Hello. Me and my wife run a S Corp. It was formed in NY in 2016. In 2017 we moved to Florida.We run the business from home office in FL. The business is getting paid from another from NY. I purchased TurboTax Business NY State extension and not sure how to complete it.

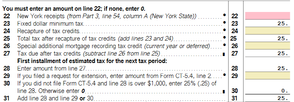

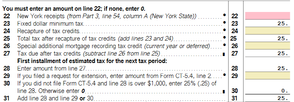

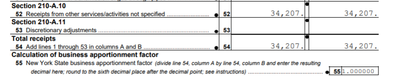

1.Should I put in any receipts in Part 2, item 22 and Part 3, item 54 and 55 on form CT-3-S? If yes, what should I type here?

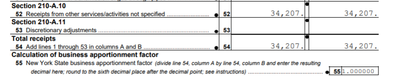

2.My 2018 tax return had an amount higher than the 1120S ordinary income in these fields (34,207 instead of 31,207). Was it a mistake? This amount was entered in New York columns as well as Everywhere column.

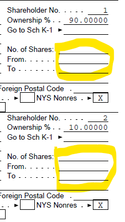

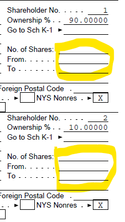

Also, TurboTax finds an error in Schedule K-1 Worksheet (Form CT-3-S). It wants me to type "No. of shares" as well as "From/To" dated.

3. Should I enter the shares as percentage?

4. What should I enter as Shares Held Start/End date?

Thank you.