- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I sold my primary residence in Aug'21, which I had acquired in May'16. I had rented this property out from Nov'18-Aug'21. Is this considered business or main home sale?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my primary residence in Aug'21, which I had acquired in May'16. I had rented this property out from Nov'18-Aug'21. Is this considered business or main home sale?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my primary residence in Aug'21, which I had acquired in May'16. I had rented this property out from Nov'18-Aug'21. Is this considered business or main home sale?

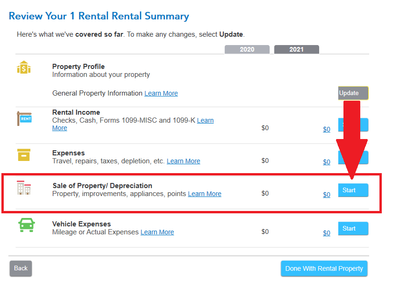

The sale can be reported in TurboTax as a home sale, but you need to dispose of the property in the Rental section if you have been reporting rental income and expenses in TurboTax during past tax years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my primary residence in Aug'21, which I had acquired in May'16. I had rented this property out from Nov'18-Aug'21. Is this considered business or main home sale?

Q. Is this considered business or main home sale?

A. Simple answer: home sale, because you meet the 2 year rule. To qualify for the home sale exclusion, of the capital gain on the sale, you must have owned and lived in the home, as you principal residence 2 of the 5 years prior to sale. That 5 year period started Aug 2016. Since you lived in the home Aug 2016 to Nov 2018 (27 months), you meet that rule.

However, taxes aren't simple. It's really both a home sale and a business asset sale. That is, you must pay tax on the depreciation "recapture". You were allowed to deduct depreciation against rental income while you were renting it out. When you sell, you must report the "recapture" as income. It is taxed at ordinary income rates (not capital gains rate) but with a 25% max.

The easiest way to report it in TurboTax, is to report the sale as a home sale. The interview will ask about depreciation, previously claimed. You make only one entry for the total depreciation allowed or allowable.

If you did not claim depreciation, while renting it out, you must still recapture the depreciation your shoulda claimed. See https://ttlc.intuit.com/turbotax-support/en-us/help-article/asset-depreciation/didnt-take-depreciati...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my primary residence in Aug'21, which I had acquired in May'16. I had rented this property out from Nov'18-Aug'21. Is this considered business or main home sale?

The sale can be reported in TurboTax as a home sale, but you need to dispose of the property in the Rental section if you have been reporting rental income and expenses in TurboTax during past tax years.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

kiMurphy

Level 2

Jnessa

New Member

Andy_W

Level 1

Andy_W

Level 1

ataguchi

New Member