- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Having child later in the year - tax credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Having child later in the year - tax credit

I’m going to have another child around October, and I’m fine not getting the monthly payments for this one, but will I get the full tax credit for a young child when tax season comes, or because they will be born later in the year, will they only get a portion? Also, is it known if the automatic payments are only through December, or if they plan to continue them next year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Having child later in the year - tax credit

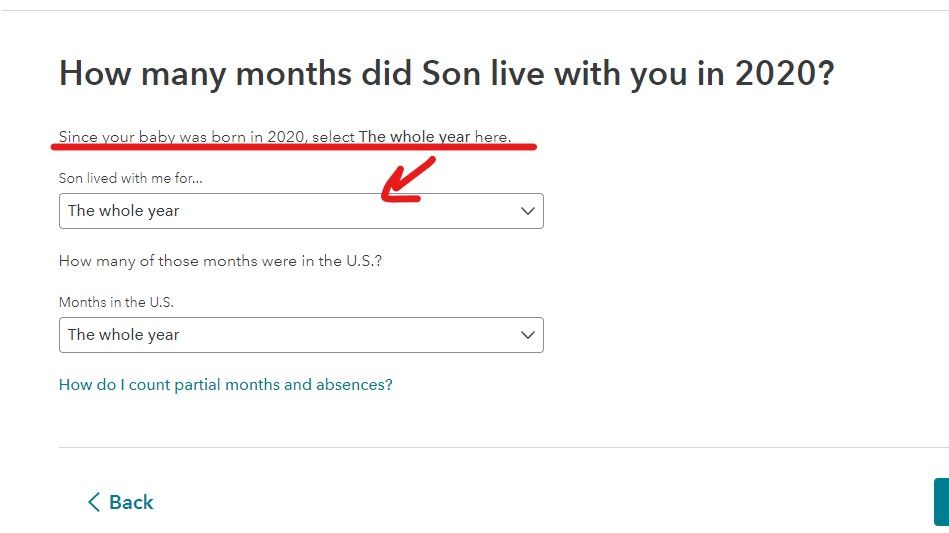

READ this screen in the dependent section next year ... it tells you exactly what to choose ...

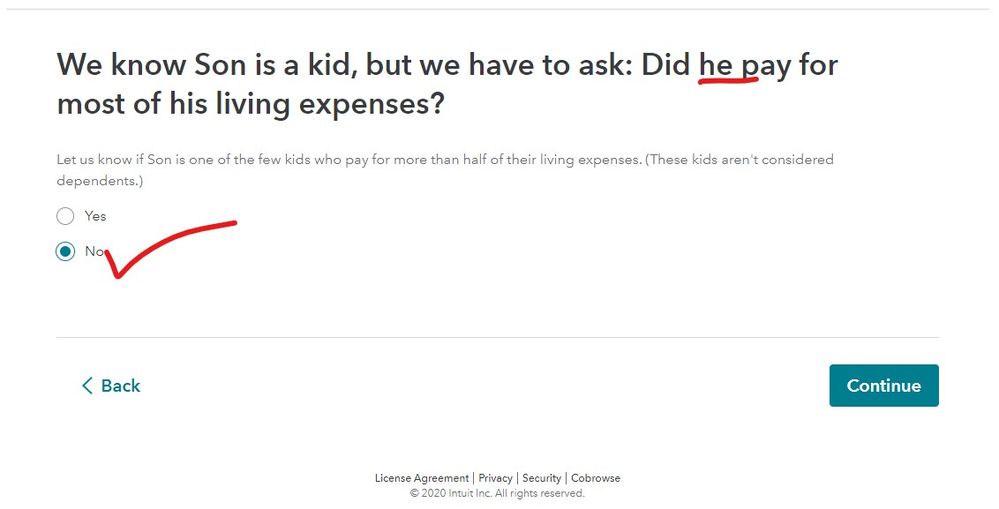

AND this screen ... it asks if the CHILD paid their own support not YOU ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Having child later in the year - tax credit

You will get the full amount when you file your 2021 return next year. A child born (even on Dec 31) is counted for the WHOLE year. So when you enter the Oct baby be sure to say he lived with you the WHOLE YEAR.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Having child later in the year - tax credit

Okay, so it’s okay to say they lived with me the whole year even if they didn’t really?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Having child later in the year - tax credit

it's ok and actually necessary to get the proper credits. think of it as if the question was asking did the child live with you during the year for the entire time it was alive.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Having child later in the year - tax credit

Yes.

See IRS 501 page 12

https://www.irs.gov/pub/irs-pdf/p501.pdf

Death or birth of child. A child who was born or died during the year is treated as having lived with you more than half the year if your home was the child's home more than half the time he or she was alive during the year. The same is true if the child lived with you more than half the year except for any required hospital stay fol- lowing birth.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Having child later in the year - tax credit

READ this screen in the dependent section next year ... it tells you exactly what to choose ...

AND this screen ... it asks if the CHILD paid their own support not YOU ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Having child later in the year - tax credit

I did this step but this also leads me to another question for potential additional stimulus credits from the 3rd stimulus. Since we are marking our child who was born later in the year and marked him as in the home all year long does this also give us the additional 1400 for a dependent in the stimulus rebate? I am assuming so but wanted to ask here for some clarification.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Having child later in the year - tax credit

Yes. You should get the whole 1,400 for him.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Having child later in the year - tax credit

I think as I kept looking down that rabbit hole I found additional articles that confirmed that as well. Thank you kindly for the response. Good to know 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Having child later in the year - tax credit

Make sure you have entered your child as a dependent in My Info, and that you have entered the child's Social Security number. If your child was born in 2021make sure you said he lived with you the whole year. There is an oddly worded question that asks if the child paid over half their own support. Say NO to that question.

You get the child-related credits including the CTC and the 3rd stimulus for a child born in 2021.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

2016kiasonata

New Member

margaret1961

New Member

kvthompson2

Level 1

rbrower42

New Member

hynrel53

New Member