- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Deductions for oil & gas royalty income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions for oil & gas royalty income

I received oil & gas royaty income for 2019 in the gross of amount of $2441. I am entitled to deductions to the gross amount for taxes that were withheld ,and also for Production Costs that were withheld, As an owner of oil and gas royalty rights, I'm also entitled to a deduction for depletion of 15% of the gross amount.

Your Schedule E Worksheet provides for taxes withheld, but not for depletion and Production Costs,whch would be reported on Schedule E, under Expenses on lines 18 and 19, respectively.

Please advise how I can include the deductions for depletion and Production costs.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions for oil & gas royalty income

If you use and work through the program in interview mode the way it is designed and intended to be used, it is practically impossible for depletion to not be taken.

Elect to EDIT your royalty property in the program, and the third or forth screen in shows the default depletion amount (default is 15% of the amount you entered previously) and you can even change that amount if necessary.

Then, if you elect to update Expenses you'll see there on the "Enter Common Expenses" screen the depletion amount in the box labeled "Depletion".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions for oil & gas royalty income

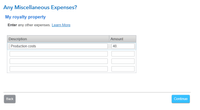

Also, in Interview step-by-step mode near the end of the Royalty Expense section is a catch-all category called "Miscellaneous Expenses". You can enter a description "Production costs" and amount there, which will flow to the Sch E worksheet. (see images below.)

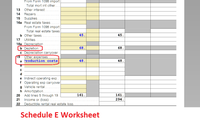

You wrote: "Your Schedule E Worksheet provides for taxes withheld, but not for depletion and Production Costs,..."

The Schedule E Worksheet DOES have an entry place for both depletion and the the production costs. See the third screen image below.

.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

JamesT81

Level 1

taxpreparer101k1

New Member

lnk-fr

Level 2

hdefontes

New Member

PostOffice1102

New Member