- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: If w2 employees can no longer deduct home office space/expenses, why is the 2020 turbo tax de...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If w2 employees can no longer deduct home office space/expenses, why is the 2020 turbo tax deluxe software allowing me to do it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If w2 employees can no longer deduct home office space/expenses, why is the 2020 turbo tax deluxe software allowing me to do it?

This was suspended through 2025 on the Federal level. Some states still allow for this deduction. The information is entered in the Federal portion and pulled over into the State portion.

See Deductions that have been suspended for 2018 - 2025

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If w2 employees can no longer deduct home office space/expenses, why is the 2020 turbo tax deluxe software allowing me to do it?

Can someone provide any insights into NY State and the home office deduction for a W2 employee if the working from home was only because of covid. I have a separate room that I converted into an office and used it exclusively for that during covid. It was previously a spare junk room. Seems doing a home office deduction would be useful as I rent so would seeminly be able to deduct a portion (proportionate to proportional area of room) of the rent. This contrasts with NY friends of mine who own and already can deduct property taxes from NY state returns. Im unclear if this is allowed since the rent was being paid anyway before covid for an empty room that I have now converted. Does anyone have any insights into this thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If w2 employees can no longer deduct home office space/expenses, why is the 2020 turbo tax deluxe software allowing me to do it?

Follow thru the NY interview to see what they will allow.

Sorry, Deductions for job expenses have been suspended with the new tax act. See Deductions that have been suspended for 2018-2025

TurboTax will ask if any of these apply when you fill out this section. You are encouraged to enter your expenses no matter what your occupation as the expenses may be deductible on your state return despite not being deductible on your federal return.

The FEDERAL job-related expenses deduction is only available to people who work in one of these specific professions or situations:

- Armed Forces reservist

- Qualified performing artist

- Fee-basis state or local government official

- You're disabled and have impairment-related expenses

If you want to skip entering your itemized deductions you can do that. Many people will not have enough itemized deductions this year to itemize, and will just be getting their new higher standard deduction. The thing is, though, that some of those deductions could make a difference on a state return even if they do not affect your federal return. Information flows from your federal return to your state return, so it might not be a bad idea to go ahead and enter them anyhow. It cannot hurt you.

The following states allow you to itemize deductions on just the state return: Alabama, Arizona, Arkansas, California, Delaware, Hawaii, Idaho, Iowa, Kentucky, Minnesota, Mississippi, Montana, New York, North Carolina, Oregon, and Wisconsin.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If w2 employees can no longer deduct home office space/expenses, why is the 2020 turbo tax deluxe software allowing me to do it?

so enter them on federal then choose to take standard deduction despite entering these home office type expenses then use them on state return? one issue- I just rechecked and on the federal return as I am a W2 employee it did not even offer itemization for miscel business expenses or home office.... what to do to get it onto the NY state return? thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If w2 employees can no longer deduct home office space/expenses, why is the 2020 turbo tax deluxe software allowing me to do it?

You will enter these deductions in the Federal section of the return.

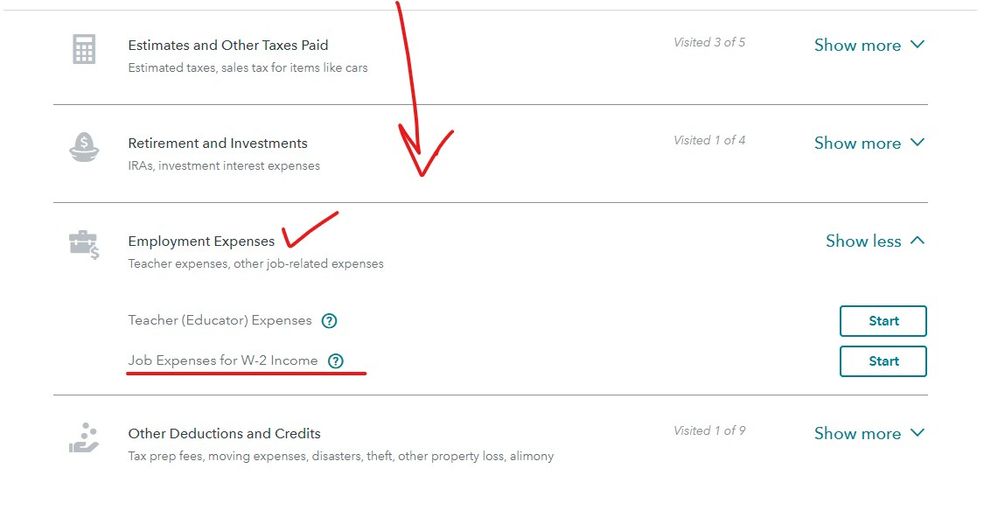

- Go to "Deductions & Credits"

- Under All breaks, select "Employment Expenses"

- Select "Job Expenses for W-2 Income

- Proceed to enter the applicable expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If w2 employees can no longer deduct home office space/expenses, why is the 2020 turbo tax deluxe software allowing me to do it?

@CatinaT1 Hello - as an expert can you address a question that i cant find an answer to anywhere: Im a W2 employee, forced to work from home for covid in 2021. regarding my NY state return, Id like to claim a home office deduction but only expense is the rent i pay ($6000/ month for a Manhattan apartment). Am i allowed to deduce as a home office expense the apportioned rent (eg 1/4 of the rent since the spare room now converted into an office is 1/4 of the apartment). Of course before covid I already paid rent so am concerned this is not allowed . Please let me know

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If w2 employees can no longer deduct home office space/expenses, why is the 2020 turbo tax deluxe software allowing me to do it?

If you have an area that is used regularly and exclusively for a home office, you are allowed to claim expenses for the area that is set aside for your work as an employee. You would be able to deduct the expense as an unreimbursed employee expense if that is your situation.

Here is a TurboTax article about the meaning of "Regular and Exclusive Use".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Vladimir101

Level 2

Andy_W

Level 1

azivnurse

Level 1

IsaiahCT

Level 1

ataguchi

New Member