- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Dependent Care Credit not being calculated in Home and Businesss

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent Care Credit not being calculated in Home and Businesss

I select my wife (who is fully disabled for entire year) and the next page says I haven't selected an eligible dependent. I did the easy guide and it says she is. What gives? I should be eligible for 20% of my expenses for her care!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent Care Credit not being calculated in Home and Businesss

Let's try a different path:

In TurboTax desktop,

- Open up program

- At the right upper corner, search for child care credit, then select "Jump to" link

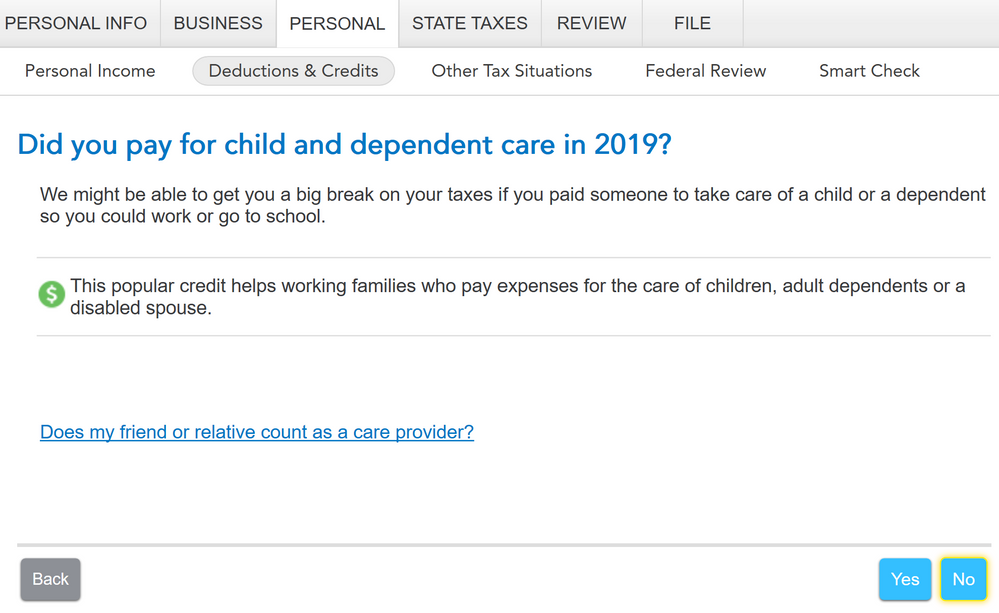

- On-screen, Did you pay for child or dependent care in 2019? Answer Yes.

- Next screen, Tell us about you and spouse? check the box for disabled under spouse

- See the image below

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent Care Credit not being calculated in Home and Businesss

That is all recorded from the first as you indicated. It gives me the choice of selecting myself and my spouse from the drop down box when asked if I paid for care. I select my wife, continue, and then get a message that I did not select an eligible dependent. If I go back to the box that has the easy guide, it proves she is eligible.

If I override the entries I can't efile. The program is holding me hostage and find no way on the website to get technical support. I'm getting pissed!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent Care Credit not being calculated in Home and Businesss

Try going back to edit the My Info/Personal Info section.

To do this, Select My Info

Next to your spouse's name select Edit (or the pencil icon)

Run through the personal questions and select that your spouse is disabled.

Then go back through the Child and dependent care expense section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent Care Credit not being calculated in Home and Businesss

