You may need to review your input in the personal information section of the return.

The state returns will pull from the federal input as well and will generate the forms in the state section accordingly based upon your input.

In the My Info section of TurboTax, confirm that you have entered the correct state information:

- Click "Edit" to the right of your name

- Confirm your input under #2 "Tell us the state(s) you lived in"

- Confirm the rest of the state-specific questions here as well including the "previous state of residence" and "date you became a resident" of the state noted

- Do the same for your spouse if you are married filing jointly.

- Go back to the personal information section, and verify the mailing address and "Other state income" section.

Review your input on your W-2 Wages under the "Income & Expenses" section.

Confirm that you have entered the correct state for each W-2 in Boxes 14-15.

This will then allow you to enter your state returns for the part-year resident states.

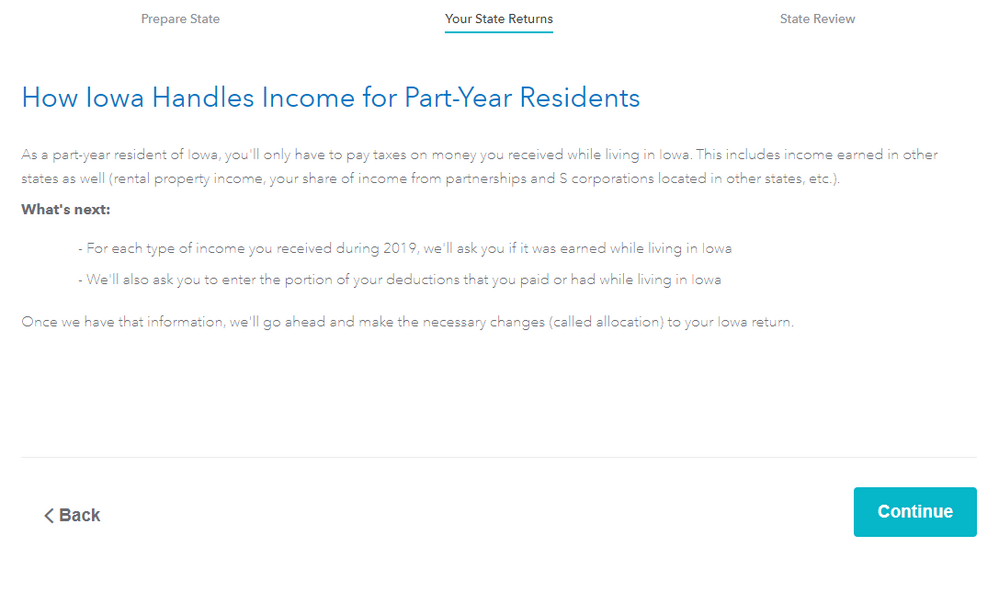

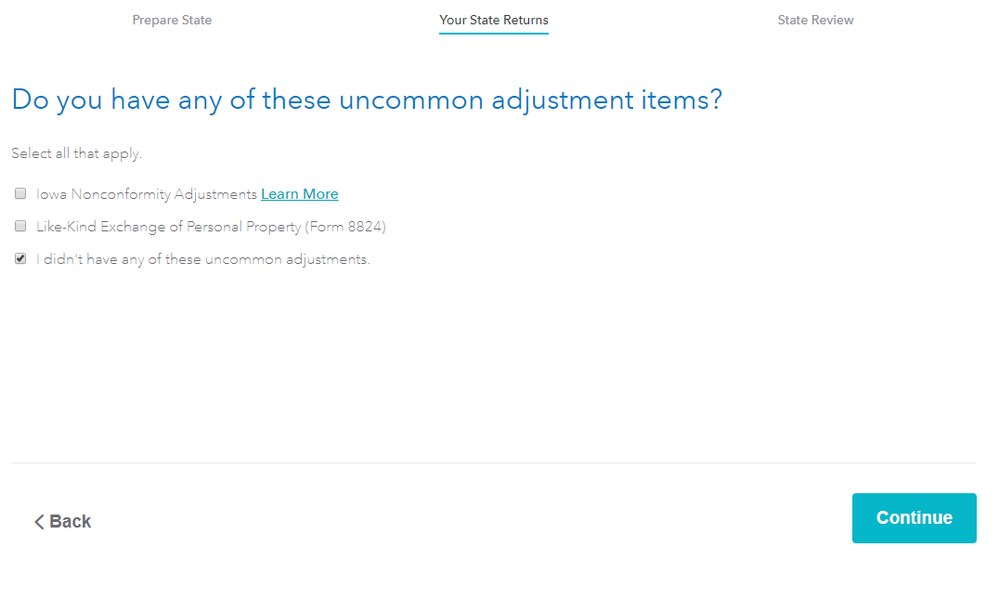

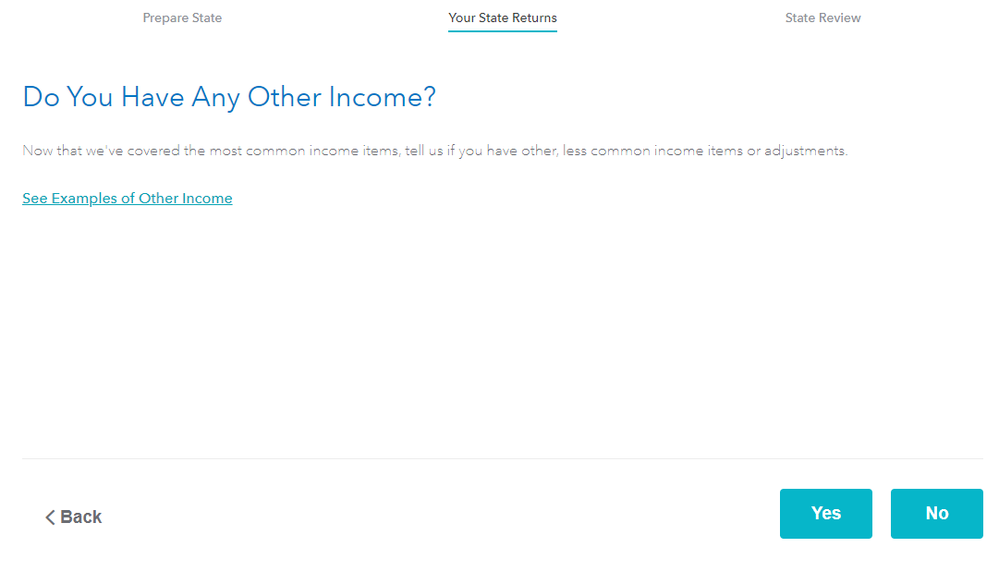

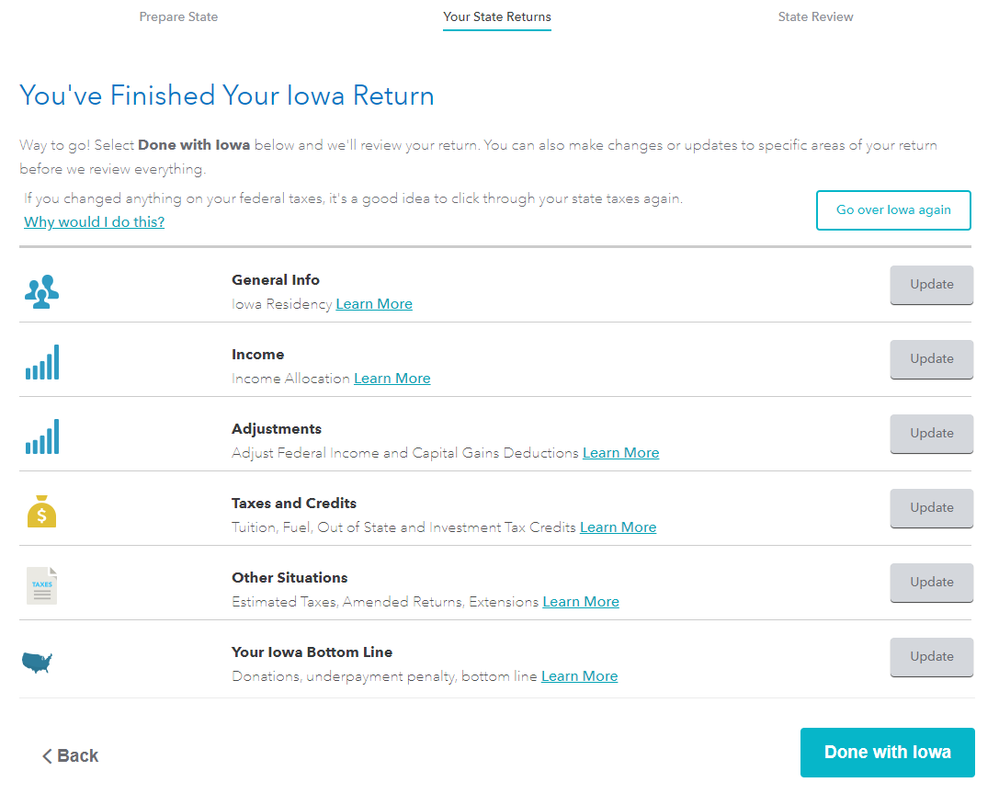

Prepare the part-year resident state tax return for the state you no longer reside in first. Be sure to answer the questions carefully as you only want to report the income earned in while residing in that state. You should now see screens allowing you to allocate your capital gains or losses as well.

Once you have entered all of the first part-year resident information, then start your part-year resident state tax return for the state you reside in as of December 31st, 2019. This will ensure you receive any credits for taxes on income which may have been taxed in both states.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"