- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- The North Carolina part year residents and nonresidents taxable percentage is calculated incorrectly by Turbo Tax. Who can fix this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The North Carolina part year residents and nonresidents taxable percentage is calculated incorrectly by Turbo Tax. Who can fix this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The North Carolina part year residents and nonresidents taxable percentage is calculated incorrectly by Turbo Tax. Who can fix this?

Please elaborate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The North Carolina part year residents and nonresidents taxable percentage is calculated incorrectly by Turbo Tax. Who can fix this?

.If you resided in the state for more than 183 days during the tax year, you will be considered a resident.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The North Carolina part year residents and nonresidents taxable percentage is calculated incorrectly by Turbo Tax. Who can fix this?

True, but the year you move you are a part-year resident.

I suspect your error (if any) is on the income allocation pages during the NC interview.

For the column "North Carolina Income While Nonresident" that column will mostly be zero's.....only $$ in that column are for NC-taxable income you earned in NC when you were NOT a resident of NC. Thus, Dividends and interest should be zero....cap gains should most likely be zero in that column (unless you owned an investment property/business/Farm/land in NC you sold while not living there ) ...working in NC when not living there, or having a rental property in NC while not living there is thus NC Income while non-resident.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The North Carolina part year residents and nonresidents taxable percentage is calculated incorrectly by Turbo Tax. Who can fix this?

Re "For the column "North Carolina Income While Nonresident" that column will mostly be zero's.....only $$ in that column are for NC-taxable income you earned in NC when you were NOT a resident of NC. "

So, if a person lives in SC and works in NC (or telecommutes for a NC company,) then if the company reports that as NC income, the respective W2 income $$ should appear in column B? It is considered NC based income not SC based?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The North Carolina part year residents and nonresidents taxable percentage is calculated incorrectly by Turbo Tax. Who can fix this?

Yes...(and maybe partially No)

___________________________

1) in the NC nonresident Income allocation sheet....none are actually "labelled" column B...but it is the last column, labelled as you noted: In the Interview it's: "North Carolina Income While Nonresident" .....On the actual worksheet, it is labelled "Nonresident With Income From NC Sources" (same thing though)

2) If you were a resident of SC, and crossed the border to physically work inside NC, then $$ for wages in that column should transfer from value in box 16 of your NC-employer's W-2 form....IF....if you properly designated that W-2 amount as "NR NC Source Income" in the NC interview, on one page where the interview asked you to "allocate" that W-2 form's income.

______________________

But...possible complication, since you mentioned telecommuting...For the majority of states, the W-2 income is considered taxable by the state you are actually physically located when you do that work. Both NC and SC tax departments & laws follow that procedure.

NC does not have a telecommuter tax law (as some states do) where the work state claims the wages as being taxable, even if the employee telecommutes from a different state...THUS..

3) ......IF the time that you worked from home in SC, was significant....then your employer "should have" broken up your wages in boxes 15-to-17 as two lines...one for NC wages where you physically worked in NC, and a separate line for the time you worked at home as SC wages. But your employer may not have done so....and if you are in this situation, things can get complicated. (i.e, the wages for the time you telecommuted from your home in SC is not supposed to be included in the column for NC Nonresident wages)

Certainly, if your time working/telecommuting from home in SC was not significant, it's probably not worth worrying about....but if all of 2021 was telecommuting, then you employer "should have" relayed that info to payroll such that only SC taxes were withheld in boxes 15-to-17 of that W-2.

......(AND...if you did telecommute from SC to the NC employer in for ALL of 2021, and ALL of boxes 15-to-17 is already listed only as SC income&withholding...then you don't file an NC nonresident tax return, since none of it was NC -taxable wages.)

__________________

You'd have to describe your full working situation for that employer, and the actual W-2 form's box 15-to-17 allocations (NC vs SC) and working situation in more detail if you need additional clarity/help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The North Carolina part year residents and nonresidents taxable percentage is calculated incorrectly by Turbo Tax. Who can fix this?

I had 2 W2s.

W2 #1 was for my wife. she physically commuted to NC each work day in 2021. All of her wages are represented in box 16. She has NC withholding in box 17 about 4% rate.

My W2 shows the same for NC. same tax rate. I worked 100% remote in SC due to covid in 2021. That employer exists in NC and I had worked there physically in 2020 before Covid hit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The North Carolina part year residents and nonresidents taxable percentage is calculated incorrectly by Turbo Tax. Who can fix this?

OK, I see the column B now on the NC D-400, Sch PN. I was looking at the worksheet that feeds into it, which doesn't have a column B.

