- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Where can I find the NY form IT-112-R form in turbo tax (or how can I get the option to inclu...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the NY form IT-112-R form in turbo tax (or how can I get the option to include this form)

Token Number: 1102682

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the NY form IT-112-R form in turbo tax (or how can I get the option to include this form)

We'd love to help you complete your tax return, but need more information. Can you please clarify your question?

What are you having trouble with?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the NY form IT-112-R form in turbo tax (or how can I get the option to include this form)

I got the message "TP should not be greater than the tax imposed by other state" that prevented me submitting the report. I have never had this issue before. not sure what I did wrong. I don't know how to upload a pic but that's what I have

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the NY form IT-112-R form in turbo tax (or how can I get the option to include this form)

I got the message of:

IT-112-R(NJ): Tax amount - TP should not be greater than the tax imposed by other state.

Tax amount - TP: 745

24 a) Taxpayer 24 a) 745

This is the only thing that has been preventing me from e-filing and I have no idea how to fix it

Token number: 1103311

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the NY form IT-112-R form in turbo tax (or how can I get the option to include this form)

token number: 1105028

It's showing an error with the IT-112-R (NJ).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the NY form IT-112-R form in turbo tax (or how can I get the option to include this form)

Token Number: 1107481

I live in NYS, and work in CT. I was getting this error message: T-112-R NY Tax Amount TP should not be greater than tax imposed by other state.

What is the correct number I should enter in 24a? Are there any other changes that need to be made?

24a was initially 6500, but it was suggesting 6407

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the NY form IT-112-R form in turbo tax (or how can I get the option to include this form)

Yes, the program will suggest a number that is based on the actual tax liability for the other state. The number you enter for line 24a should be no more than the suggested number.

To review this screen In TurboTax:

- Open your return, click on State Taxes, then Your State Returns.

- Select Edit to the right of New York.

- On the screen, You Just Finished Your New York Return, scroll down and find Credits and other taxes, click Update to the right.

- Click Update to the right of Taxes Paid to Another State.

- Click Edit to the right of the other state.

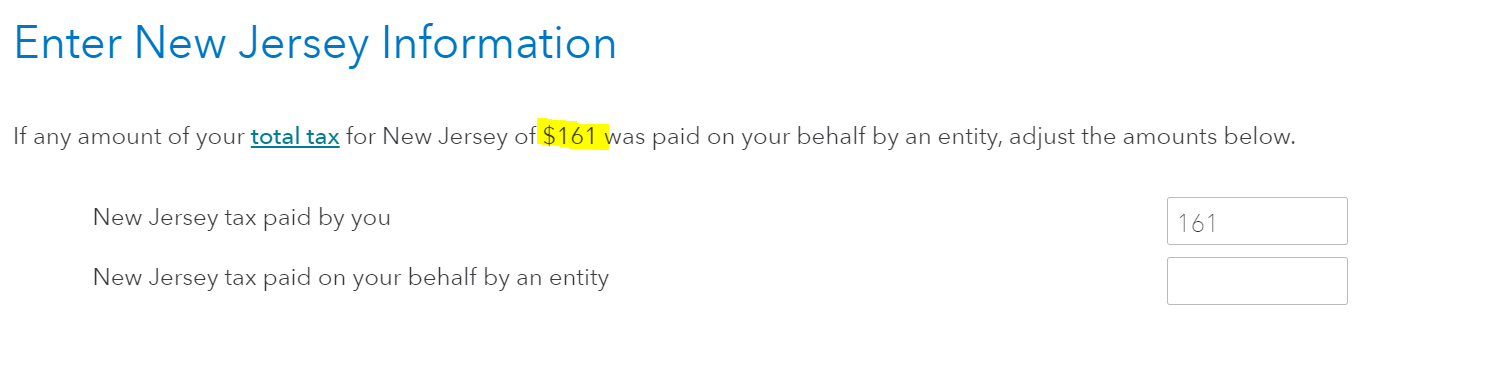

- On the screen Enter (other state) Information, enter the tax paid by you, but no more than the amount shown as the total tax. See the image below.

- Continue and Review the return.

I think this is the same error for all of you, but if you are still having trouble, please respond back with more details, including the name of the other state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the NY form IT-112-R form in turbo tax (or how can I get the option to include this form)

Hello,

I worked in NJ last year, but was a resident of NY the whole time.

My problem is that I wanted to verify the issue with this error.

I changed the number to the suggested number as you said, and that did fix the problem. I am just concerned because that significantly impacted my return. When the number was generated automatically it was $3,320 but the suggested number was $1, 600 or something similar. Once I change the number, the amount that I get in return after filing taxes goes down by about $600. I don’t want to overpay in taxes. I am not sure why the number that was automatically generated was higher. Is there a way for me to calculate the number? An equation to follow instead of just following the suggestion on the page? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the NY form IT-112-R form in turbo tax (or how can I get the option to include this form)

Hi, this answer does not apply to my question? All my income is from CT, so my portion taxed by CT should match NY total?

Token Number: 1107481

I live in NYS, and work in CT. I was getting this error message: T-112-R NY Tax Amount TP should not be greater than tax imposed by other state.

What is the correct number I should enter in 24a? Are there any other changes that need to be made?

24a was initially 6500, but it was suggesting 6407

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the NY form IT-112-R form in turbo tax (or how can I get the option to include this form)

Hi, I have the exact same issue. My token number is 1110537, thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the NY form IT-112-R form in turbo tax (or how can I get the option to include this form)

@JulieS I have the same problem with TP cannot be greater than the tax imposed by other state . My token is 1110634

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the NY form IT-112-R form in turbo tax (or how can I get the option to include this form)

I think you are all missing the real question and why it is such an impact to your return. Let me try to shed some light on what the question is trying to do.

As resident of NY, NY will give you a credit for income that is being double taxed by both NJ, CT, any other state and NY. However, NY will only give you a credit equal to the lowest state tax on the amount.

Because NY taxes your full income and then prorates for the NY amount, it is often higher than the other state tax.

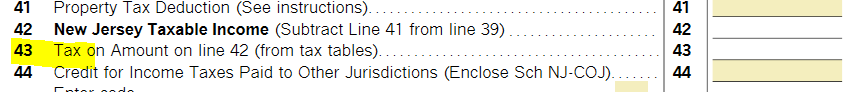

To determine your correct tax deduction, you can look at the nonresident tax form, locate the tax liability - not what you paid in through withholdings. The tax liability on the income is the number that should be entered when asked about your non-resident tax liability.

@priscilla24 @Rayy @tfz2101 @Anonymous50

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the NY form IT-112-R form in turbo tax (or how can I get the option to include this form)

I am having the same issue. I work in CT but live in NY. What should I put in 24a for tax payer amount? Token ID is 1111499.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the NY form IT-112-R form in turbo tax (or how can I get the option to include this form)

If you are referring to form IT-112-R NY Line 24a, enter the amount of income tax imposed that you paid.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the NY form IT-112-R form in turbo tax (or how can I get the option to include this form)

I'm having the same issue with my return, Married filing jointly, we live in NY but my husband works in NJ.

Tax Amount - TP should not be greater than the tax imposed by other state

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.