- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Deductible Home Mortgage Interest Worksheet

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

I'm using the desktop version. I had a house we sold in 2019 so I have a 1098 for that, and in 2019 I bought a house with a loan that was sold and later refinanced, so I have 3 1098s for that house. 4 1098s total for 2 loans. I am having this same problem as the rest.

I entered the 1098 for the house we sold in 2019 - very straightforward. I entered the first two loans for the new house as one loan and combined the interest on the 1098s. I checked the box that says what I'm reporting is not what's printed on the form and it had me enter an explanation. That way I treated it as one loan, which it kind of is, and checked the box that it was refinanced. I also entered the new refi - very straightforward.

Then I went to the Deductible Mortgage Interest worksheet and entered all four loans in separately, it calculated the correct amounts for the average loan balances - note that the "ending balance" it asks for each loan is the remaining balance when the loan was sold or paid off, not "$0". You will need to know how much principal was applied to each loan during the year, if you can sign in to your mortgage holder online or have the paperwork from the loan refi it will help.

With these two things I don't have to manually check the box that my mortgage interest should be limited on the Tax and Interest Deduction Worksheet, and TurboTax gives me the full interest deduction. I don't know if this is ultimately the best solution, I'm not a tax expert but it makes sense and the numbers are documented on the worksheets if the IRS wants the details.

I agree that Intuit really needs to improve this, a lot of people's loans get sold and it should be set up that if I answer the questions TT asks, I get the right tax calculation like they say it will.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

Well done. Thank you for sharing this. I was pulling out what's left of my hair.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

We're having the same issues and nothing we try is working. Any other tips or suggestions? Has TT actually replied to any of you or given an update as to when they will fix this? It's been over a month already since they've been aware of this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

@Sanjeevg TT has failed to fix the problem. Some people have been told by TT there is no bug. I tried 2 workarounds and both worked.

1. go into the interest worksheet and manually check the “no” box.

2. In the interview select “none of these situations apply”, exit the program without selecting continue, re-enter the program but start the interview after the mortgage interest section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

@ultrasurf I never did receive a satisfactory answer. I agree with you - since the numbers on the forms that are actually sent to the IRS are correct, I think I'm just going to submit my returns as I originally had it (entering each 1098 separately, entering 0 for the adjustment for interest, and manually adjusting the home acquisition debt).

The worksheet still looks messed up since it keeps adding the balances on some of the lines, but it doesn't affect the final numbers on the IRS forms, which are correct.

Not pleased with this outcome, as I believe TT should be able to handle refinancing without such manipulation (either adding 1098s together or changing automatically calculated numbers).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

I have also tried your #2 option with accurate results... basically avoiding the 'continue' button, going out and then coming back in right after that point and get the right answers... I am disappointed that TT does take some responsibility for wrong results.. there are ways to mitigate this situation in their software with the information they have. Unfortunately I think many customers will not get the deductions they deserve by following the 'guide me' approach.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

I'm experiencing the same thing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

i am hitting into same issue and cannot correct. i refinanced the loan under $750K, still it keep saying limit the mortgage interest deductible and say standard deduction of $24K is best option. Tried re-entering all the information again and it does not work. Can Turbo tax team please fix the issue? Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

what did you do at the end? I'm thinking about same thing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

Answer Yes, and then enter the full amount of interest allowed.

Please go back to the Home Mortgage Interest section:

Click Federal on the left side-bar

Click Deductions & Credits along the top

Scroll down to “Mortgage Interest and Refinancing (Form 1098)” Click Edit/Add

Scroll down the “Here’s your 1098 info” screen and click Done.

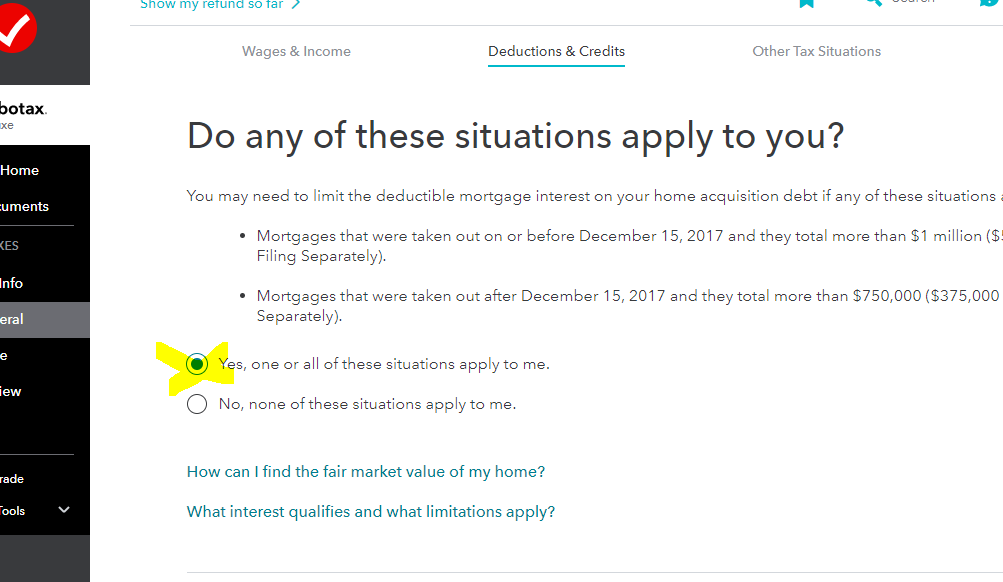

Next screen asks “Do any of these situations apply to you?” Select “Yes, one or all of these situations apply to me.” and Continue.