_____________________________

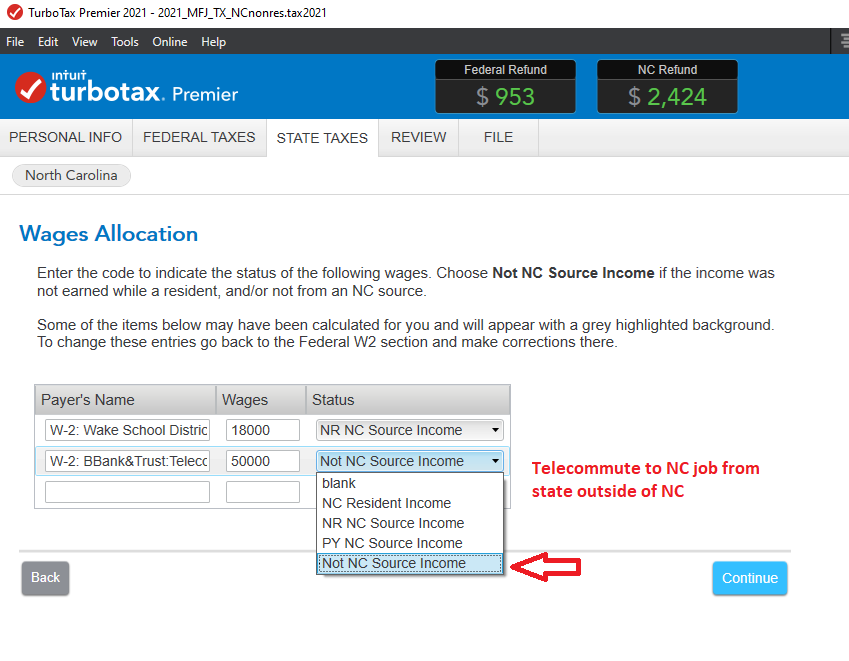

1) For a W-2, where you-yourself telecommuted from outside of NC all year, you mark that W-2 as being "Not NC Source Income" during the NC nonresident interview income allocation section. In the desktop software (which I'm using), it looks like the following (not sure how they present it in the Online software) Situation: a) Telecommute W-2 $50k, & b) Spouse worked in NC W-2 $18k

_____________________________

____________________

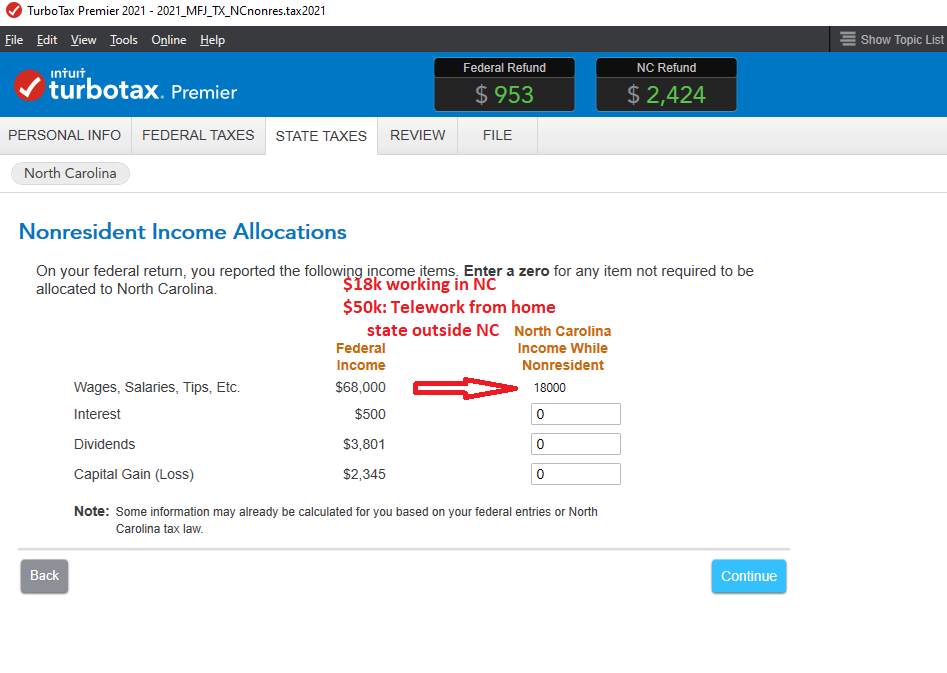

That removes that W-2 as being subject to NC taxation...since it shouldn't be taxed by NC since you were physically located in SC NC when you did that work. The follow-up page on Desktop software would then look like:

