- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- mortgage interest deduction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mortgage interest deduction

My mortgage is over $1 million obtained before 2017, therefore the excess is not deductible. Why Turbotax does not calculate the correct deduction after I enter the 1098 amount, beginning and end balance for the year 2018?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mortgage interest deduction

@saodk wrote:

My mortgage is over $1 million obtained before 2017, therefore the excess is not deductible. Why Turbotax does not calculate the correct deduction after I enter the 1098 amount, beginning and end balance for the year 2018?

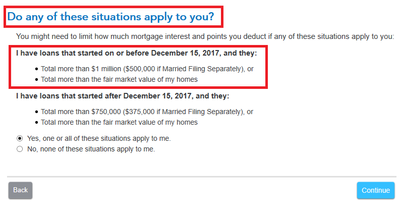

You need to adjust the amount of the deduction and you should have encountered the screen in the screenshot below after you entered your mortgage information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mortgage interest deduction

This screen does not appear! It asks mortgage origination date, starting and ending balance but does not adjust the deductible interest amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mortgage interest deduction

I figured it out. However, Turbotax does not calculate the adjusted mortgage deduction and I had to do it manually by a) calculating the outstanding AVERAGE mortgage balance for the year (beginning + ending balance/2) ,and b) multiplying the total interest paid for the year by ratio of $1 million/AVERAGE mortgage balance. For mortgages initiated after Dec 15, 2017 replace $1 million with $750,000.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mortgage interest deduction

What a nightmare! TurboTax should calculate this

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mortgage interest deduction

I have this problem every year. This year I have (3) 1098s for each property - so 6 total. Turbo Tax needs to fix this mess. Be careful that when you have multiple 1098s, so it does not double your loan basis. I had that happen last year and I had to file an amended return. Turbo Tax asks the question about over a million in mortgage interest, but has no format for fixing this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mortgage interest deduction

When you have multiple 1098s for the same property and you enter all of them and enter the Outstanding Mortgage Principle in each one, yes it is going to add them all together because that is what TurboTax does it combines them. To enter them correctly for each group of 1098s, enter them as follows:

- Add the amount in Box 1 of each 1098 and enter that as the Box 1 amount.

- For Box 2 enter the Outstanding Mortgage Principal on the most recent loan that you have. Only enter the Outstanding Mortgage Principal once do not combine them.

- For the Origination Date, use the latest date of the 3 1098s (this should be the original loan date).

- For property taxes, go ahead and enter any property taxes shown on all of them making sure that you are not duplicating the amount. Double-check the amount of your property taxes by looking at your tax bill. The amount entered should not be more than the amount of your taxes for 2021.

- For points and mortgage insurance premiums, you can enter these amounts. Again, if points and mortgage insurance premiums show on more than one 1098, make sure that you are not duplicating amounts.

Then go back and do the same for the other 3 1098s you have. If all six of them are for the same property, then follow the steps above adding the interest in all six of the 1098s and entering that amount in Box 1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mortgage interest deduction

Thank you, but I think Turbo Tax needs to specifically state this in the instructions, and fix this problem. I cannot imagine how many people have duplicated their mortgage basis amount and then had to file an amended return - or just pay more. For me, it made the mortgages incorrectly over 2 million. Last, there needs to be a formula to calculate and record the deductible interest when it exceeds the 1 million or 750K limits. Although Turbo Tax asks this question, it does not provide a calculator. Even the IRS Publication 936 does not tell you how to address where to put this information. I reduced my deductible interest by the .95 calculation on the IRS Publication 936 work sheet - but this is not a good answer. We were audited over this once before - same problem. After all of this time, this should be fixed in Turbo Tax.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

chunhuach

Level 1

gowrish

New Member

Kaybru20

New Member

VAer

Level 4

SelenaP

New Member