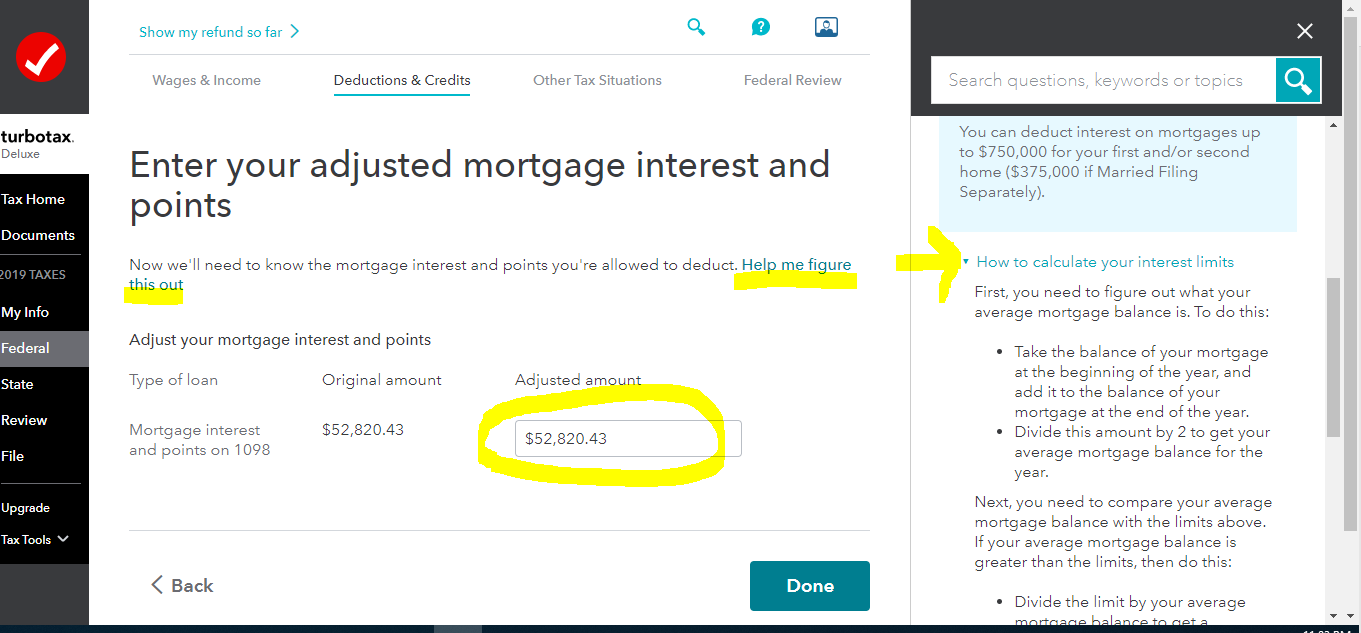

On the following screen, you will see the “Original amount”.

Enter the amount you can claim as a Home Mortgage Interest deduction in the “Adjusted amount” box. The Adjusted amount cannot be larger than the original amount or you will receive an error when trying to file. Instructions on who needs to adjust interest and how to calculate are available by clicking the blue “Help me figure this out” link.

The available “original” amount should only be adjusted for any cash out not used on the home, and that amount cannot be claimed for the Federal deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

It worked for federal tax return. But in Deductible Home Mortgage Interest Worksheet for CA tax return, it still added all the loans together to calculate the deduction limit, and the limit is much lower that what it should be.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

If you have multiple 1098's because your bank sold your loan to another bank it can be confusing.

- Report the interest on the first bank loan.

- The balance of the loan will be zero

- Report the interest and information on the second bank

- The balance will be your outstanding balance

- This will still be the original loan (Not a refi or line of credit)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

The software did not ask for any balances or provide a place to enter the information. In my case there are 3 1098s: the original loan, the refi, and the transfer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

Suppose you have three 1098s and each one has loans of 1M (one was original, one was sold, one was refinanced), you paid interest of 50K, and CA tax has a limit of 1M loans to be deducted. Ideally, you can deduct 50K from the CA tax as the three loans happens at different period (they were sold or refinanced).

The way how TurboTax calculated for CA tax is:

Loan 1: (1M - 0) / 2 = 500K

Loan 2: (1M - 0) / 2 =500K

Loan 3: 1M

and the deductible amount becomes 50K * 1M / (500K + 500K + 1M) = 25K.

The Deductible Home Mortgage Interest Worksheet assumed only 25K can be deducted from the CA tax return. This was wrong calculation and I can't manually fix the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

My situation is similar to the below but we did not refinance. The mortgage servicing company changed ad we received two 1098's for the same mortgage. I followed the guidance below and checked "no" to the question is your mortgage interest limited. When I exit and go back to the step by step entry TT changes the answer and limits my interest deduction. I can't figure out how to override TT and have it stick.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

karlameyer

Level 1

zomboo

Level 6

g213

Level 1

Njpl

New Member

cashrn-gmail-com

New Member