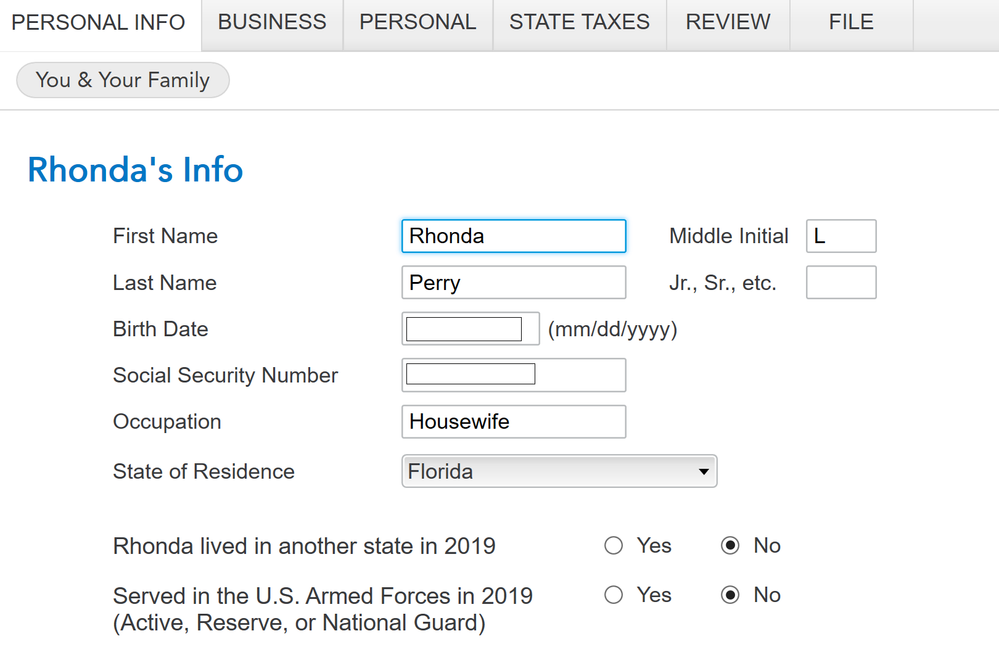

First, I'll show you what I saw and marked when I followed your directions:

No option to select "Disabled" in this section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent Care Credit not being calculated in Home and Businesss

