- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- My wife and I living outside the U.S. for about 6 months

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I living outside the U.S. for about 6 months

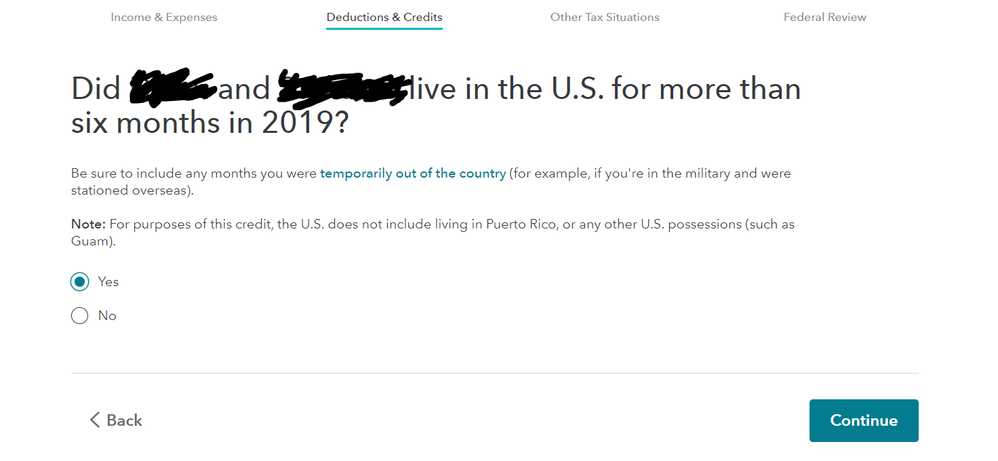

My wife and I are filing taxes jointly this year. I lived in the U.S. for 192 days this year and my wife lived in the U.S. for 178 days. How should I answer the following question:

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I living outside the U.S. for about 6 months

We can see your return but looks like you are answering the questions to determine if you qualify for the Earned Income Tax Credit (EITC). If I am incorrect, let me know in what deduction or credit this question was asked.

If it is for the EITC the question is to determine the Residence Test.

Residency Test. Your child must have the same main home as you (or your spouse if you filing jointly) in United States for more than half of the year.

If the child was living in the United States for over 6 months with you or spouse, you should answer the question as YES. It is establishing if you or your spouse lived in U.S. for over 6 months.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I living outside the U.S. for about 6 months

We can see your return but looks like you are answering the questions to determine if you qualify for the Earned Income Tax Credit (EITC). If I am incorrect, let me know in what deduction or credit this question was asked.

If it is for the EITC the question is to determine the Residence Test.

Residency Test. Your child must have the same main home as you (or your spouse if you filing jointly) in United States for more than half of the year.

If the child was living in the United States for over 6 months with you or spouse, you should answer the question as YES. It is establishing if you or your spouse lived in U.S. for over 6 months.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I living outside the U.S. for about 6 months

Hello Kurt,

Thank you so much for the information!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

candyblahz2

New Member

alireadrean

New Member

jcanalesr92

New Member

roast12345

New Member

paulhyoo

New Member