- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Arizona Capital Gains

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona Capital Gains

What do I input? It's a personal investment not related to a Small Business

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona Capital Gains

Don't enter any personal investment capital gain information here. This information should be pulled over from the federal information you've entered.

A subtraction for net long-term capital gain is computed on line 23 of your Arizona Form 140. A subtraction for net capital gain derived from investment in qualified small business is taken on line 24. These are different things, so you don't want to enter information that doesn't apply.

The form and instructions can be found at Form 140 - Arizona Resident Personal Income Tax Booklet, if you want to see them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona Capital Gains

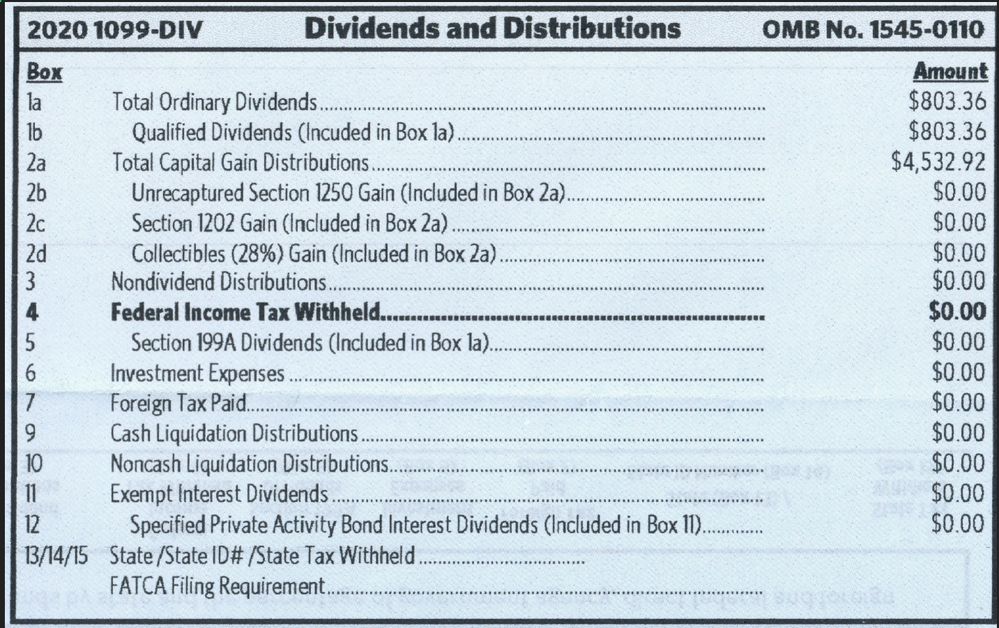

I earned long term capital gains from mutual fund investments (not a business or real estate). Fed taxes are fine but when transferring data to AZ state taxes, it wants to know what was earned after 31 Dec 2011. is this a hard requirement or am I missing something?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona Capital Gains

Arizona provides a reduction of 25% of the net Long-Term Capital Gains received from assets acquired after 12/31/2011 and included in the Federal Adjusted Gross Income (AGI). The reduction shows up as a credit on line 23 of your Arizona tax return. You would have to check your records to see if your mutual fund shares qualify.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona Capital Gains

Be careful. Bringing over all the capital gains may not be the correct thing for TurboTax to do. The instructions on the Arizona 140NR (for non-residents) says the only capital gains to be listed on lines 34 - 37 and used in the calculations on line 38 are "Arizona Sourced" capital gains. According to a representative at the Arizona Department of Revenue that means capital gains from Arizona assets, not all the assets that may be in the 1099-B's or other documents on capital gains you may have.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

pkg04792

New Member

MellowStudent

Level 1

IsaiahCT

Level 1

Karen1949

New Member

patanov1

Level 1