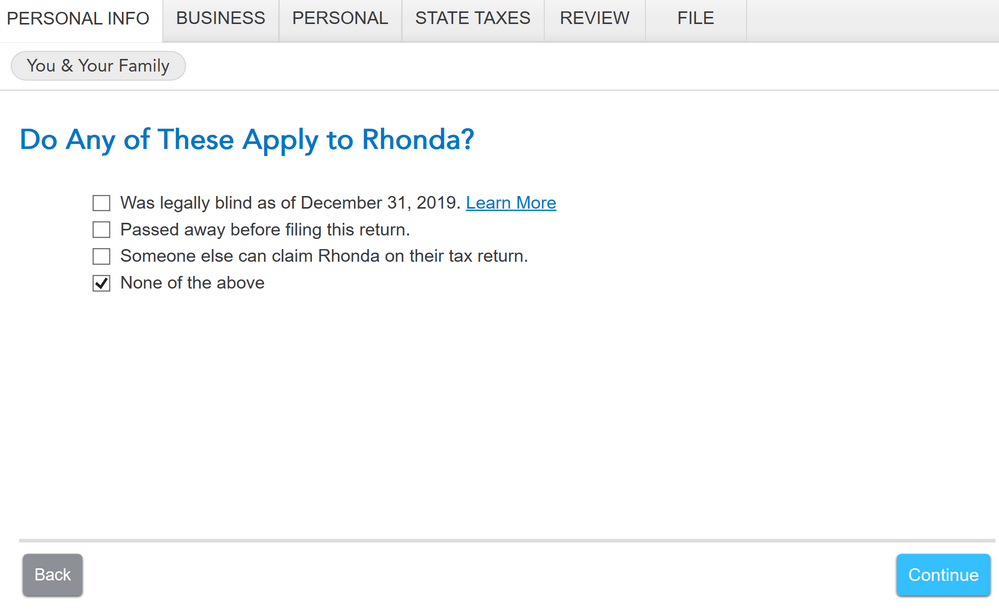

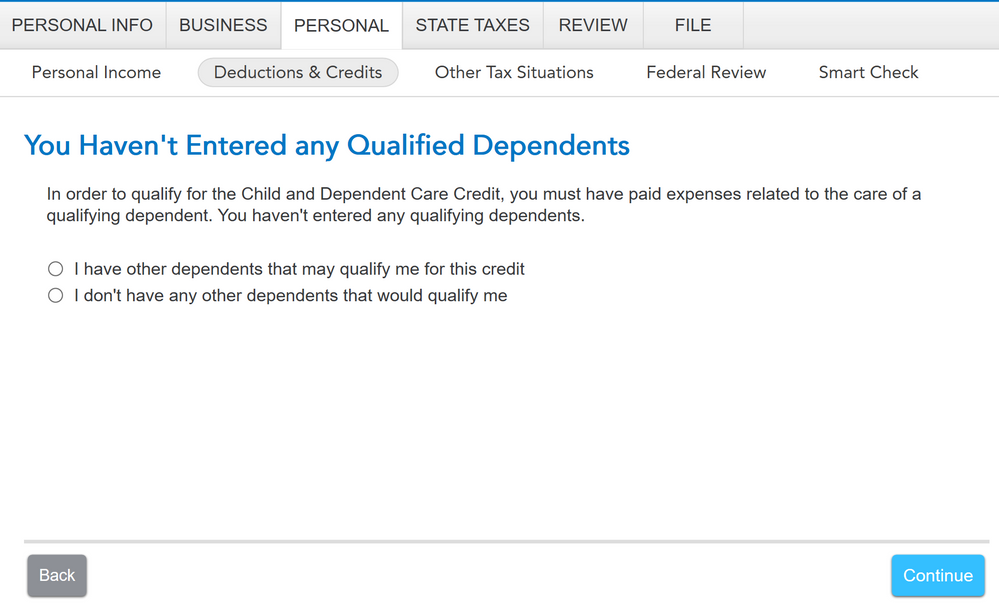

Here's what I see in the deductions section:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent Care Credit not being calculated in Home and Businesss

Have you seen my responses? I was quick to get responses when people made assumptions that I was doing something wrong. Now that I've posted screenshots that effectively prove a software issue, I get nothing. Not even a response from an employee to tell me how to address it. This is why in my previous post I said I was getting pissed. No help for software issues. Can't find a place for it on the website. Where do I turn? Intuit just takes my money, wastes my time, and even if the software is the problem, the response is SILENCE! Where's your tech support!!!!!????? How do WE get this fixed? Someone that doesn't know any better might be out $600 or more. I'm not giving up. I know I am eligible. The "Easy Guide" also confirmed it. Where's my help???? Where do I turn to??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent Care Credit not being calculated in Home and Businesss

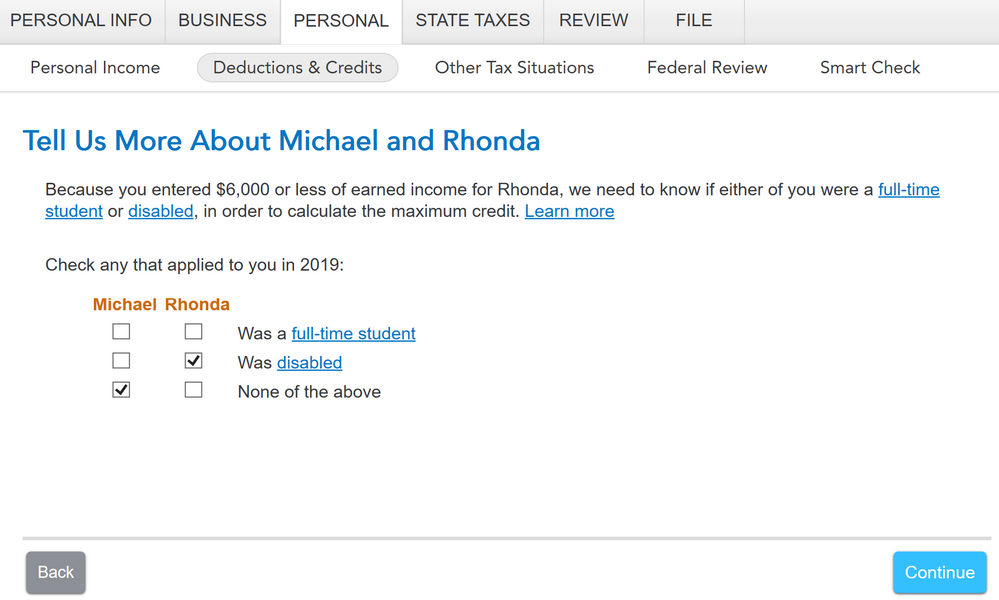

The option to select that your spouse is disabled and qualifies for the Child and Dependent Care Credit is only available in the Deductions and Credits section. Please follow these steps:

- Click on the "Personal" Tab and then click on Deductions and Credits at the top

- Click "I'll choose what I work on" and then click Update next to Child and Dependent Care Credit

- Click Yes and then select "Was Disabled" for your spouse in section "Tell us more about Taxpayer and Spouse" (See screenshot below) Click Continue

