- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: How do force turboTax to provide Shedule 3 for a DirectPay credit to my 2019 tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do force turboTax to provide Form 3 for a DirectPay credit to my 2019 tax (please do not tell me it is automatic, that is only for 1040X or extenision)

Last year I had a large capital gain and made an IRS DirectPay payment (with no extension, no 1040X no contacting turbotax to let them know so there is no way turbo tax can know this). I see this question asked many times with the same WRONG answer, it is not always automatically done in TurboTax!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do force turboTax to provide Form 3 for a DirectPay credit to my 2019 tax (please do not tell me it is automatic, that is only for 1040X or extenision)

Ok ... you must mean SCHEDULE 3 not FORM 3 ... and what kind of payment did you make ? Was it an estimated payment ? Or a balance due on a return ? Or a payment with an extension ?

You will see sections for federal, state, and local under the Estimated Taxes screen -

- Log into your account and click Take Me to My Return (you must click this first)

- Use the search feature in the top right-hand corner of your screen (or search topics/bar if using desktop)

- Search for "estimated tax payments" and click the "jump to" link.

- This will bring you right to the appropriate section to enter all of your estimated taxes paid

Or, you can also find the section by clicking on the following tabs:

- Federal Taxes

- Deductions and Credits

- You may have to click “I'll Choose what to work on” or "Show All" or "Check for More Credits" to get full list to appear

- Scroll down to Estimates and Other Taxes Paid (you may need to scroll down all the way past your "common" tax breaks list that will appear in your summary)

- Scroll down to Estimates

- Enter your 2019 Paid Estimated Taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do force turboTax to provide Form 3 for a DirectPay credit to my 2019 tax (please do not tell me it is automatic, that is only for 1040X or extenision)

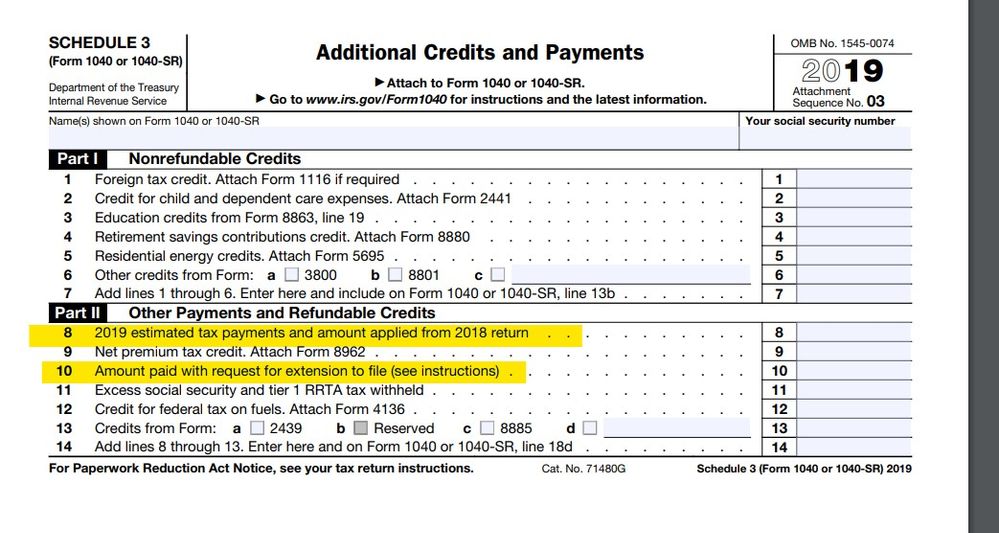

It is also not by placing the DirectPay amount into the quarterly estimated tax fields, I made that mistake in 2018 and still have not gotten that straightened out with the IRS (due to CV-19 stopping IRS from processing any 1040X forms now). IT HAS TO GO INTO FORM 3 ( which is same as Form 5 for 2018).

Is there a way in TurboTax to request Form 3, if not they need to fix this problem!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do force turboTax to provide Form 3 for a DirectPay credit to my 2019 tax (please do not tell me it is automatic, that is only for 1040X or extenision)

Ok ... you must mean SCHEDULE 3 not FORM 3 ... and what kind of payment did you make ? Was it an estimated payment ? Or a balance due on a return ? Or a payment with an extension ?

You will see sections for federal, state, and local under the Estimated Taxes screen -

- Log into your account and click Take Me to My Return (you must click this first)

- Use the search feature in the top right-hand corner of your screen (or search topics/bar if using desktop)

- Search for "estimated tax payments" and click the "jump to" link.

- This will bring you right to the appropriate section to enter all of your estimated taxes paid

Or, you can also find the section by clicking on the following tabs:

- Federal Taxes

- Deductions and Credits

- You may have to click “I'll Choose what to work on” or "Show All" or "Check for More Credits" to get full list to appear

- Scroll down to Estimates and Other Taxes Paid (you may need to scroll down all the way past your "common" tax breaks list that will appear in your summary)

- Scroll down to Estimates

- Enter your 2019 Paid Estimated Taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do force turboTax to provide Form 3 for a DirectPay credit to my 2019 tax (please do not tell me it is automatic, that is only for 1040X or extenision)

After entering your four regular quarterly payments, scroll down the "How much did you pay in federal estimated taxes" screen and click on +Add another payment, in the lower left corner.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do force turboTax to provide Form 3 for a DirectPay credit to my 2019 tax (please do not tell me it is automatic, that is only for 1040X or extenision)

I am guessing it would be considered and estimated payment. What happened is while I was looking over my investment accounts, I saw I a large capital gain where the taxes where not taken out. I then went onto Direct Pay and made a payment with the selection it was for my 2019 tax year. There was no request for me form to fill out any forms. I will try what you suggested to see if I can get there THANX!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do force turboTax to provide Form 3 for a DirectPay credit to my 2019 tax (please do not tell me it is automatic, that is only for 1040X or extenision)

FYI - It was under "Other Income Taxes Paid in 2019" " then select "Visit all"

Was able to manually enter information which turbotax accepted; however, I could not see if it goes onto Schedule 3. Will have to complete return and report back (if I do not forget to do this)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do force turboTax to provide Form 3 for a DirectPay credit to my 2019 tax (please do not tell me it is automatic, that is only for 1040X or extenision)

I just confirmed TurboTax allowed me to manually input the DirectPay which now shows up on Schedule 3 in my 1040 tax return

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

johntkerich7203

Level 1

rebecca2024

Level 1

danboy2112

New Member

_confused_

Returning Member

djm115

Level 1