- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Missouri: Since Missouri is a nonresident state for you,...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I worked in MO and lived in Kansas before Sept 2016 and then moved into another state . How should I file my tax return? Do I need to file part year return for 3 states?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I worked in MO and lived in Kansas before Sept 2016 and then moved into another state . How should I file my tax return? Do I need to file part year return for 3 states?

Missouri: Since Missouri is a nonresident state for you, then you only pay tax on the income that is derived from Missouri on that state tax return. Select the status of nonresident.

Kansas: Since Kansas was a resident state for you.all income your receive/earned while living in Kansas is taxed to your resident state. They understand some of your income may be taxed to another state so they will provide a credit to reduce the tax, eliminating the double taxation.

When you complete the state returns you should always complete the nonresident state first being careful to select the "nonresident" option.

- Begin with the "State Taxes" tab.

- Continue through the pages until you see the steps below to enter your Missouri income only.

- The tax for Missouri will carry to your Kansas return

- Next go through the Kansas return begin with Taxes and Credits

- Follow the prompts to enter the income and the tax that was on the Missouri

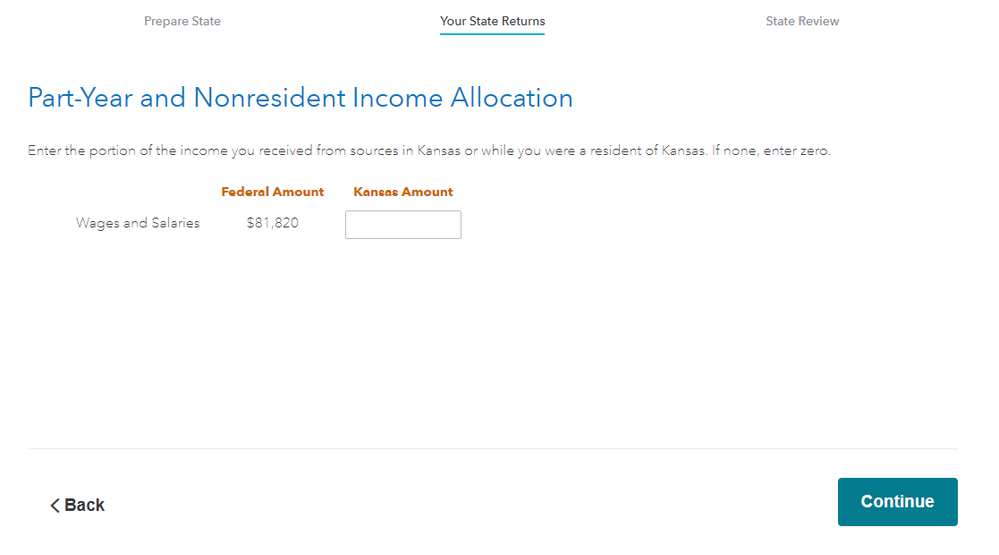

- Finish the Kansas return (see the images for assistance)

Finally, do the third state (second resident state) and choose part year resident for both Kansas and the third state. There will be no credit on the third state if the income was earned in the part year resident state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I worked in MO and lived in Kansas before Sept 2016 and then moved into another state . How should I file my tax return? Do I need to file part year return for 3 states?

Missouri: Since Missouri is a nonresident state for you, then you only pay tax on the income that is derived from Missouri on that state tax return. Select the status of nonresident.

Kansas: Since Kansas was a resident state for you.all income your receive/earned while living in Kansas is taxed to your resident state. They understand some of your income may be taxed to another state so they will provide a credit to reduce the tax, eliminating the double taxation.

When you complete the state returns you should always complete the nonresident state first being careful to select the "nonresident" option.

- Begin with the "State Taxes" tab.

- Continue through the pages until you see the steps below to enter your Missouri income only.

- The tax for Missouri will carry to your Kansas return

- Next go through the Kansas return begin with Taxes and Credits

- Follow the prompts to enter the income and the tax that was on the Missouri

- Finish the Kansas return (see the images for assistance)

Finally, do the third state (second resident state) and choose part year resident for both Kansas and the third state. There will be no credit on the third state if the income was earned in the part year resident state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I worked in MO and lived in Kansas before Sept 2016 and then moved into another state . How should I file my tax return? Do I need to file part year return for 3 states?

I have the same situation. First two months worked in KS and lived in MO. Income only from MO. Then moved to IN and worked there for rest of the year. Income only from IN. I reached up to Kansas Taxes and Credits page.

What I need to enter in the filed "Kansas - Income - Part-Year and Nonresident Income Allocation" and "Kansas - Credit and Taxes - Credit for tax paid to other states -Tax paid to Missouri"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

acb7b540bec1

New Member

Popgam

Returning Member

med87-aol-com

New Member

rbalakri

New Member

natalieclaire

New Member