- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: How do enter Form CSF 1099R in my Ohio Taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do enter Form CSF 1099R in my Ohio Taxes?

How do enter Form CSF 1099R in my Ohio Taxes? It was easy to do in the Federal portion. Since the amount is not automatically transferred to my Ohio taxes, where/how do I enter it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do enter Form CSF 1099R in my Ohio Taxes?

Line 28 of sch A is for uniformed services retirement income. Dawn is right, you should not have to enter anything in state, it all goes in the federal. After you enter the form, there are a lot of questions in federal.

Please return to the federal screen and carefully answer all the questions that come up after you enter the 1099-R form. Then review your state return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do enter Form CSF 1099R in my Ohio Taxes?

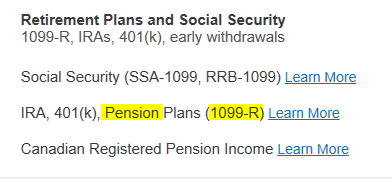

You don't have to enter any 1099s on your state return - all tax forms get entered on the federal return and TurboTax will transfer the applicable forms to the state return(s). When TurboTax transfers your income, we do this according to the state tax code. For resident Ohio tax returns - Deduct the following to the extent included in federal AGI:

• Social Security benefits.

• Tier I and Tier II railroad retirement benefits.

• Supplemental railroad retirement benefits.

• Dual railroad retirement benefits.

• Railroad disability or unemployment benefits.

Be sure that you entered the CSF-1099-R in the correct spot on the federal portion. The first entry section (SSA-1099 and RRB-1099) is for the items above. The 2nd entry section is for civil service retirement (1099-R) that you have. Make sure you have entered your 1099-R in that second category. Amounts entered in the first category will transfer over but will be excluded from OH income.

On your OH Form IT-1040, the retirement income you entered on the federal return should be included in the amount on Line 1 (Federal AGI). Any portion that is excludable will be on line 2b and your OH AGI will be on Line 3 - this number takes into account the additions and subtractions from federal AGI. Your OH tax is based on your OH income (line 3) and should include any taxable retirement income.

If you enter it in the 1099-R section, when you go through the OH return, click START next to Military and Civil Service retirement income on the screen titled Here's the income that Ohio handles differently. The amounts referenced below (excludable income) are amounts included in federal AGI but are non-taxable on your OH tax return. If the info below applies, the income is subtracted from federal AGI to arrive at your OH AGI number.

-------------------Taxpayers who retired from service in the active or reserve components of the U.S. Army, Navy, Air Force, Marine Corps, Coast Guard, or National Guard can deduct their military retirement income to the extent that income was not otherwise deducted or excluded in computing federal or Ohio AGI. Taxpayers who served in the military and receive a federal civil service retirement pension are also eligible for a limited deduction if any portion of their federal retirement pay is based on credit for their military service. The military retirement income also applies to amounts received by the surviving spouse, or the former spouse, of each military retiree who is receiving payments under the survivor benefit plan.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do enter Form CSF 1099R in my Ohio Taxes?

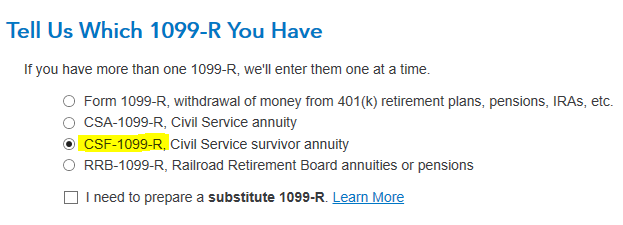

My 1099R is for a survivor Annuity. The form says CSF 1099R_LS

The entry on the Federal is correct, based on the help tool. The amount of the annuity appears on the federal form, but it does not show up on the state form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do enter Form CSF 1099R in my Ohio Taxes?

Please clarify: Are you are a surviving spouse or former spouse, collecting retired personnel pay on behalf of a service member?

If so, then you can deduct the portion of the income you received that's attributable to the service member's time in the uniformed services.

See Line 28 – Uniformed Services Retirement Income in the Ohio 2020 Instructions for Filing Form IT 1040.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do enter Form CSF 1099R in my Ohio Taxes?

I am his Son. My father was a retired Postal Worker.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do enter Form CSF 1099R in my Ohio Taxes?

It seems Line 28 is referring to military service. My dad did serve during the Korean War, but I thought the payment was part of his Postal Service

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do enter Form CSF 1099R in my Ohio Taxes?

Line 28 of sch A is for uniformed services retirement income. Dawn is right, you should not have to enter anything in state, it all goes in the federal. After you enter the form, there are a lot of questions in federal.

Please return to the federal screen and carefully answer all the questions that come up after you enter the 1099-R form. Then review your state return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

charlitajones576

New Member

hyundaijk

New Member

Charliepdl2

New Member

williams3796

New Member

tbhemphill-comca

New Member