- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: QBI deduction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction

I got a QBI deduction last year, but it is not showing up for 2019. Not sure why.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction

Again ... look at the worksheet ... switch to the FORMS mode to look at everything.

This is my mini version of a tutorial that should be in the downloaded program:

What is Forms Mode?

Forms Mode lets you view and make changes to your tax forms "behind the scenes."

If you're adventurous, you can even prepare your return in Forms Mode, but we don't recommend it. You may miss obscure credits and deductions you qualify for, and you may forget to report things that will come back and haunt you later.

Forms Mode is exclusively available in the TurboTax CD/Download software. It is not available in TurboTax Online.

Related Information:

- Why would I use Forms Mode?

- How do I switch to Forms Mode in the TurboTax for Windows software?

- How do I switch to Forms Mode in the TurboTax for Mac software?

If you want to play around with different figures and tax scenarios without affecting your original return you can ….

- >>>In the TurboTax CD/Download software by creating a test copy:

- 1. Open your return in TurboTax.

- 2. From the File menu, choose Save As.

- 3. Give the copy a new name to distinguish it from the original (for example, by adding "Test" or "Example" to the file name).

- 4. Click Save. You are now safely working in the test copy and anything you do here will not affect the original.

- https://ttlc.intuit.com/questions/1900642-how-to-make-a-test-copy-of-your-return

- >> use the WHAT IF tool:

- - Click Forms Icon (upper right of screen) or Ctrl 2 (forms view)

- - Click on the Open Form Icon

- - In the “Type a form name.” area type What-If (with the dash), click on the name of the worksheet - click on Open Form

- - You will see the worksheet on the right side of the screen; enter the information right into the form

- - To get back to interview mode - click on the Step-by-Step Icon (upper right of screen) or Ctrl 1

It's always a good idea to make a backup copy of your tax data file, in case your original gets lost or corrupted. Here's how:

- From the File menu in the upper-left corner of TurboTax, choose Save As (Windows) or Save (Mac).

- Browse to where you want to save your backup.

- Tip: If you're saving to a portable device, save it to your computer first to prevent data corruption. Then, after completing Step 4, copy or move the backup file to your device.

- In the File name field, enter a name that will distinguish it from the original tax file (for example, add "Backup" or "Copy" to the file name)

- Click Save and then close TurboTax.

- Restart TurboTax and open the backup copy to make sure it's not corrupted. If you get an error, delete the backup and repeat these steps.

If you make changes to your original tax return file, repeat these steps to ensure your original and backup copies are in-synch.

Related Information:

- Retrieve a Tax File from a Portable Device

- What's the difference between the tax data file and the PDF file?

AND save it as a PDF so you have access to a copy even if you don’t have the program still installed and operational :

- How do I save my return as a PDF in the TurboTax software for Windows?

- How do I save my return as a PDF in the TurboTax software for Mac?

AND protect the files :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction

Well the program has a worksheet for everything ... save a PDF with the worksheets and review the QBI calculations ...

You can peek at only the Federal form 1040 and the summary of the state info by going here:

1) lower- Left side of the screen...click to the left side of the "Tax Tools" text selection.

2) then select "Tools"

3) then select "View Tax Summary" from the pop-up

4) then back to the left-side and "Preview 1040"

Then hit the "Back" on the left side to get back to your tax entries.

To view your entire return using the online editions (including the state) before you file, you will need to pay for your online account.

To pay the TurboTax online account fees by credit card, without completing the 2019 return at this time, click on Tax Tools >>> Tools and then Print Center. Then click on Print, save or preview this year's return. On the next page, to pay by credit card, click Continue. On the next screen it will ask if you want Audit Defense, if you do not want this option just click on the Continue button. The next screen will ask for all your credit card information so you can pay for the account.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction

Thanks for the detailed answer!

I should have mentioned I am using the desktop version of TT, and that I have K-1 income from my S-Corp. In any case, TT seems to have concluded I am not eligible for the QBI deduction. Is there some place where it tells me the reason for that determination?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction

Again ... look at the worksheet ... switch to the FORMS mode to look at everything.

This is my mini version of a tutorial that should be in the downloaded program:

What is Forms Mode?

Forms Mode lets you view and make changes to your tax forms "behind the scenes."

If you're adventurous, you can even prepare your return in Forms Mode, but we don't recommend it. You may miss obscure credits and deductions you qualify for, and you may forget to report things that will come back and haunt you later.

Forms Mode is exclusively available in the TurboTax CD/Download software. It is not available in TurboTax Online.

Related Information:

- Why would I use Forms Mode?