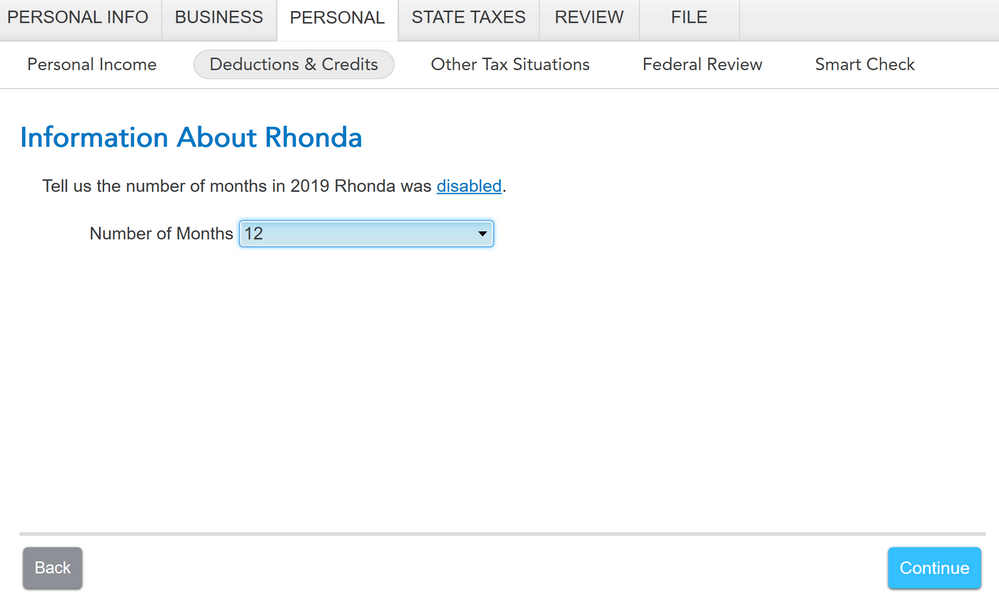

- Select 12 from the drop down menu to answer "Tell us the number of months in 2019 'Spouse' was disabled" Click Continue

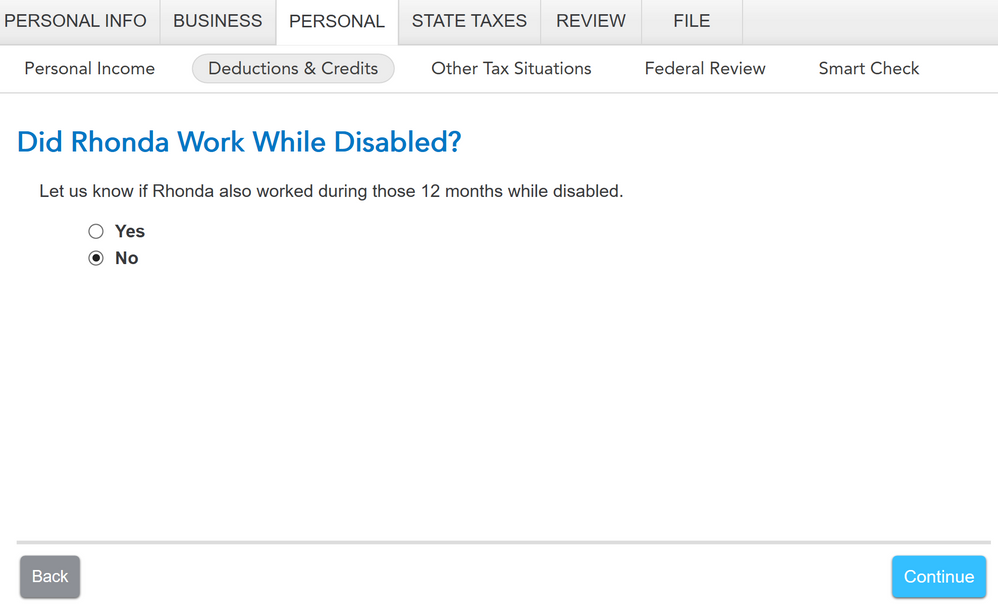

- Answer Yes or No to the question "Did 'Spouse' work while disabled?" (Answer any additional questions in this section if applicable)

