- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Deductible Home Mortgage Interest Worksheet

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

JoannaB2,

Your response does not appear to be related to the issue at hand.

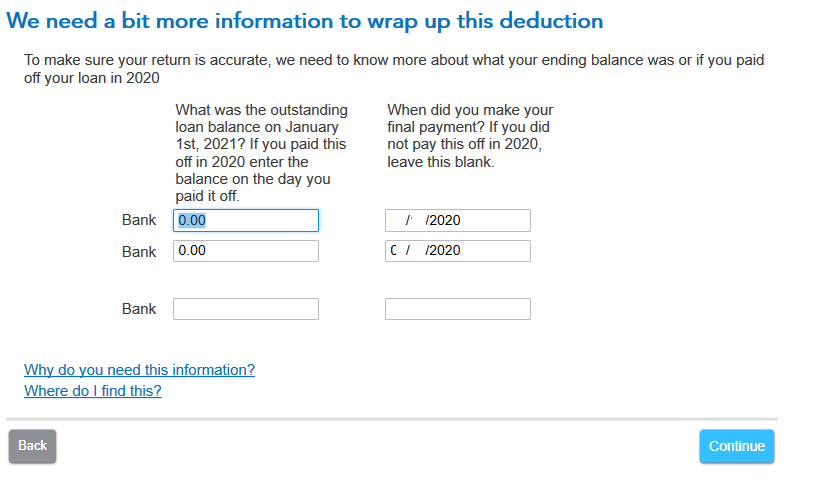

However, I just updated the software and noticed a new screen page that looks to address the Average Monthly Balance calculation issue that I answered how to calculate last year.

While I chose a weighted monthly balance, it appears they TurboTax is performing a different calculation. Researching the issue, I couldn't find a hard definition of what method to use at is not defined by the IRS in their forms.

This new screen queries the proper question of how much your ending refi balance was and the date. These are not included on the 1098s. You have to get them from your loan statements or other loan payoff documentation.

Unfortunately, this problem was not addressed last year, so hopefully no one lost money over it. I ended up manually entering the average monthly weighted balances.

Also, I am not a tax professional so if I may be wrong about some things, this isn't my day job.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

The issue has been submitted and is currently under investigation. Please click on the following link and sign up for an email notification when it's fixed.

Limited interest and points must be entered

Home Mortgage interest being limited

Thank You for your patience.

Your deduction is generally limited if all mortgages used to buy, construct, or improve your first home (and second home if applicable) total more than $1 million ($500,000 if you use married filing separately status) for tax years prior to 2018. Beginning in 2018, this limit is lowered to $750,000. Mortgages that existed as of December 14, 2017 will continue to receive the same tax treatment as under the old rules.

For tax years before 2018, you can also generally deduct interest on home equity debt of up to $100,000 ($50,000 if you're married and file separately) regardless of how you use the loan proceeds. For details and learn more, click here: Home mortgage interest limitation

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

ALL: I've learned that developers have met and deemed that this is not a product defect. Please see the article I'm sharing below (just published) to assist you in completing your return. Thanks for your patience.

What do I do if I have multiple 1098s from refinancing my home debt?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

This is a non-solution, based on this the software will for sure compute the wrong deduction. Simple example: 1M mortgage & 1M refinance, 25k interest (on each) .... the proposed solution would show 2M loan, 50k in interest and would incorrectly limit the deduction to 750k/2M = 0.375 * 50k = $18,750; when the deduction should be 750/1M = 0.75 * 50k = $37,500.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

The solution says to enter box 2 from the “first” 1098. I still think it is a non-solution; how do you enter the information (name etc) for 2 different lenders? I know the 1098’s and worksheets aren’t sent with the return but they should reflect accurate information for our documentation. Maybe TT doesn’t know how to correct the problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

Let the developers know this is not an acceptable answer. The software should complete the various worksheets with correct and complete information even if they are not submitted with the return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

@jake93 I've already shared with Moderators that all of you users are unhappy with this "solution". I agree that a company with the resources of Intuit should have the finest of programmers. Not sure what the developers would have concluded that this is a solution. I, however, am simply sharing what I've been told.

And I'm sharing what you all have said. Thank you again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

The solution that worked for me was to combine all my 1098s into one entry as is explained here.

However, I still had to manually correct my Tax & Int Wks to remove the mortgage interest limit, which did not automatically correct itself.

Make me wonder how many other errors are being left in my tax returns when I go back to revise numbers...

The Turbotax Easy Step really needs to make how to handle refinancing clearer. This has got to apply to a lot of users especially in a year like 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

I was sent an email saying an update was available that fixes this problem. I installed it, it does not fix the problem. The worksheet is incapable of performing the math correctly. I hade to override the check box that says my deduction needs to be limited. This absolutely unacceptable. I refuse to combine my 1098s for the refinance into one. It's more likely to cause issues with the IRS and I'm not interested in that. I was lucky I realized my return looked off and found the problem in the first place. This would have cost me thousands of dollars. TT can no longer be trusted and they have lost a customer for life.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

Still no updates to correct this worksheet. Has anyone heard that turbotax is actually working to correct it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

Some Turbo Tax customers are experiencing an issue with their home mortgage average balance. This can cause the home mortgage interest to be incorrectly limited. This may be affecting your return. See this link for what to do if you have multiple 1098s. See also this Turbo Tax Help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

TT is being very lazy. This is an unacceptable answer. You should be advertising this defect in your product that you can't or won't seem to fix so that people who are unaware don't lose money.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

Wow, I have the exact same problem and was wondering why adding my third amount of interest was INCREASING my taxes.

I would think that, with people refinancing for years, the questions that I answer for the turbo tax program would account for this.

Don't they have some promise or guarantee to get the best refund I am due?

I would call Turbo Tax to talk but I can never find a number and/or get a person.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

If you have more than one 1098 form, I will recommend you to combine all 1098 forms and enter as one. I am attaching a TurboTax link for the instructions how to do claim your mortgage interests. Click here:

For tax years prior to 2018, your mortgage interest deduction is generally limited if all mortgages used to buy, construct, or improve your first home (and second home if applicable) total more than $1 million ($500,000 if you use married filing separately status). Beginning in 2018, this limit is lowered to $750,000. For more information about the mortgage interest deductions, click here: Mortgage Interest deduction

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

Combining all the numbers into some fake 1098 is not a solution. I don't want to get audited. I might as well break out the Excel and do the worksheets in Publication 936 manually and fill out the deduction myself if TurboTax is not going to do it right. I'm probably going elsewhere to file if this is the recommended solution. And for a cash-out refinance on a mortgage greater than $750,000 and less than $1,000,000, this method will not produce the right result.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

VAer

Level 4

joycesyi

Level 2

SelenaP

New Member

Tax_Lego

Returning Member

anon30

Level 3