- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Does NOL automatically carry over from 2017 to 2018?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does NOL automatically carry over from 2017 to 2018?

My sole income is from rental property. IT is all sched E. I actively manage rentals and therefore am a real estate professional.

Due to acquisition and remodeling projects my 2017 AGI was about -14,000 (Loss)

The construction project continued into 2018 and my AGI is again looking about -11,000 (Loss).

I am confused though that I don't see anywhere in turbotax that it is bringing in the loss from TY2017 into the TY2018. Please help me determine how to account for this? Does this need to be done manually . If so how?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does NOL automatically carry over from 2017 to 2018?

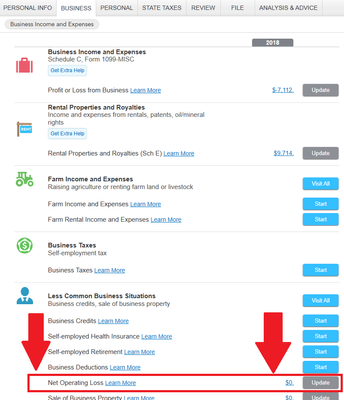

In TurboTax Home & Business, you can manually enter an NOL (see screenshot).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does NOL automatically carry over from 2017 to 2018?

Thanks for the exposition. Is there a bug in TurboTax Home & Business that it doesn't do this automatically?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does NOL automatically carry over from 2017 to 2018?

should I just put that AGI of -14,000 as the NOL?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does NOL automatically carry over from 2017 to 2018?

That was not the question he/she asked. I have the same one. WHY DOESN'T TurboTax bring this info over from 2017. That's why I bought the product.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does NOL automatically carry over from 2017 to 2018?

Good question. I see the Intuit folks are crickets.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does NOL automatically carry over from 2017 to 2018?

It is possible you did not have an NOL to carry forward ... and TT doesn't calculate the NOL so you are responsible for doing so and making the entry in the correct place ...

Contact TurboTax support and speak directly with a TurboTax support agent concerning this situation.

See this TurboTax support FAQ for a contact link and hours of operation -https://ttlc.intuit.com/questions/1899263-what-is-the-turbotax-phone-number

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does NOL automatically carry over from 2017 to 2018?

@BobTooms wrote:

Good question. I see the Intuit folks are crickets.

Sorry, but it is contained in the following TurboTax Help article:

The program does not calculate the amount of NOL to be carried back or forward to another year.To determine your NOL, if any, refer to Form 1045, Schedule A (not included with this program). Also refer to IRS Publication 536 for details about the NOL calculation.

https://digitalasset.intuit.com/DOCUMENT/A7aTcVUwu/2018-unsupported-calcs-L1FQfTTgn-073019.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does NOL automatically carry over from 2017 to 2018?

Um, but that is why I buy TurboTax. So that I do not have to reference IRS codes and instructions. Any idea on when you might be automating this better?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does NOL automatically carry over from 2017 to 2018?

Thanks, but I have an enormous NOL carryover. I know some functionality is difficult to automate, but I would expect at least basic functionality of NOL integrated into this product.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does NOL automatically carry over from 2017 to 2018?

@BobTooms wrote:

Um, but that is why I buy TurboTax. So that I do not have to reference IRS codes and instructions. Any idea on when you might be automating this better?

We are all just volunteers trying to answer questions posted in this board; we have no insight into when, or if, Intuit will implement a new feature or correct an omission.

Regardless, an NOL is not exactly a common occurrence and TurboTax has never calculated an NOL in past yearly editions. Therefore, it seems doubtful that the functionality would be added anytime in the near future.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does NOL automatically carry over from 2017 to 2018?

Thanks. Just adding my feedback and opinions to help make a better product. For me personally, NOL is a big deal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does NOL automatically carry over from 2017 to 2018?

Turbotax is written for the masses to use and some forms/subjects are either too complex or so little used that the program doesn't address them ... it is not cost effective to do so thus they will probably never be added to the program. Not even the professional programs complete the NOL automatically ... they need human intervention. So if this is your situation I highly recommend seeing a local professional well versed in NOLs.

When I worked for a big box tax prep company there was usually only 1 or 2 preparers in the entire tri county district that were proficient enough to handle NOL calculations. It is just not that common.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does NOL automatically carry over from 2017 to 2018?

Thanks for your input, I appreciate you taking the time to respond.

I am just frustrated that the IRS creates such complex code, then directs taxpayers to their instructions, which are very involved and prone to the taxpayer making errors.

To add insult to injury, I then need to pay someone about $250 an hour to explain it or do it.

Just more fuel IMHO for removing all subsidies, credits, offsets, brackets, etc., and go to a flat tax.

It would be more fair, equal, and eliminate all this wasted time pouring over ridiculous tax code.

Accountants would still have plenty of work.

Sorry, did I say thank you?

Have a great night.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does NOL automatically carry over from 2017 to 2018?

You are welcome ... but a final thought. Only the rich will benefit from a "flat tax" and having a large NOL means you are not paying any taxes at all just like President Trump .... so paying $250 to a CPA to avoid paying any tax at all is not such a bad deal.

Also a small piece of history ... the IRS used to provide tax preparation assistance services to all for free and they decided to stop the service ... the first place they tried was in Kansas City where the Brothers Henry & Richard Bloch had an accounting business ... so the IRS change in policy started an entire Tax Preparation industry. https://en.wikipedia.org/wiki/H%26R_Block

Over the years the tax laws have become more complicated thanks to Congress trying to not offend or alienate the masses at the same time needing to bring in funds to run the country. Also they have cut the IRS budget every year for 2 decades so they have to do so much more with so much less ... so there is less assistance to help folks navigate the system. Write your congress person to demand change for the better.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Stuff8181

New Member

NNGAL

Level 1

SelenaP

New Member

kare2k13

Level 4

Normanroad

New Member