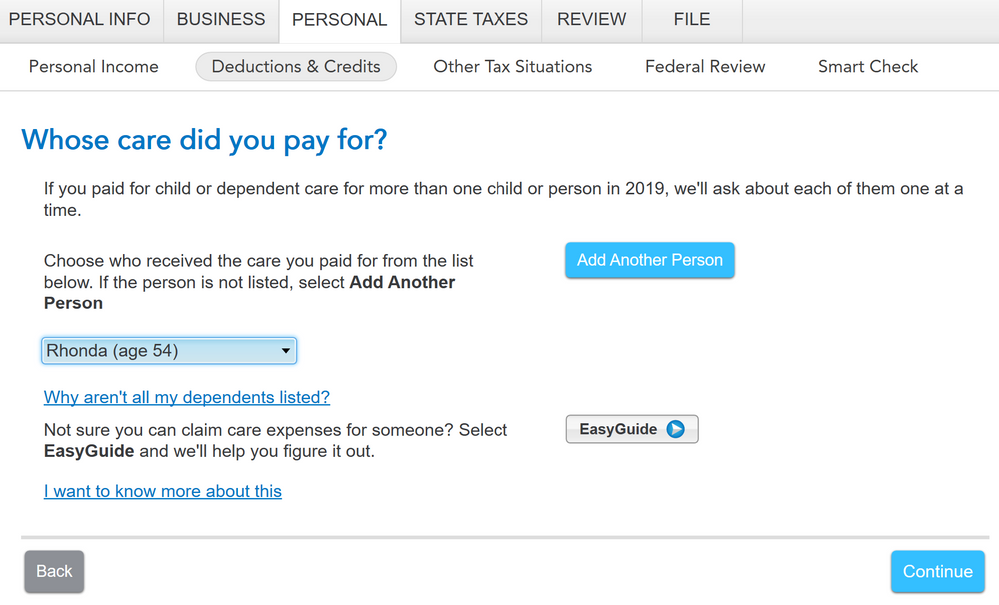

- In section "Whose care did you pay for?" Select your spouse's name from drop down menu. Click Continue.

- Answer Yes or No to the question "Was Spouse Incapable of Self-Care?" (Note: Your spouse must be incapable of self-care in order to qualify for the credit.)

- Enter Dependent Care expenses in the section "How much did you spend on 'Spouse's' care?" Click Continue and then click Done.

- Enter the care provider information in the section "Let's get some info about your care provider" Click Continue and then click Done.

- Answer any other questions and select continue until to you get to section "Your Child and Dependent Care Credit Summary"

Please Note: This is a nonrefundable credit. If you do not have a tax liability, you will not be eligible for a credit.

Please see IRS Topic No. 602 for the requirements to claim the Child and Dependent Care Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent Care Credit not being calculated in Home and Businesss

Thank you for your detailed answer. Please review the entire thread. I only went to the front personal information section because of a previous recommendation. If you look at my next post, I have already gone through all the steps that you detailed here. I did that before ever posting, but to show everyone what the problem is, I posted all screens. After I select my wife (who is definitely eligible and is marked in this section as disabled and no income), the software says I have not selected an eligible dependent. See the screens. This appears to be a software issue. How do I get help with that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent Care Credit not being calculated in Home and Businesss

You should have when answering these questions gotten to a question about if your spouse was incapable of self care. If you answer no then no expenses are allowed as shown below.

.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent Care Credit not being calculated in Home and Businesss

I am having the exact same problem. Seems to be a software glitch unless the rules have changed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent Care Credit not being calculated in Home and Businesss

Yes, you should be able to claim dependent care services for your wife. To test to see if the software worked properly, i did a test scenario using my wife. i tested in both Turbo Tax online and Turbo Tax Desktop.

- When you select Child and Dependent Care Credit >start

- Did you pay for child or dependent care in 2019? yes

- Do any of the following apply to xxxx? Yes

- here you would indicate that she was incapable of self care or if you are using the software, it will ask if she is disabled

- it will then ask Did Jane work during this time? NO

- Whose care did you pay for? Your wife's name should be a choice

- Then it will prompt you to list a provider. It has to be a person or organization that has a social security number or EIN

- Then after you enter the information, it will say Pick a dependent and a provider, and tell us how much you paid.

- In this screen, there should first be a drop down where you will pick your wife's name as the dependent, the provider's name, and most important, the amount.

I entered all this in my Turbo Tax program and received a dependent care credit for my disabled wife. if you are still experiencing difficulty, you might reach out to phone support so they can pinpoint any potential issue. The only thing i can say is that i tested it through the program and the software and it works like it should.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Skajs

Returning Member

dedgecomb

New Member

krm123

Returning Member

corinna37

New Member

leochens

New Member