- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: I can't file my Massachusetts return because I'm told that tax-exempt pensions should not be ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

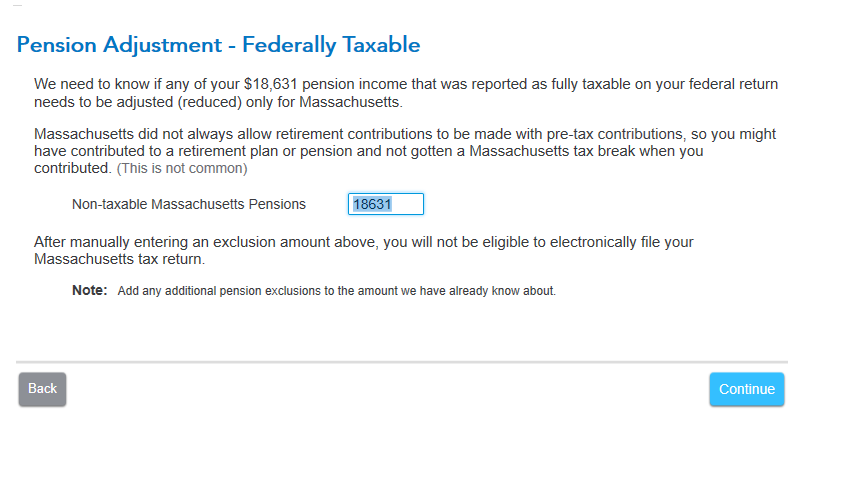

I can't file my Massachusetts return because I'm told that tax-exempt pensions should not be entered directly on the Mass. form. How do I resolve this issue?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't file my Massachusetts return because I'm told that tax-exempt pensions should not be entered directly on the Mass. form. How do I resolve this issue?

I am sorry, but I tried to duplicate the error that you have described above, and could not. However, try to revisit your State of Massachusetts return by following these instructions:

- While in your Tax Home,

- Select State,

- Select Continue,

- Select Continue next to the State of Massachusetts,

- Work through the on-screen prompts, looking for your tax exempt pension described above,

- Correct or delete this entry.

Hopefully this helps!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't file my Massachusetts return because I'm told that tax-exempt pensions should not be entered directly on the Mass. form. How do I resolve this issue?

what is the reason for that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't file my Massachusetts return because I'm told that tax-exempt pensions should not be entered directly on the Mass. form. How do I resolve this issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't file my Massachusetts return because I'm told that tax-exempt pensions should not be entered directly on the Mass. form. How do I resolve this issue?

Yes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't file my Massachusetts return because I'm told that tax-exempt pensions should not be entered directly on the Mass. form. How do I resolve this issue?

was what I posted the same reason for you not being able to electronically file? What was your finally outcome?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't file my Massachusetts return because I'm told that tax-exempt pensions should not be entered directly on the Mass. form. How do I resolve this issue?

Yes.

I mailed the return in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't file my Massachusetts return because I'm told that tax-exempt pensions should not be entered directly on the Mass. form. How do I resolve this issue?

I'm stuck on this error, too, however my pension distribution is fully taxable, so I selected it as taxable and set the tax-exempt amount to $0. Still won't let me get past this error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't file my Massachusetts return because I'm told that tax-exempt pensions should not be entered directly on the Mass. form. How do I resolve this issue?

If your pension is fully taxable, you will want to ensure the pension income on line 4 matches the taxable amount reported on your U.S. Form 1040, line 4d. The tax-exempt amount should be left blank unless you need to account for adjustments made to the federal amount, such as distributions from an annuity, stock bonus, pension, profit-sharing, or deferred payment plans or contracts described in §§ 403(b) and 404. If these adjustments were made, you would need to enter the amount in the tax-exempt box.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't file my Massachusetts return because I'm told that tax-exempt pensions should not be entered directly on the Mass. form. How do I resolve this issue?

Glad to see that I am not the only one with this problem.

In my Federal tax form I find 5a Pensions and Annuities blank but taxable income 5B shown equal to the sum of the taxable pension I received in 2022. On the Mass Form 1, page 2 item 4 I see an amount equal to the total taxable pensions I received in 2022. The numbers on the Federal and the State forms for taxable pensions match exactly.

So why does the check run (on TurboTax Premium) before accepting the Mass tax for electronic submission fail?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't file my Massachusetts return because I'm told that tax-exempt pensions should not be entered directly on the Mass. form. How do I resolve this issue?

Just checking, Your answer refers to U.S. Form 1040, line 4d. There is no such line on Form 1040 SR which Turbo Tax Premium selected for me but there is a line 5a for pensions and annuities. Are they the same?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't file my Massachusetts return because I'm told that tax-exempt pensions should not be entered directly on the Mass. form. How do I resolve this issue?

Line 5a on Form 1040 or 1040-SR is for the total amount of pension and annuity payments you received during the tax year. You calculate that figure by adding up the amounts in box 1 of any Forms 1099-R you received from financial service providers

This would be equivalent to Form 1040 line 5a Pension and Annuities. Form 1040 Line 4a shows IRA distributions.

Please repost if this does not answer your question.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

mhdfp

Returning Member

mhdfp

Returning Member

alison352

Level 1

russell29

Returning Member

jepisadog

New Member