- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Federal Schedule 1, Line 1 (state refund) not transferring to Minnesota (M1) Line 6

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Schedule 1, Line 1 (state refund) not transferring to Minnesota (M1) Line 6

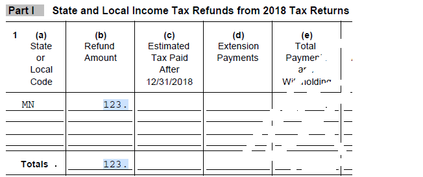

Hi. The amount of my MN state refund from 2018, as reported on federal Schedule 1, Line 1, is not transferring to Minnesota form M1, Line 6. Is there a fix or a workaround? Please see below for details:

Thank you.

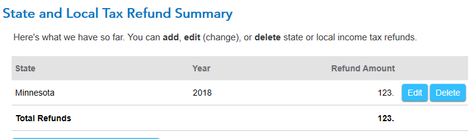

As-entered ($123 for MN 2018 refund):

As-shown in underlying form on federal schedule 1, line 1:

As-shown in print preview of Minnesota form M1, line 6, $123 did not transfer from Schedule 1, line 1:

As-shown in underlying table of M1M:

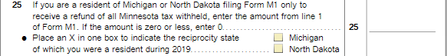

Note, I have no income from MI or ND which could otherwise explain my issue:

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Schedule 1, Line 1 (state refund) not transferring to Minnesota (M1) Line 6

It depends. If you took the standard deduction, then you do not have to claim the refund as income.

The underlying question is whether you had a tax benefit for your refund in the prior year. If you did not itemize your deductions, but instead took the standard deduction, then you did not "over-deduct" your state taxes that were then partially refunded.

If you do not have to claim the refund as income, then there is no correlating income tax refund reported on line 6 of your Minnesota Schedule 1.

Click on the link for the 2019 Minnesota Individual Income Tax Instructions page 13 on Line 6-State Income Tax Refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Schedule 1, Line 1 (state refund) not transferring to Minnesota (M1) Line 6

Thank you for the reply Kathryn. I did itemize last year and typically do.

I too was reading through the MN Line 6 instructions which lead me to post my question. Since I did file a return, and, I do have an amount on Line 1 of federal Schedule 1, I was expecting TurboTax to populate MN Line 6 automatically.

If I manually override MN Line 6 and put in the refund amount (per federal Sched. 1) then that increases my refund for this year (2019) by. However, I am then unable to e-file per turbo tax.

In the end, I ended up leaving it blank, as TurboTax has it. I like to think it is smarter than me.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Schedule 1, Line 1 (state refund) not transferring to Minnesota (M1) Line 6

The form you posted showing the refund in the Federal worksheet does not mean it was carried through to the 1040.

Please check your Federal Schedule 1 line 10.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

acb7b540bec1

New Member

SigilTattooed

New Member

kevin-chow

New Member

MGS

New Member

lindencasonwhite

Returning Member