- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: I am a US Citizen and a US Navy Veteran living in the Philippines since 2013. For stimulus pa...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a US Citizen and a US Navy Veteran living in the Philippines since 2013. For stimulus payment purposes, if qualified, do I input my California address or foreign?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a US Citizen and a US Navy Veteran living in the Philippines since 2013. For stimulus payment purposes, if qualified, do I input my California address or foreign?

No, as long as you will be able to receive mail at the address you use you can enter the California address. Since your pension was not taxable income, you would not have been required to file so you would be eligible for the stimulus.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a US Citizen and a US Navy Veteran living in the Philippines since 2013. For stimulus payment purposes, if qualified, do I input my California address or foreign?

You can enter your current mailing address.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a US Citizen and a US Navy Veteran living in the Philippines since 2013. For stimulus payment purposes, if qualified, do I input my California address or foreign?

Thank you for the quick reply.

My other question is as a US Navy Veteran receiving compensation pension monthly that has been out of the country since 2013, and have not filed any tax since then, am I eligible for the economic impact payment or the stimulus?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a US Citizen and a US Navy Veteran living in the Philippines since 2013. For stimulus payment purposes, if qualified, do I input my California address or foreign?

If you were required to file tax returns and did not because you were not in the country, you would not be eligible for the stimulus.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a US Citizen and a US Navy Veteran living in the Philippines since 2013. For stimulus payment purposes, if qualified, do I input my California address or foreign?

I started receiving Compensation Pension since 2012, per the VA Compensation Pension is non-taxable. Since 2012 I have not work and no tax to report.

I updated my profile on Turbo Tax and it stated that I am eligible.

The only issue was the address. I placed my foreign address, Philippines, but it required me to input a US address to proceed.

Would it be correct to place my previous US address to continue with the process?

Would there be any legal consequences if two address are used?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a US Citizen and a US Navy Veteran living in the Philippines since 2013. For stimulus payment purposes, if qualified, do I input my California address or foreign?

No, as long as you will be able to receive mail at the address you use you can enter the California address. Since your pension was not taxable income, you would not have been required to file so you would be eligible for the stimulus.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a US Citizen and a US Navy Veteran living in the Philippines since 2013. For stimulus payment purposes, if qualified, do I input my California address or foreign?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a US Citizen and a US Navy Veteran living in the Philippines since 2013. For stimulus payment purposes, if qualified, do I input my California address or foreign?