- How do I switch to Forms Mode in the TurboTax for Windows software?

- How do I switch to Forms Mode in the TurboTax for Mac software?

If you want to play around with different figures and tax scenarios without affecting your original return you can ….

- >>>In the TurboTax CD/Download software by creating a test copy:

- 1. Open your return in TurboTax.

- 2. From the File menu, choose Save As.

- 3. Give the copy a new name to distinguish it from the original (for example, by adding "Test" or "Example" to the file name).

- 4. Click Save. You are now safely working in the test copy and anything you do here will not affect the original.

- https://ttlc.intuit.com/questions/1900642-how-to-make-a-test-copy-of-your-return

- >> use the WHAT IF tool:

- - Click Forms Icon (upper right of screen) or Ctrl 2 (forms view)

- - Click on the Open Form Icon

- - In the “Type a form name.” area type What-If (with the dash), click on the name of the worksheet - click on Open Form

- - You will see the worksheet on the right side of the screen; enter the information right into the form

- - To get back to interview mode - click on the Step-by-Step Icon (upper right of screen) or Ctrl 1

It's always a good idea to make a backup copy of your tax data file, in case your original gets lost or corrupted. Here's how:

- From the File menu in the upper-left corner of TurboTax, choose Save As (Windows) or Save (Mac).

- Browse to where you want to save your backup.

- Tip: If you're saving to a portable device, save it to your computer first to prevent data corruption. Then, after completing Step 4, copy or move the backup file to your device.

- In the File name field, enter a name that will distinguish it from the original tax file (for example, add "Backup" or "Copy" to the file name)

- Click Save and then close TurboTax.

- Restart TurboTax and open the backup copy to make sure it's not corrupted. If you get an error, delete the backup and repeat these steps.

If you make changes to your original tax return file, repeat these steps to ensure your original and backup copies are in-synch.

Related Information:

- Retrieve a Tax File from a Portable Device

- What's the difference between the tax data file and the PDF file?

AND save it as a PDF so you have access to a copy even if you don’t have the program still installed and operational :

- How do I save my return as a PDF in the TurboTax software for Windows?

- How do I save my return as a PDF in the TurboTax software for Mac?

AND protect the files :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction

TT seems to have concluded I am not eligible for the QBI deduction. Is there some place where it tells me the reason for that determination?

What kind of income does your S-Corp produce? Earned income? Or passive income?

On the K-1 earned income is in box 1. Passive income is in box 2, 3, and/or 6.

Might just be simpler to ask what boxes on your K-1 show any income/loss in them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction

Only box 1 (Ordinary business income) has an amount in it.

So I switched to Forms and picked Form 8995. It has the corporation name but 0 in column (c) Qualified business income or (loss), and WILL NOT let me change it.

Lines 11,12,13, and 14 have amounts in them. 0 in all other lines. I see the same thing in the QBI Ded Summary.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction

Can someone from #TurboTax answer this question?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction

@jt2018 wrote:Can someone from #TurboTax answer this question?

If you don't get a resolution in this forum, here's how to speak to TurboTax Support by phone:

Hours are 5AM-9PM Pacific (8AM-12 Midnight Eastern) 7 days.

You can use this contact form to get an incident number and phone number:

https://support.turbotax.intuit.com/contact

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction

Thanks for the tip, I was able to get help from TT.

In case this helps someone else, TT asks that you check the boxes in your K-1 that have an amount in them. Well box 17 on my K-1 (created by TT Small Business) said V* STMT, so I did not check it. Box 17 is what takes you into the QBI. TT needs to update this page to say Check All The Boxes that have anything in them!

I was able to take the QBI deduction. This issue is now solved. Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction

I'm having a very similar problem, except I file a Schedule C, and am a sole proprietor. TT calculated a QBI deduction for me in 2020 and in 2021, but suddenly in 2022, and again now in 2023 it no longer calculates one. I know I'm not over the income limit, as my income is steadily decreasing. I looked at the forms mode, but as the original poster said, that did not allow me to change anything, nor does it tell me how it came up with 0. I need to know what has changed. I have a strong feeling I'm missing out on this deduction, both last year and again this year.

Any suggestions?

Ruth

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction

To look at this in detail, to see why QBI is not calculating, we would like to see a diagnostic copy of your return. The information in this file is a sanitized copy meaning there is no personal information, only numbers so that we can troubleshoot in depth, check for calculation issues, and to see how certain items are applied. Here is how to order.

For Turbo Tax online, go to tax tools>tools>share my file with agent. When this is selected, you will receive a token number. Respond back in this thread and tell us what that token number is.

