- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: The software will not let me enter my California tax exempt dividends- can you please help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The software will not let me enter my California tax exempt dividends- can you please help?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The software will not let me enter my California tax exempt dividends- can you please help?

Here are the steps:

- Return to federal

- Income & Expenses

- locate Dividends on 1099-DIV

- Edit/Add

- Select the one with CA exempt dividends and click Review

- screen Let's get the info from your 1099-DIV

- Check the box My form has info in other boxes (this is uncommon).

- Box 11 Exempt-interest dividends would have a number there

- Continue

- Tell us if any of these uncommon situation apply to you

- select None of these apply

- Continue

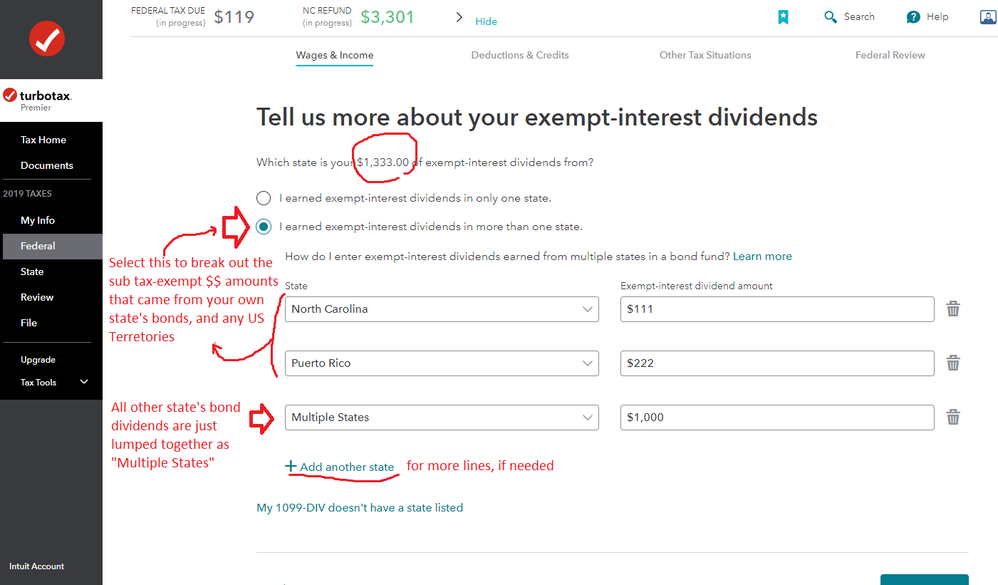

- Tell us more about your exempt-interest dividends

- Select whichever button is correct for you

- Enter all the states and exempt interest

- Continue

That will flow into the state return for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The software will not let me enter my California tax exempt dividends- can you please help?

Here's a complication...

1) for CA residents, they can only declare the CA amount from box 11...only if the Fund concerned has invested at least 50% of its holdings in CA Bonds or US Government obligations./...otherwise you must t select "Multiple States" for all of it (At the end of the drop-down states list).

2) IF the fund does qualify, when you get to the listing page, you only have to break out the CA amount, any US Territories, and the remaining amount is just totaled as "Multiple States" (You don't have to list all the other states)

_________________________

An example of a breakdown for an NC resident would look like this:

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

AndrewK24

New Member

akandelman

New Member

Booba

New Member

MakeMoreDave

Level 1

Mojo-6

New Member