I've completed my Iowa state tax return for 2019 in TurboTax and believe that the result is incorrect.

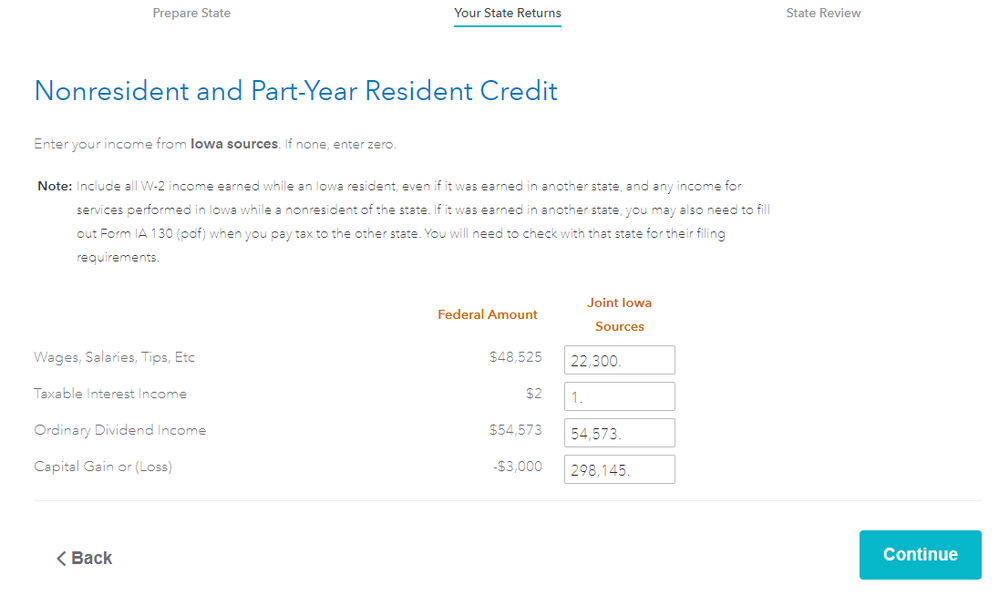

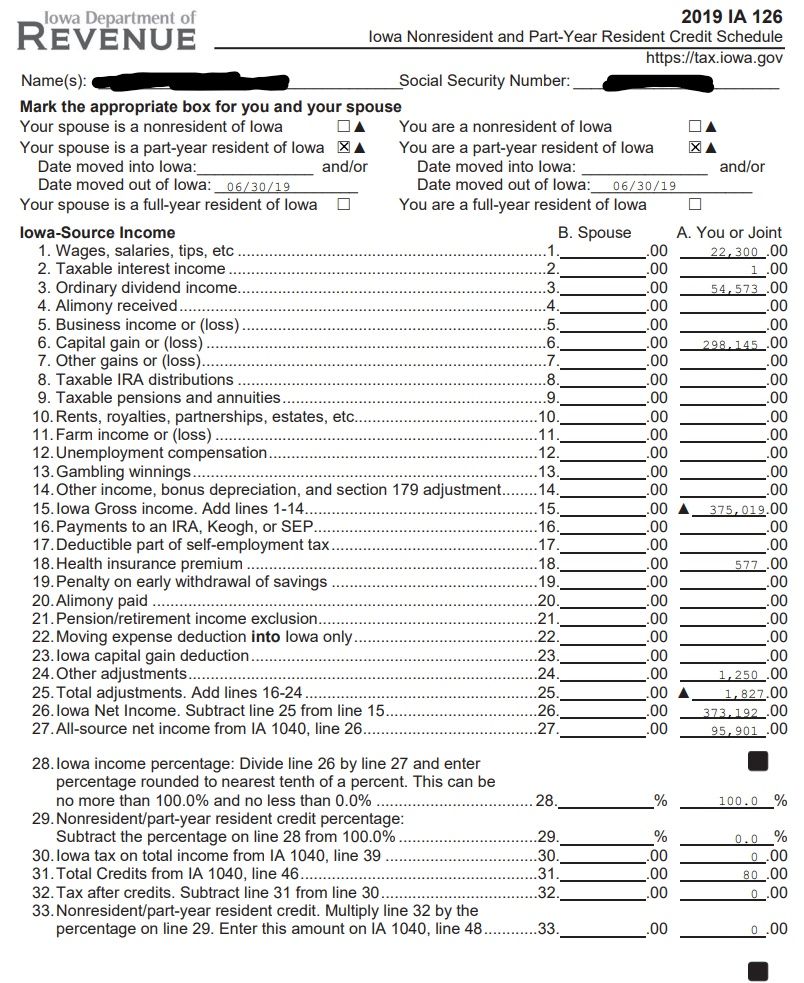

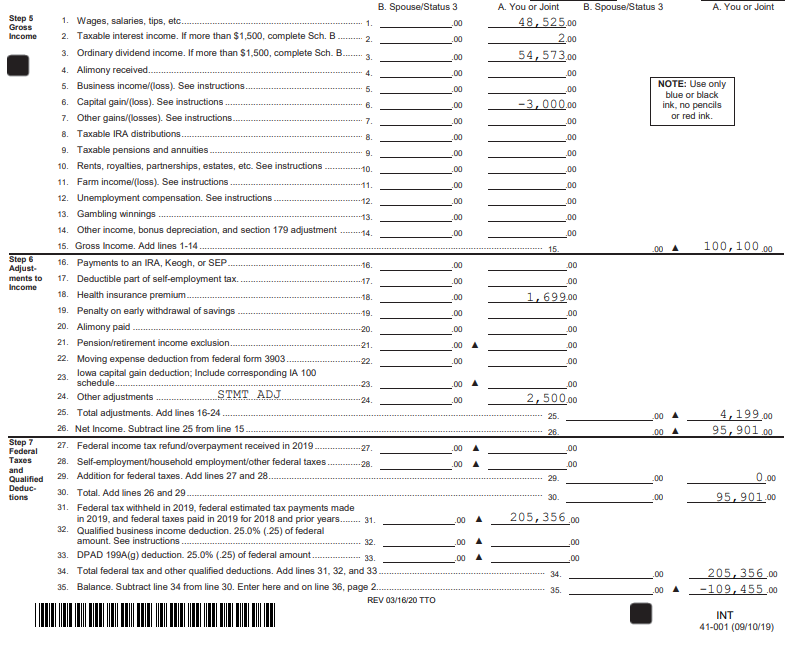

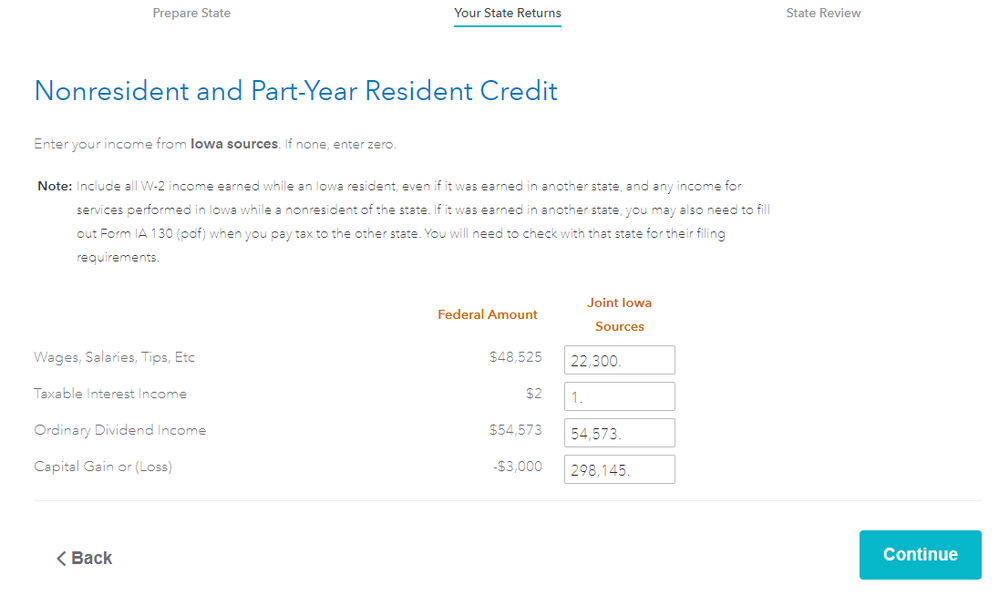

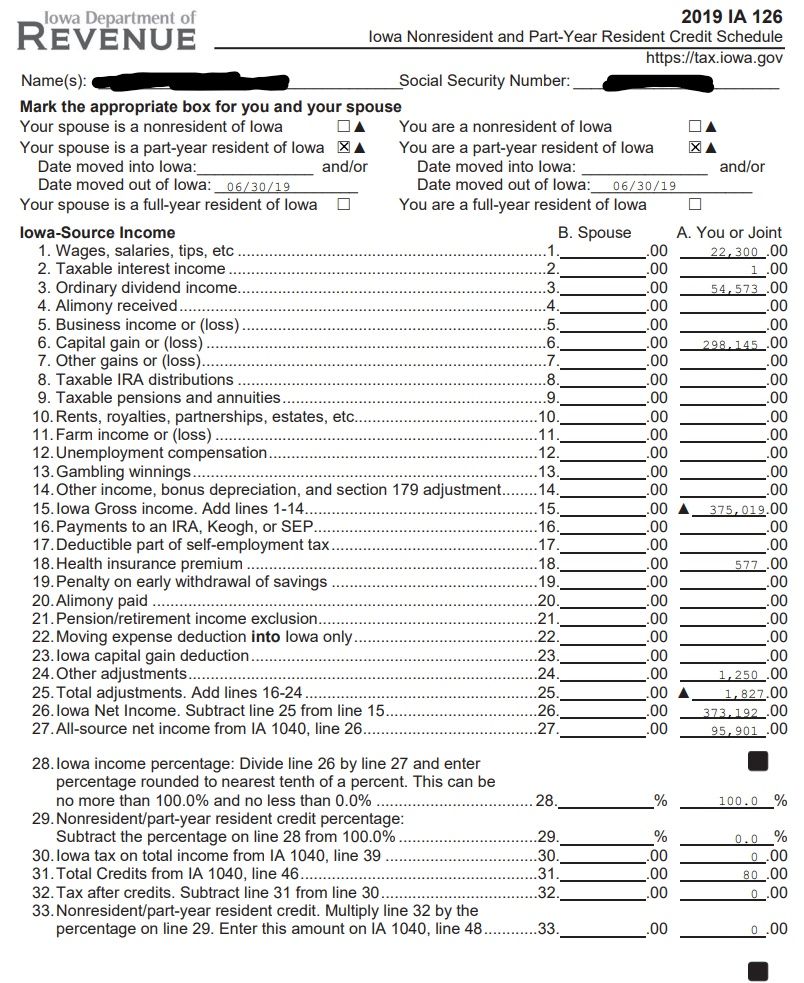

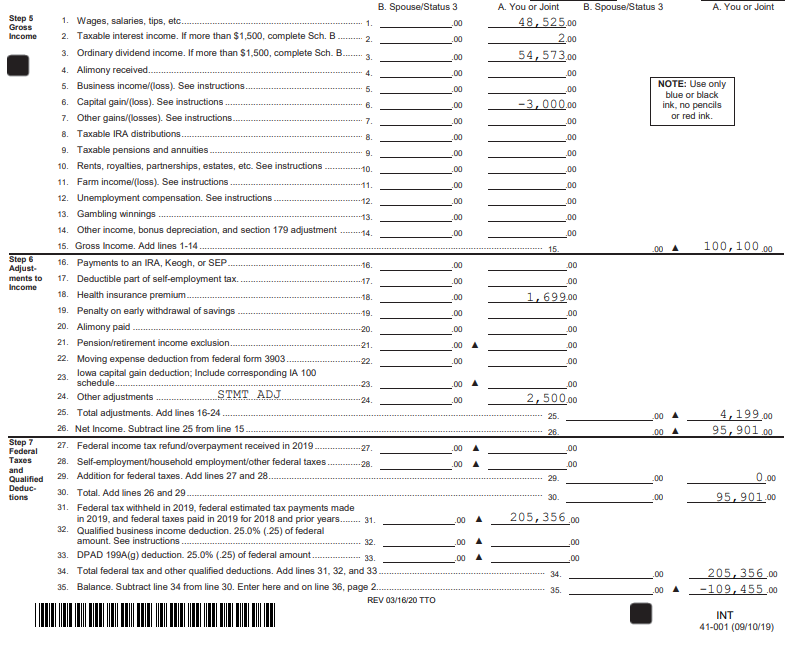

I've tried to specify the income I earned while a resident of Iowa, but don't believe there's any way to correctly do so in TurboTax Premier. I asked about this yesterday and was directed to fill out the "Nonresident and Part-Year Resident Credit" section. I had already done this (attached). The problem is: this only records Iowa-source income on my "Iowa Nonresident and Part-Year Resident Credit Schedule" but not on my Iowa 1040, where I believe it should be recorded (both attached). As such, I believe my Iowa-source income should be significantly higher on my 1040, resulting in a significant tax burden, which I've already paid in estimated tax payments. I would love to get that money back, but am afraid this can't be right. Please help!