- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I want to claim a theft loss in 2020. I want to add form 4684 Section C

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to claim a theft loss in 2020. I want to add form 4684 Section C

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to claim a theft loss in 2020. I want to add form 4684 Section C

Personal casualty and theft losses of an individual sustained in a tax year beginning after 2017 are deductible only to the extent they're attributable to a federally declared disaster.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to claim a theft loss in 2020. I want to add form 4684 Section C

That form will not be functional until at least 2/24/22 per the chart here : https://care-cdn.prodsupportsite.a.intuit.com/forms-availability/turbotax_fed_windows_individual.htm...

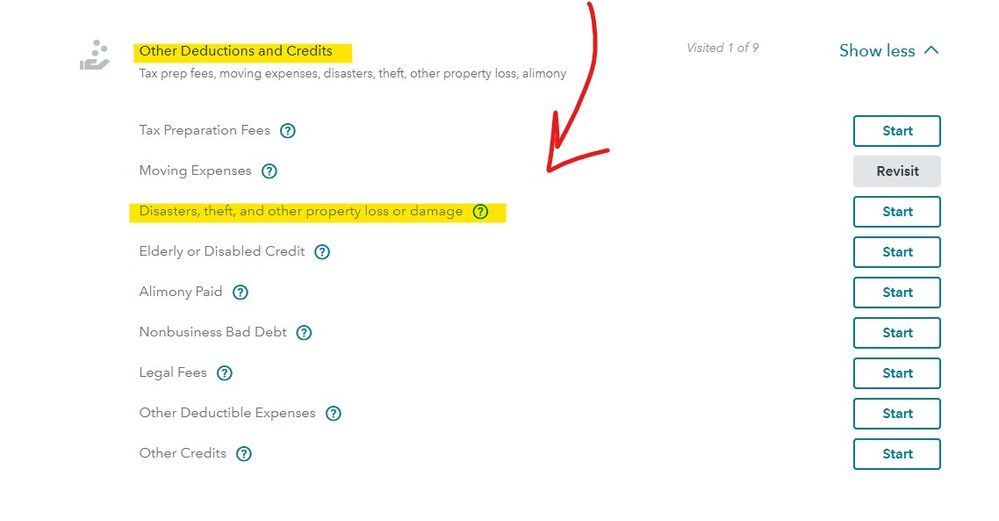

That is handled in the Deductions & Credit section of the interview ... scroll down until you see this section:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to claim a theft loss in 2020. I want to add form 4684 Section C

That is true ... I thought the Ponzi loss was still deductible but alas no ... this is from my professional program's site instructions :

Beginning tax year 2018

Beginning tax year 2018 taxpayers will be not be able to claim a casualty, or a loss on their Federal return, unless it is located in a Federally Declared Disaster area. The taxpayer will also be required to register with FEMA for each of the disasters and create an account. Once the taxpayer registers with FEMA they will receive a registration number, that will be required to be present on the form when filing the return.

Note: Some states do not plan to conform to the new federal laws, and will still allow this form as well as the losses associated with it regardless of the area being a federally declared disaster. Please note the state's specific instructions to see if the loss is still allowed.

For further instruction, please see the Tax Cuts and Jobs Act.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to claim a theft loss in 2020. I want to add form 4684 Section C

the laws and the IRS left the deductibility of PONZI-type losses a mess. the TCJA only ruled out the deduction for personal casualty losses unless ......

this is from IRS instructions for 2020 Form 4684

https://www.irs.gov/instructions/i4684

Section C—Theft Loss Deduction for Ponzi-Type Investment Scheme Using the Procedures in Revenue Procedure 2009-20

Fill out Section C if you claim a theft loss deduction for a Ponzi-type investment scheme and you meet both of the following conditions.

You qualify to use Revenue Procedure 2009-20, as modified by Revenue Procedure 2011-58.

You choose to follow the procedures in the guidance.

If you meet both conditions, fill out Section C in lieu of Appendix A in Revenue Procedure 2009-20.

For more information about claiming a theft loss deduction from a Ponzi-type investment scheme, see the following guidance.

Revenue Ruling 2009-9, 2009-14 I.R.B. 735 (available at IRS.gov/IRB/2009-14_IRB#RR-2009-9).

Revenue Procedure 2009-20, 2009-14 I.R.B. 749 (available at IRS.gov/IRB/2009-14_IRB#RP-2009-20).

Revenue Procedure 2011-58, 2011-50 I.R.B. 849 (available at IRS.gov/IRB/2011-50_IRB#RP-2011-58).

Why is there section C for 2020 if you can't deduct them? So there would seem to be a contradiction between IRC 165(h)(5) which denies the deduction for personal casualty losses for 2018-2025 and the IRS's own instructions and forms that seem to allow it. perhaps unsaid is that "personal" means loss from an event not entered into for profit.

if fact this link provides guidance in that it states that transactions entered into for profit are outside the scope of a personal casualty loss and thus allowable.

https://www.meadowscollier.com/claiming-a-theft-loss-deduction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to claim a theft loss in 2020. I want to add form 4684 Section C

the key word is "personal". the IRS continues to include section C in form 4864 and talks about Ponzi-type losses in the form's instructions and on its website.

and PUBL 547 for 2020 contains the following

Losses from Ponzi-type investment

schemes. The IRS has issued the following

guidance to assist taxpayers who are victims of

losses from Ponzi-type investment schemes.

• Revenue Ruling 2009-9, 2009-14 I.R.B.

735 (available at IRS.gov/irb/

2009-14_IRB#RR-2009-9).

• Revenue Procedure 2009-20, 2009-14

I.R.B. 749 (available at IRS.gov/irb/

2009-14_IRB#RP-2009-20).

I could not find in either the code or regs what the code means by "personal" but evidently, it exludes losses with regard to business and income-producing property.

https://www.financialdreamteam.com/tax/use-the-irs-safe-harbor-tax-relief-for-ponzi-scheme-losses/

the Tax Cuts and Jobs Act (TCJA), which crushed most theft losses for tax years 2018–2025, allowed the IRS tax-favored Ponzi scheme loss deduction rules to remain in place.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

PaulKoss

New Member

alainamholly

New Member

Csaylor1984

New Member

Elbarbar

Level 1

TomB11

New Member