For computing the underpayment penalty Oregon says "Withholding is treated as if it were paid

in equal amounts on the due date for each required installment payment unless you can show that it was paid differently. " I can show that it was paid once, early in the year. How can I get TurboTax to generate OR Form 10: Underpayment Statement showing this?

I owe more than $1000 and completed the Underpayment Interest (Form 10) section. When I selected the annualized income method, the following screen allows me to annualize my income but not my withholding.

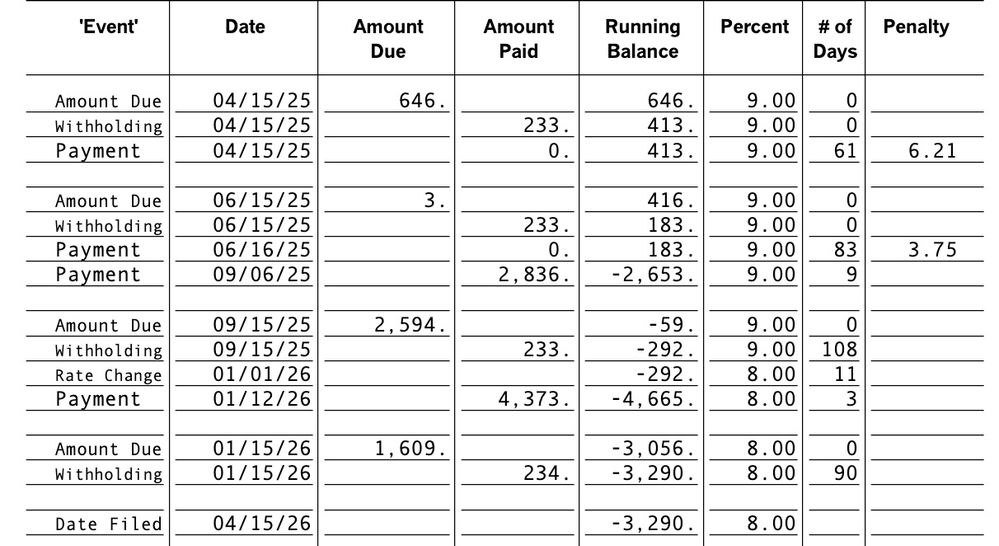

When I hit Continue, TurboTax creates the Underpayment Statement form below showing the withholding evenly distributed across all 4 quarters ($233/$234 each) even though all $933 was withheld in the first quarter.

This results in underpayment penalties I do not owe so I would like to know if/how I can force TurboTax to list all my withholding in the first quarter where it occurred. BTW, there are extra questions in the Federal interview that allow this but not in the Oregon interview and I cannot force the change directly in Forms.