- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: I sold my house on 11/3/19 and took the allowed capital gains exemption for married couple ($500,000) I want to sell my current house and want to make sure i dont pay

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my house on 11/3/19 and took the allowed capital gains exemption for married couple ($500,000) I want to sell my current house and want to make sure i dont pay

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my house on 11/3/19 and took the allowed capital gains exemption for married couple ($500,000) I want to sell my current house and want to make sure i dont pay

Q. Do I have to sell after11/3/21 (2 years) to be allowed to get capital gains exclusion again?

A. Yes. From Pub 523:

Generally, your home sale qualifies for the maximum exclusion, if all of the following conditions are true.

-

You didn’t acquire the property through a like-kind exchange in the past 5 years.

-

You aren’t subject to the expatriate tax.

-

You owned the home for 2 of the last 5 years and lived in the home for 2 (1 if you become disabled) of the last 5 years leading up to the date of the sale (limited exceptions available).

-

For the 2 years before the date of the current sale, you didn't sell another home on which you claimed the exclusion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my house on 11/3/19 and took the allowed capital gains exemption for married couple ($500,000) I want to sell my current house and want to make sure i dont pay

If Elizabeth Warren and AOC get their way, another loophole that will surely go the way of the Dodo Bird.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my house on 11/3/19 and took the allowed capital gains exemption for married couple ($500,000) I want to sell my current house and want to make sure i dont pay

Under certain circumstances, you may be able to avoid paying taxes if you lived there less than 2 years. The most common is moving due to relocating for work, but see Publication 523 for details:

https://www.irs.gov/publications/p523#en_US_2017_publink100073096

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my house on 11/3/19 and took the allowed capital gains exemption for married couple ($500,000) I want to sell my current house and want to make sure i dont pay

Deleted

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my house on 11/3/19 and took the allowed capital gains exemption for married couple ($500,000) I want to sell my current house and want to make sure i dont pay

In pertinent part, Section 1.121-2(b)(1) provides:

Except as otherwise provided in §1.121-3 (relating to the reduced maximum exclusion), a taxpayer may not exclude from gross income gain from the sale or exchange of a principal residence if, during the 2-year period ending on the date of the sale or exchange, the taxpayer sold or exchanged other property for which gain was excluded under section 121.

In pertinent part, Section 1.121-3(g)(1) provides:

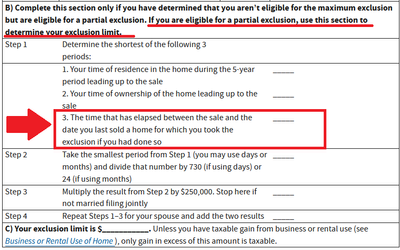

The reduced maximum exclusion is computed by multiplying the maximum dollar limitation of $250,000 ($500,000 for certain joint filers) by a fraction. The numerator of the fraction is the shortest of the period of time that the taxpayer owned the property during the 5-year period ending on the date of the sale or exchange; the period of time that the taxpayer used the property as the taxpayer's principal residence during the 5-year period ending on the date of the sale or exchange; or the period of time between the date of a prior sale or exchange of property for which the taxpayer excluded gain under section 121 and the date of the current sale or exchange.

The worksheet below is from Publication 523 for reference.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my house on 11/3/19 and took the allowed capital gains exemption for married couple ($500,000) I want to sell my current house and want to make sure i dont pay

Even if they owned the home less than two years and lived in the home less than two years, they could qualify for a partial exclusion using one of the safe harbors or the facts and circumstances exception in the regulations which is described in publication 523. In that case, the amount of the partial exclusion is determined by the shortest of three periods.

A. The length of time since they last used the exclusion.

B. The length of time they lived in the home as their main home.

C. The length of time they owned the home.

If the taxpayers do not qualify for a partial exclusion under the special circumstances or Safe harbor rule, then they must not close on their current sale until on or after November 3, 2021.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

davidcotey

New Member

ellac26

New Member

tngrl

Level 1

spitfire

Level 1

wangjiefei

New Member