- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Do I have to list every state listed on my 1099-DIV if I live in CA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to list every state listed on my 1099-DIV if I live in CA?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to list every state listed on my 1099-DIV if I live in CA?

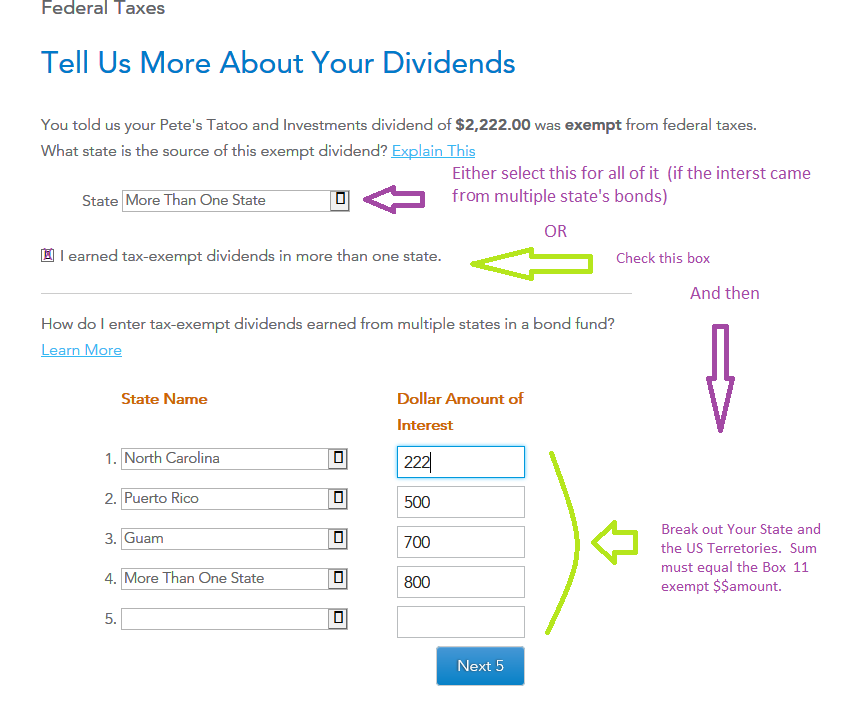

No. Make only two entries. Show only the dividends allotted to CA. Then, total the rest as "Multiple States" ("more than one state” in the desktop program)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to list every state listed on my 1099-DIV if I live in CA?

ooooo...maybe "Multiple States" for all of it....unless it is a CA-specific fund, or heavily weighted to CA bonds.

___________

For a 1099-DIV, CA requires ....For the bond fund that reports the tax-exempt interest on a 1099-DIV , that Fund must contain at least 50% of its assets as CA-only bonds before you can break out the CA-bond amount. Otherwise all of it must be tagged "Multiple states"

(The same limit does not apply box 8 on a 1099-INT since those are individual bonds you own...not a fund).

________________________________

Here's a picture of how it would be broken down...if you can do so (NC example):

______________________________

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

rjpu66135

New Member

adeljabb

New Member

ColoradoK

Level 1

DanTheDapperMan

Level 1

yenrakekim17

New Member