_______________________

__________________________

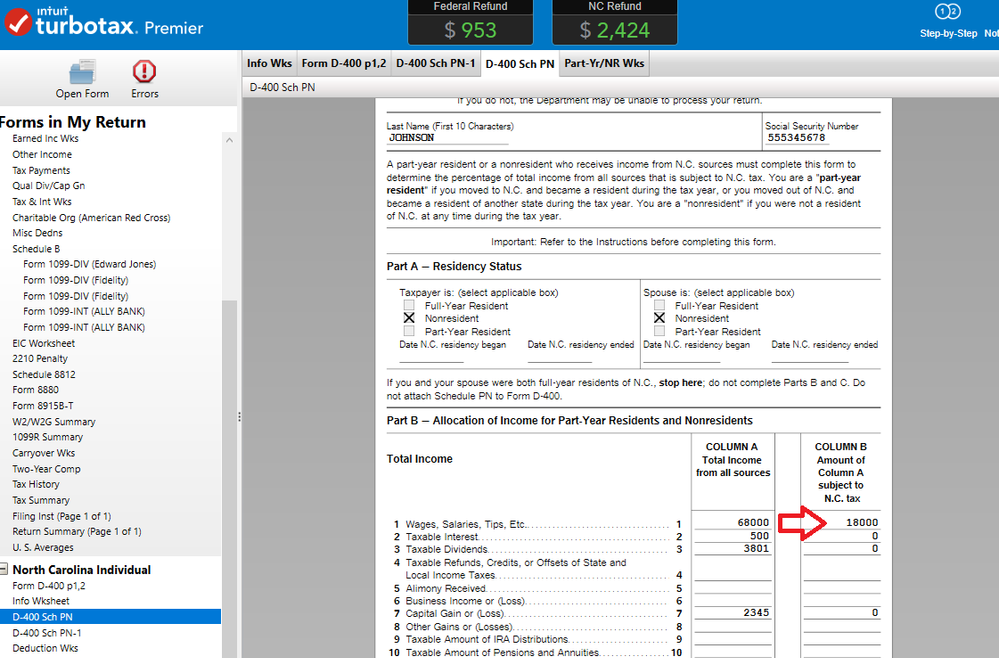

And the D-400, Sch PN would look like (Name and SSN are fake):

______________________

____________________

____________________

1) You fill out the NC nonresident tax return first, and error check it.. Then work on the SC resident tax return last. The SC tax returns will calculate a tax on ALL your income, but give you a credit "up-to" the taxes you ended up having to pay to NC. (i.e, not what was withheld for NC taxes, but only what NC is keeping after whatever refund NC is "expected" to send you)

Now...potential complications.

2) I have no idea if NC will allow this to be e-filed. Many states have a cutoff, where if State withholding on W-2 forms is above a certain % of that state's income, the state then requires paper filing. And you've effectively removed a lot of NC income. The software will know that and block e-filing NC forms if that ends up being yoru situation....but I don't know if it uses the NC-income $$ before you removed the telecommuting $$, or after removing those $$.

3) NC computers might kick your tax file for agent review, even if you can e-file it. Their question becomes...why does your W-2 show all that income as being NC...and you claim it isn't. IF they send you a letter asking you to explain.....you'd indicate you telecommuted from SC all year ( a letter from your employer might help too). It would be great if such a note could be attached to an e-file, but the software doesn't allow it right now.

4) Certainly, if you are forced to paper-mail file the NC forms, you could attach a signed note to your own W-2 forms, explaining that you telecommuted from SC all year. NC reviewers might still challenge it and ask for confirmation from the employer......but perhaps telecommute issues like this were so common for 2020/2021...they might just shrug and pass it on. No way to know.

_______________

5) For 2022, if you telecommuted at all early in the year, (more than just a few occasional days)....talk to your employer/payroll NOW about breaking the $$ up properly to SC vs NC for the 2022 W-2, so that you aren't again stuck in such a situation for the 2022 tax filing. Certainly, it may depend on how sophisticated the payroll department is, and whether they are even willing to try to break it out. It would also depend on you and your immediate boss keeping track, and indicating that time in SC vs NC to the payroll department...even if they are willing to parse it out ~properly between the two states.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The North Carolina part year residents and nonresidents taxable percentage is calculated incorrectly by Turbo Tax. Who can fix this?

Edited a couple things....one spot I put in NC when I meant SC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The North Carolina part year residents and nonresidents taxable percentage is calculated incorrectly by Turbo Tax. Who can fix this?

My current situation is that NC has sent me a letter stating NC taxes withheld are expected and will be retained based on the W2s and the employer provided info. I guess that implies the telecommuter angle is ignored and they will treat both as NC generated income. My intention is to align with the NC decision and then refile/ adjust my SC return showing the adjusted taxes paid to NC.

Thoughts?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The North Carolina part year residents and nonresidents taxable percentage is calculated incorrectly by Turbo Tax. Who can fix this?

Ahhh, so they are already disagreeing with you assigning that income to SC and not to NC, as noted on your original W-2......

In this situation, I suspect that you would have to retain a tax attorney to fight it (if you want to assign the $$ to SC)...and also get your employer to agree to issue a W-2C reassigning the income for 2021 in the state lines on that W-2 to the proper state.

_________________

I would guess, that yielding to NC on this would not necessarily be out-of-bounds....but no one here can give you direct legal advice, since actual tax attorneys are the only ones who could run thru the proper legal ramifications of what you decide to do. Nor can we know whether SC would take an opposing view from NC's....and create a further mess.

___________________________

Again, if you were telecommuting again at the start of 2022 for more than a few days, a serious discussion with your payroll department would be in order to get your 2022 W-2 pay properly assigned to the correct state based on the % of time you worked from home in SC.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

rbrower42

New Member

frank1618

Level 2

fobpurchase

New Member

sandrawa

Level 2

FoundlingsAreOurFuture

Level 2