If you use the desktop version, go to the black stripe at the top of the program>online>send tax file to agent. Once you receive the token number, reply back in this thread and let us know what that token number is.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction

@ rkrawczyk wrote:I'm having a very similar problem, except I file a Schedule C, and am a sole proprietor. TT calculated a QBI deduction for me in 2020 and in 2021, but suddenly in 2022, and again now in 2023 it no longer calculates one. I know I'm not over the income limit, as my income is steadily decreasing. I looked at the forms mode, but as the original poster said, that did not allow me to change anything, nor does it tell me how it came up with 0. I need to know what has changed. I have a strong feeling I'm missing out on this deduction, both last year and again this year.

Any suggestions?

Ruth

While you can view in Forms Mode to see if things are flowing correctly, don't try to use Forms Mode to make any entries for this; the data flows from various other sources, and the computation can sometimes be complicated.

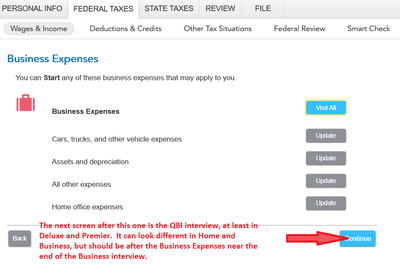

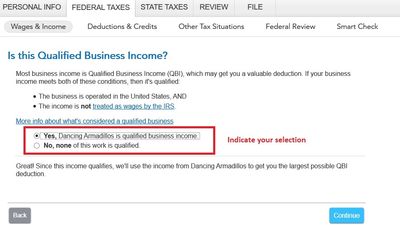

You didn't mention if you went through the QBI interview screens or not. Have you actually seen the interview screens for QBI and entered a choice? How you get to the QBI interview depends a little bit on what product you are using. In Deluxe and Premier, the QBI interview for a Schedule C business comes up right after the Business Expense summary screen (see the 2 images below.) If you are using Home and Business, the screens are designed a little differently, but the QBI interview should be at the end of the Business Expenses section just before wrapping up the entire Business interview topic. I don't have the Home and Biz. Here are a couple of images that one would encounter at least in Deluxe and Premier. If you have Home and Biz walk through the entire Business interview after the Expense section, and you should encounter it.

.

Click to enlarge:

.

.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction

Thanks for responding!

I am indeed using Home & Business, and I looked at the Business Expenses section all the way through, but do not find the QBI screen, so no I have never seen that screen, not this year and not last year. But evidently it did come up in prior years. I've looked back further in my records and I had the QBI deduction every year since it started up until 2022, and again now 2023. After Business Expenses comes Business Assets and then Final Details until the overall Business Income and Expenses tab. Where else could I look?

Thanks again!

Ruth

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction

Thanks for this offer, but I'm not finding the black stripe at the top you refer to in my desktop version. Program>online>send tax file??? I don't see any of these. I have TurboTax File Edit View Forms EasyStep Flags Window Help. But I have a feeling that's not even what you mean. Where is this black stripe?

Thanks!

Ruth

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI deduction

@ rkrawczyk wrote:Thanks for this offer, but I'm not finding the black stripe at the top you refer to in my desktop version. Program>online>send tax file??? I don't see any of these. I have TurboTax File Edit View Forms EasyStep Flags Window Help. But I have a feeling that's not even what you mean. Where is this black stripe?

Thanks!

Ruth

I don't have Home and Business so unfortunately I can't walk you manually to the screen with those QBI questions. The business section of Home and Business has slightly different format than the other desktop versions. However, I'll tell you another navigation method to try lower down in this posting.

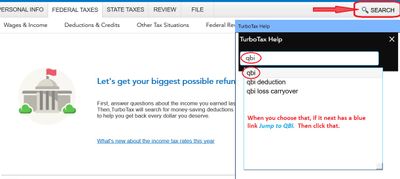

The "black stripe" that @ DaveF1006 was referring to in his comment above about a diagnostic file is the top menu bar of the desktop program, above the TurboTax logo. In that top menu bar one can choose the ONLINE menu, then in the dropdown choose "Send tax file to an agent." See this image from the Windows desktop version:

.

.

I think you are just not getting to the screen where you choose to use QBI or not (i.e., the second image in my earlier post). Try this other navigation method to get to QBI using the Search tool:

In the top right corner of your desktop program with your return open is a magnifying glass Search icon. Click on Search. When the search box opens, enter qbi without quotes, and click qbi in the results.

Then choose Jump to QBI. See this image: (click to enlarge)

.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Noxlord1234

New Member

Irasaco

Level 2

olegyk

Level 1

John9900

New Member

curtbus-gmail-co

New Member