- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- IRA deductions are not correct

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA deductions are not correct

According to IRS Publication 590-A and IRS Section 219(g), the minimum deduction for an IRA, the credit it $200. However, making a $10 Traditional IRA contribution does not affect my taxes owed at all (when it should be adjusting my income down $200) and lowering my taxes owed.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA deductions are not correct

Go to this IRS website for information on the Retirement Savings Contributions Credit - https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-savings-contributions-save...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA deductions are not correct

adamsh18, you are confusing tax deductions with tax credits and how each of these works with respect to an IRA contribution. Under no circumstances will a $10 IRA contribution reduce your tax liability by $200. A $10 deductible traditional IRA contribution will generally reduce your AGI by $10 (although sometimes there are side effects that can cause it to reduce your AGI by slightly more than that). For a majority of people a $10 reduction in AGI will not change their income tax liability because the tax tables for the most part operate in $50 increments of taxable income.

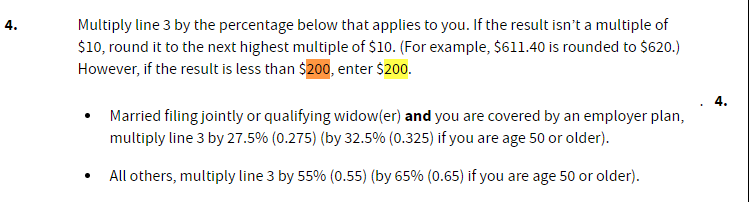

If you qualify for the Retirement Savings Contributions Credit, a $10 IRA contribution will give you a tax credit that directly reduces your tax liability (separately from any deduction you might get for the contribution) of, at most, $5 (50% of the $10 contribution), often less.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA deductions are not correct

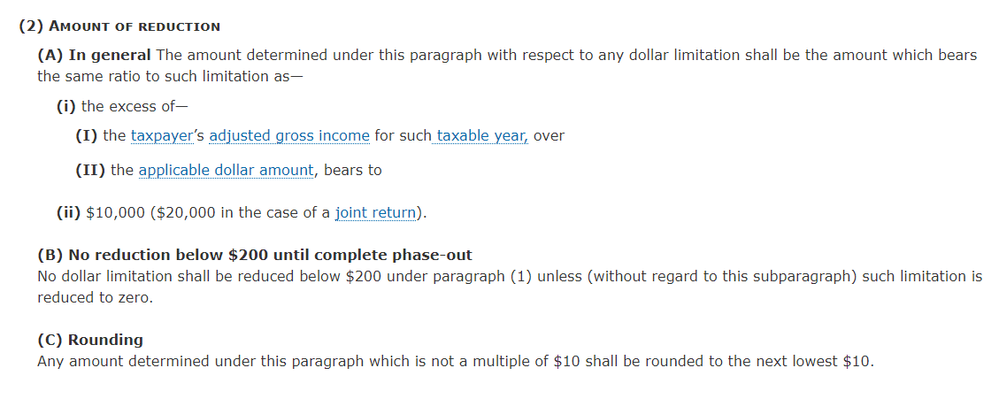

Here is IRC 219 (g) stating that the reduction should be no less than $200.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA deductions are not correct

Section 219(g)(2) governs the limitation of your deduction for a traditional IRA contribution based on modified AGI when you or your spouse is covered by a retirement plan at work. The limitation gradually drops from the full contribution limit when modified AGI is below the phase-out range to $200 as your modified AGI approaches the top of the phase out range, then drops from $200 to zero as your modified AGI reaches the top of the phase out range. This $200 is the limitation ion the deduction, not the deduction itself unless your contribution is at least $200 and your modified AGI is near (but not at) the top of the phase-out range. This calculation is implemented properly on TurboTax's IRA Deduction Worksheet.

For example, an individual with a modified AGI of $73,999 in 2019 ($1 below the top of the phase-out range) will receive a deduction of $200 or the amount of of their traditional IRA contribution, whichever is less. Increasing the modified AGI by $1 to $74,000 will cause the deduction to drop to $0.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA deductions are not correct

I agree that if you are below the phase-out and contribute anywhere between $10 and $200, according to Publication 590-A, you get a $200 deduction to your MAGI.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA deductions are not correct

No, that's not what it says. You cannot get a deduction of more than the amount you contribute. See section 219(a):

(a) Allowance of deduction

In the case of an individual, there shall be allowed as a deduction an amount equal to the qualified retirement contributions of the individual for the taxable year.

Section 219(g)(2) simply further limits the permissible deduction.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jlem768695

New Member

M-Bat

New Member

AgiFix

New Member

misandmak

New Member

jawship-gmail-co

New Member