- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- How to enter the CA state tax exempt dividends from US government securities?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter the CA state tax exempt dividends from US government securities?

My 2019 1099 DIV includes 20% of my dividends (about $2,000) which are exclusively from US government securities, and thus exempt in my CA state tax.

How best to enter this info and get the state exception in Turbotax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter the CA state tax exempt dividends from US government securities?

In California you can only exempt dividends from a mutual fund if more than 50% of the fund is invested in federal and California obligations.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter the CA state tax exempt dividends from US government securities?

Thanks! exactly what I too know.

The dividends I am asking about are from a fund 100% invested in federal and California obligations. so, they are CA state tax exempt!

Hence, my question is about how to do it in Turbotax...

please advise. Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter the CA state tax exempt dividends from US government securities?

DID you eve figure it out? Perhaps too late, but since your fund qualifies:

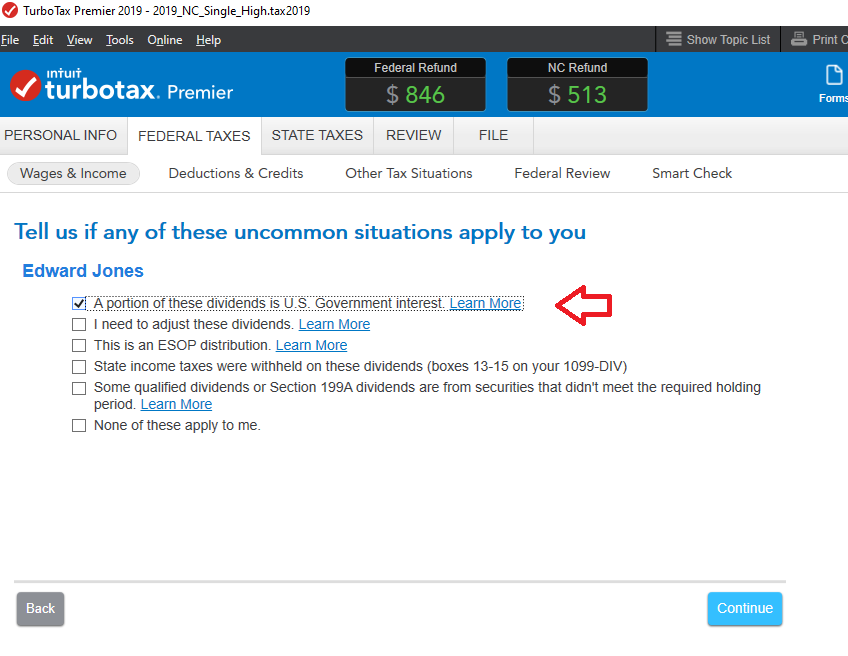

1) You have to have a listing or do calculation of exactly how many $$ came from US Obligations for that fund. Those $$$ are a part of box 1a, not box 11 . Then Edit that 1099-DIV form, and you step past the main page, and on a followup page there is a checkbox you need to check that says "A portion of these dividends is US Government Interest" ...and

2) as you "continue" from that page you'll be able to enter the exact $$ amount you calculated previously (normally it's the first page after that checkbox page...but can be a page or two later if you checked more than one box on that page)

________________________________________________

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

suli570486

New Member

RobC3

Returning Member

tom-menger

New Member

GrumpyCamel1409

New Member

amacol

New Member