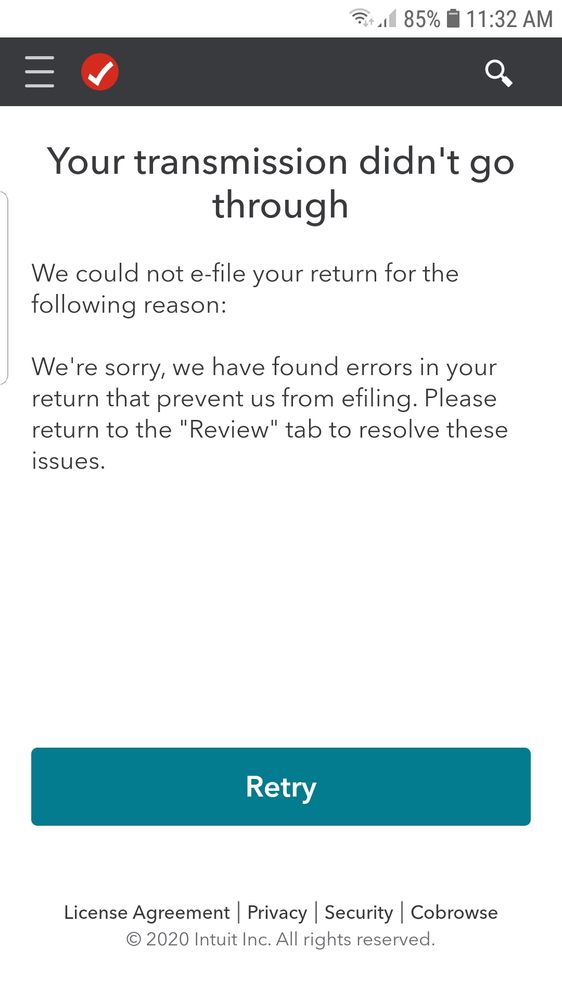

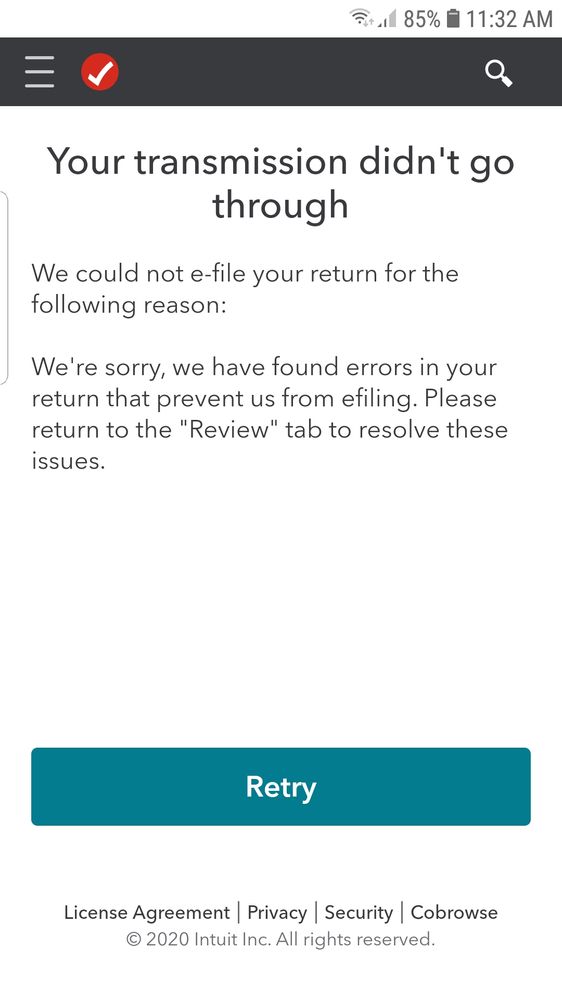

I tried to submit my information thru turbo tax to register for the stimulus and it posted this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a US Citizen and a US Navy Veteran living in the Philippines since 2013. For stimulus payment purposes, if qualified, do I input my California address or foreign?

I tried to submit my updated information thru turbo tax for the economic impact payment or stimulus. It suggested to "review".

It took me to state and federal tax. The outcome was "0" for both.

Do I submit the file just to update the direct deposit account for the stimulus?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a US Citizen and a US Navy Veteran living in the Philippines since 2013. For stimulus payment purposes, if qualified, do I input my California address or foreign?

When you go to the website you need to choose the option that you don't need to file your taxes this year. When it asks you if you have a TurboTax account, say no.

Then enter a new user name and password, etc so the website does not take you to your TurboTax account. Then go through and answer the few questions so the the IRS has your latest information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a US Citizen and a US Navy Veteran living in the Philippines since 2013. For stimulus payment purposes, if qualified, do I input my California address or foreign?

I created a new account for turbo tax to register for the stimulus. I followed the instruction and it still says "transmission did not go through", and to go back to "review".

When I did that to my previous account, it made me do my state and federal tax. The state and federal tax refund and due is "0". Should i proceed on my previous account, even though I am not required to file tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a US Citizen and a US Navy Veteran living in the Philippines since 2013. For stimulus payment purposes, if qualified, do I input my California address or foreign?

You will not be able to e-file it with a zero income. You will need to add $1 of interest or dividends I think to get it to e-file. Thank you for your patience.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a US Citizen and a US Navy Veteran living in the Philippines since 2013. For stimulus payment purposes, if qualified, do I input my California address or foreign?

So to actually proceed a minimum number has to be met to register for the stimulus.

So do i proceed with my previous account and file it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a US Citizen and a US Navy Veteran living in the Philippines since 2013. For stimulus payment purposes, if qualified, do I input my California address or foreign?

This TurboTax website will let you know how much you will get and what you have to do next.

To register for your Stimulus Check, please see our website: TT Stimulus Website

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

WarriorPro

Level 1

tygilliard11

New Member

ggoffsr

New Member

Sammyhiro

Level 2

kadiekellie1804-

New Member