- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Personal allowance for 66 year old with 12k soc security and a 12k withdrawal from a 401k

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal allowance for 66 year old with 12k soc security and a 12k withdrawal from a 401k

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal allowance for 66 year old with 12k soc security and a 12k withdrawal from a 401k

No. You still get the same Standard Deduction for MFS as Single. Just that more of your SS might be taxable. But I think your 20% withholding should cover any tax due. I'll go test it in my program.

May i ask why you are not filing a Joint return? Joint is almost always better.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal allowance for 66 year old with 12k soc security and a 12k withdrawal from a 401k

There are no more personal exemptions but the Standard Deduction doubled to 12,000 for 2018 so that would wipe out your withdrawal and SS would not be taxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal allowance for 66 year old with 12k soc security and a 12k withdrawal from a 401k

Thanks for the reply. The 12k 401k withdrawal would bethis year and it automatically deducts 20% in tax leaving a $9600.00 net payment although gross income for 2019 would be $24000.00. Would I be correct in assuming I would have an additional tax bill based on a gross of $24000.00 this year less the $15,000 allowance. Having already had $2400 deducted from the 401k withdrawal my taxable income would be effectively $21,600 less the personal allowance?

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal allowance for 66 year old with 12k soc security and a 12k withdrawal from a 401k

No. That's not how it works. In the first place your SS should not be taxable. Up to 85% of Social Security becomes taxable when all your other income plus 1/2 your social security, reaches:

Married Filing Jointly: $32,000

Single or head of household: $25,000

Married Filing Separately: 0

So without SS (or very little taxable SS) your AGI Adjusted Gross Income would only be the 12,000 401K. Then minus the 15,000 Standard Deduction gives you zero Taxable Income. Tax on zero is zero. So you will get the 20% withholding back as a refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal allowance for 66 year old with 12k soc security and a 12k withdrawal from a 401k

Where are you getting the 15,000? The Standard Deduction for 2019 for Single is 12,200 plus 1,300 for over 65. So your Standard Deduction is 13,500. Which is still more than your 12,000 Withdrawal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal allowance for 66 year old with 12k soc security and a 12k withdrawal from a 401k

Being married but filing seperately reduces all those allowances to zero. Is this correct?

Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal allowance for 66 year old with 12k soc security and a 12k withdrawal from a 401k

No. You still get the same Standard Deduction for MFS as Single. Just that more of your SS might be taxable. But I think your 20% withholding should cover any tax due. I'll go test it in my program.

May i ask why you are not filing a Joint return? Joint is almost always better.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal allowance for 66 year old with 12k soc security and a 12k withdrawal from a 401k

Must have had a brain-fart with the $15000.00 figure. Sorry for the confusion.

Thanks again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal allowance for 66 year old with 12k soc security and a 12k withdrawal from a 401k

My wife seems to believe her filing status, she earns approx. $62000.00 per annum, is best served filing seperately.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal allowance for 66 year old with 12k soc security and a 12k withdrawal from a 401k

Does she itemize deductions or take the Standard Deduction? If she itemizes you must also itemize even if it is less than the Standard Deduction (even if your deductions are zero). You should really run the numbers both ways, Joint and Separate to see the differences.

