit.

Regards,

Adrian

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit -- IRS says we owe them extra money.

If IRS adjusted your line 30 you have to pay, the audit is already complete.

If your check was lost or destroyed, that is a completely separate process.

If you create an account with IRS and view your account, your EIP1 and EIP2, if any, will be listed there.

If there is no EIP paid to you, you can dispute the IRS adjustment based on that fact.

You can't dispute based on your religion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit -- IRS says we owe them extra money.

@AdrianAlbrecht If you got a stimulus check after March it was probably for the 3rd stimulus (1,400 per person). That didn't go on your 2020 tax return. Only the first 2 payments are entered on your 2020 return.

So you got the first 6k refund plus another 1.7K? Did you have any unemployment? There was a change for unemployment. If you filed early before the exclusion, the IRS will recalculate your return for the new 10,200 unemployment exemption for you. There is no need for taxpayers to file an amended return unless the calculations make the taxpayer newly eligible for additional federal credits and deductions not already included on the original tax return.

Then what are you still missing? Or are you saying your refund went from 6K down to 1.7K? How much is on 1040 line 30? Why do you need Audit Defense?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit -- IRS says we owe them extra money.

@AdrianAlbrecht wrote:

Hi Opus 17, I filed with no stimulus for 2020 for a refund of ~$6K, about a week later It jumped ~$1.7K without any input from me. I waited several months before the IRS sent the refund for both the refund plus stimulus. I didn't know it was a stimulus until I got the letter. I assume the 1.7k was put in by TurboTax. Where on line can I get these 1444-1444b letters? How do I engage the audit defense, I only have the # and the cost but don't know how to contact. My letter from the Christian attacking IRS implies an audit.

Regards,

Adrian

You are adding to an old discussion with different people who have different problems, so we really need more information to address your specific situation.

