- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: In Dependents, 2 of my children qualify as child tax credit while one is listed as credit for other dependent (despite being filled out the same) why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

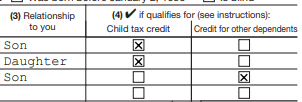

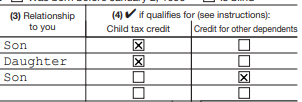

In Dependents, 2 of my children qualify as child tax credit while one is listed as credit for other dependent (despite being filled out the same) why? The oldest is 6

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Dependents, 2 of my children qualify as child tax credit while one is listed as credit for other dependent (despite being filled out the same) why? The oldest is 6

Did one turn 17 in 2020? Or born in 2020? Only get it for under 17. A child born (even on Dec 31) is considered to live with you the whole year. So pick the Whole Year at the top of the drop down box.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Dependents, 2 of my children qualify as child tax credit while one is listed as credit for other dependent (despite being filled out the same) why? The oldest is 6

If one of the children turned 17 before the end of 2020 that is why you cannot get the CTC for that child. Per 2020 tax law, you lose the CTC in the year that the child turns 17. Or...check to make sure you entered a Social Security number for the child, and see if you said the child lived with you for at least 7 months of 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Dependents, 2 of my children qualify as child tax credit while one is listed as credit for other dependent (despite being filled out the same) why? The oldest is 6

Dependent age 17 and older are other dependents.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Dependents, 2 of my children qualify as child tax credit while one is listed as credit for other dependent (despite being filled out the same) why? The oldest is 6

I should have been more specific, the oldest is 6

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Dependents, 2 of my children qualify as child tax credit while one is listed as credit for other dependent (despite being filled out the same) why? The oldest is 6

The oldest is 6, and they were all selected the same, full year. I went back and made sure this was the case but still shows like this

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Dependents, 2 of my children qualify as child tax credit while one is listed as credit for other dependent (despite being filled out the same) why? The oldest is 6

Delete the one that is not showing up correctly and re-enter the child as a dependent. Make sure you are saying the child lived with you the whole year, say NO when it asks if the child paid for over half his own support. Make sure you enter a SSN.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

kfontenot11

New Member

Wilzen

New Member

sheilawhitson198

New Member

silentzypher

New Member

sulliz

New Member