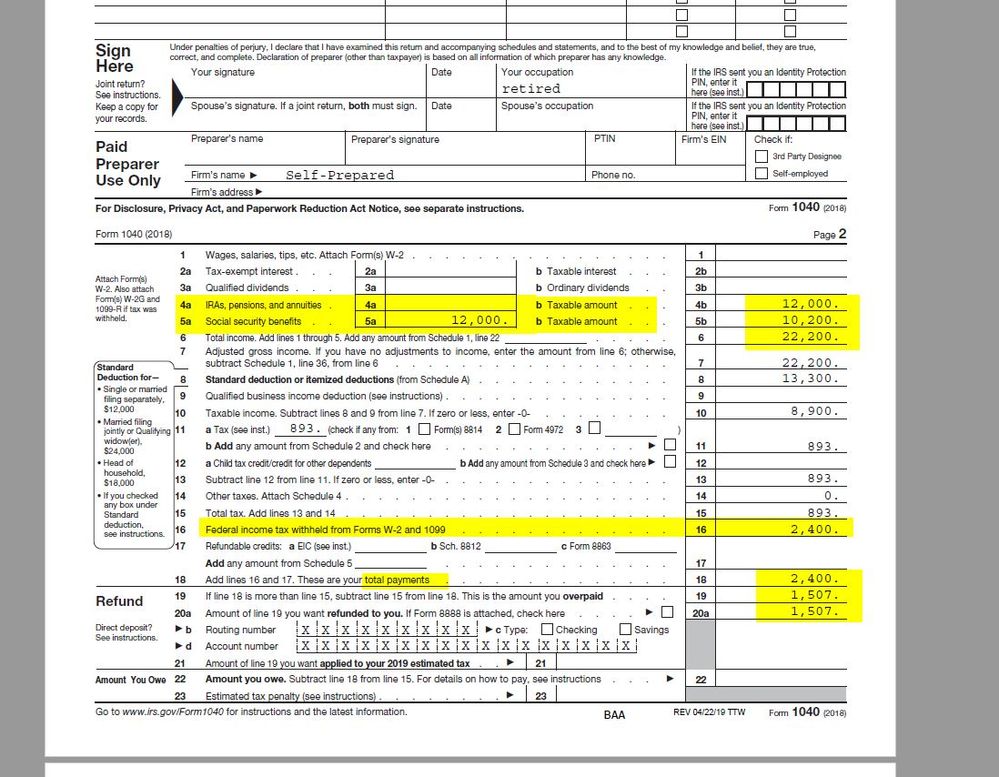

I put in your amounts on a 2018 return to see the result for MFS. You would get a 1,500 refund out of the 2,400 withholding. I have a screen shot of the 1040 return but the forum isn't working right now and won't let me post it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal allowance for 66 year old with 12k soc security and a 12k withdrawal from a 401k

Neither of us have sufficient itemised deductions to go that route and we both use standard deductions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal allowance for 66 year old with 12k soc security and a 12k withdrawal from a 401k

If you file separately then 85% of your SS is taxable ... it would be the same as if you filed jointly HOWEVER by filing jointly you would get a better LOWER tax rate so it would be best if you filed jointly OR at least compute it both ways BEFORE you file to find the best option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal allowance for 66 year old with 12k soc security and a 12k withdrawal from a 401k

Thanks for the info. Guess I'll run both scenarios and see what transpires. I truly appreciate your help and once again, thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal allowance for 66 year old with 12k soc security and a 12k withdrawal from a 401k

Are you using the Online version or the Desktop program? Desktop can do several returns so you can compare.

You can not compare that in the Online version and really can't do that in the Desktop program either. If you are using the Online version don't go changing it around. It won't work and won't give you the right results. And it will mess up your account and return. You just can't change from joint to separate. You would also have to delete all one person's name, info and income. Then do a separate return for them. For Online you would have to set up 3 accounts, 1 Joint and 1 each for both of you separate. You don't have to pay unless you want to print or file.

If you have the desktop version you can do a What-If worksheet. Go to Forms Mode (click Forms at the top) and click Open Form. The What-if form is near the bottom of the US1040 listing (you have to hunt for it). You can play with that. There is a check box at the top to compare MFJ vs MFS. You should save your return with another name and work in the copy. And you can also make up two separate test returns for each of you to see.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal allowance for 66 year old with 12k soc security and a 12k withdrawal from a 401k

Let me see if the forum is working better now and lets me post a picture. Here is a 2018 MFS return using your amounts.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Nickstax15

New Member

ddubs82

Level 2

dontknowtaxes2024

New Member

mrk_corbett

New Member

nicholascuginies

New Member