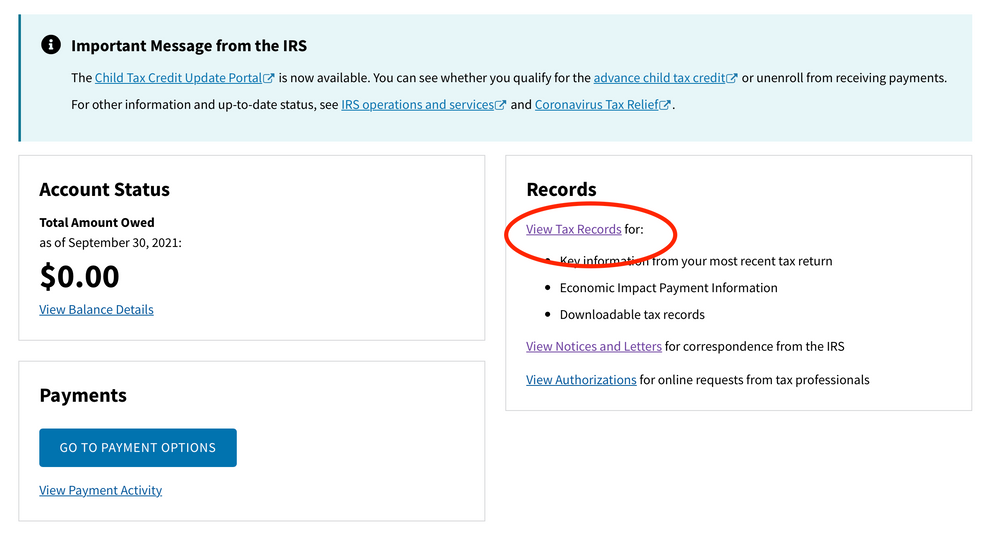

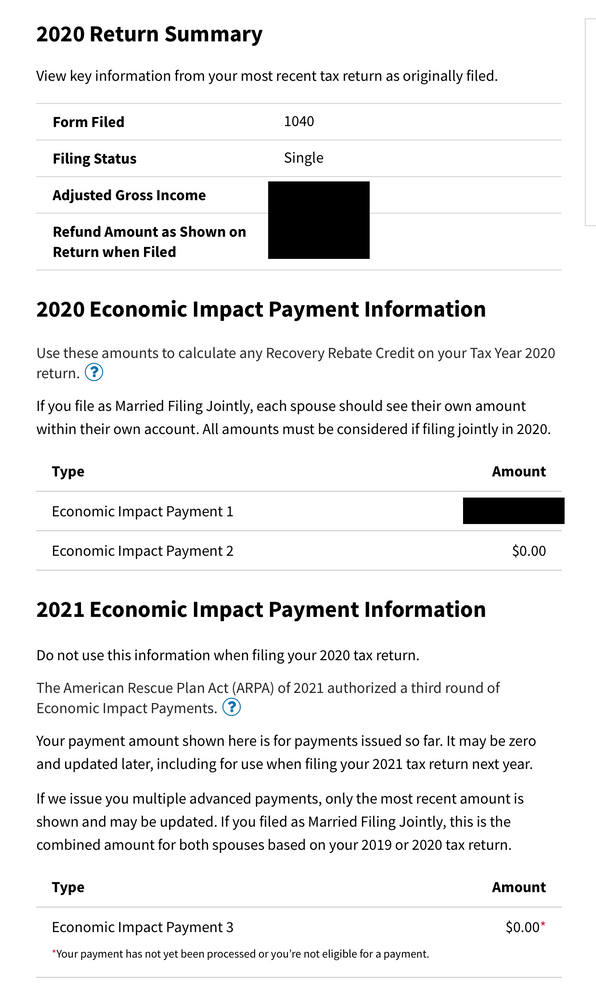

This is where to view your IRS online account.

https://www.irs.gov/payments/view-your-tax-account

If you have not registered your account before, you will have to verify your identity through the IRS procedure. Hopefully that will go smoothly but some people have reported problems. Once you log in, you will Click the link for account documents, and it will tell you the amount of stimulus payments the IRS issued to you. See pictures:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit -- IRS says we owe them extra money.

I had the same thing happen...... Si now we owe around $1700 on top of the $2000 already paid. I retired on 12/30/19 and I kind of think TT did not cpmplete our taxes properly..So, now having to pay the additional $1700! I found other issues with TT this year as well regarding clarity of a transfer if funds from my 403B to an IRA. I almost think that is where the oroblem possibly lies. I contacted IRS, and of course got NO assistance. Nothing online either.... Typical.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit -- IRS says we owe them extra money.

I AM SO DISSAPPOINTED WITH TTAX. I HAVE NEVER HAD A PROBLEM WITH YOUR SRVICE.

IRS SAYS YOUR CALCULATIONS ON RECOVERY REBATE RRCEXCEEDS [removed].000

the data I entered on my dependent is does not match their records, its my Mom who I claim she is 84 years old,

LETS FIX THIS PROBLEM NOW.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit -- IRS says we owe them extra money.

That is one of the list of generic reasons they give if they changed the Recovery rebate credit on line 30. How much is on 1040 line 30?

Did you receive the full amount for both the first 2 Stimulus payments? Better check your 1040 line 30 and see if an amount is listed. That's been a problem. A common adjustment is if you claimed the Recovery rebate credit on 1040 line 30 when you already got the Stimulus payments or got the second one after you filed. Or you might have answered the Stimulus questions wrong and tried to claim it again or some more on line 30. So the IRS took it off because you already got it. They know they sent it to you.

If you claimed a missing stimulus payment on your return but the IRS took it off you have to ask the IRS. They think they already sent it to you. Maybe it went to an account you don't remember. Or you got a check or a card. It was probably easy to miss the debit card in the mail and think it was junk mail. They have to put a trace on it.

How to put a trace on a missing 1st or 2nd Stimulus payment. IRS for Payment Issued but Lost, Stolen, Destroyed or Not Received

See question F3 here, you can expand it to see how to put a trace on it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit -- IRS says we owe them extra money.

Maybe this is helpful.

I received a similar CP11 from the IRS.

I spent time with a TurboTax CPA, we revisited the RRC worksheet and it was all in order...the phase out rule was properly applied, etc. I received neither the first nor the second stimulus payment.

I called the IRS using the number in the letter (moments after 7am eastern time), got cut off several times 🙂 but finally sorted it out. The CPA was exactly right.

Folks should know that the IRS figured the first payment (at least in my case) on 2018 AGI. I understand you are entitled to having it calculated on your 2020 AGI (they-IRS told me). Same thing on the second payment.

Now they want an additional $132 in penalties and interest. It seems to me they owe me interest for not getting the two EIPs into my hands.

I need to appeal that in a letter. Wish me luck...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit -- IRS says we owe them extra money.

thanks for sharing,

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

wzhulkie

New Member

svdi16182

New Member

peteZ88

Level 2

mrsmaz

Level 1

MogesT

Level 1