- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Wife left her job with MA state, decided to be paid out From retirement board. Received 1099-R, states “non taxable” in box 12. How should I enter this 1099-r?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife left her job with MA state, decided to be paid out From retirement board. Received 1099-R, states “non taxable” in box 12. How should I enter this 1099-r?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife left her job with MA state, decided to be paid out From retirement board. Received 1099-R, states “non taxable” in box 12. How should I enter this 1099-r?

Massachusetts fully exempts Social Security retirement benefits and income from public pension funds from taxation. If your wife's retirement distribution was from a public pension, it's not taxable. Enter the 1099-R exactly like it's printed, and for Box 12, leave it blank.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife left her job with MA state, decided to be paid out From retirement board. Received 1099-R, states “non taxable” in box 12. How should I enter this 1099-r?

Thanks David, This is what I did, but TurboTax calculated state tax on it. Then a series of questions following are asked to see how Massachusetts will treat the disbursement. It was an early distribution before 59 1/2, my wife was a social worker for the Massachusetts Department of Children and Families. I'm not sure I answered these following turbo tax questions correctly because turbo tax is calculating tax owed for MA even though the 1099-r states non taxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife left her job with MA state, decided to be paid out From retirement board. Received 1099-R, states “non taxable” in box 12. How should I enter this 1099-r?

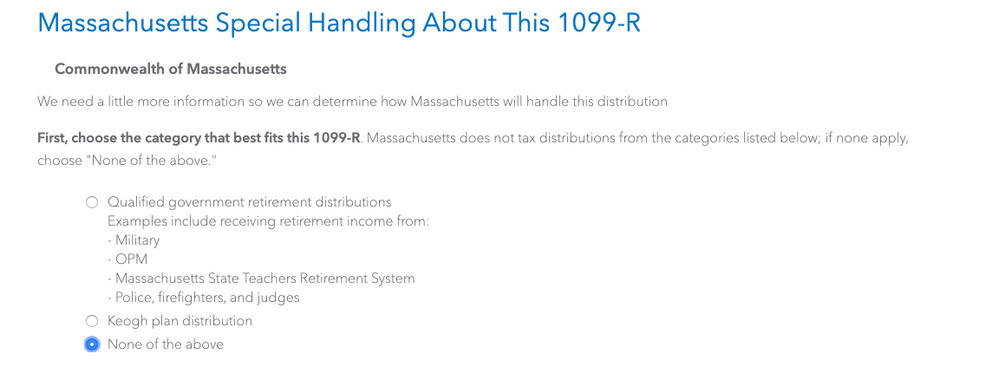

Here is the question I'm not sure I'm answering correctly following the 1099-r data entry:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife left her job with MA state, decided to be paid out From retirement board. Received 1099-R, states “non taxable” in box 12. How should I enter this 1099-r?

As David noted, pensions from the the Commonwealth of Massachusetts and its political subdivisions are not taxed in Massachusetts.

So, if the pension you received is from the pension fund run by the state government (it sounds like it may be), you should check the top box "qualified government retirement distributions".

But please contact your pension plan administrator to confirm that they are a MA government pension - they will know.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife left her job with MA state, decided to be paid out From retirement board. Received 1099-R, states “non taxable” in box 12. How should I enter this 1099-r?

Thanks Bill. It was a MA government employee pension fund that she was paying into run by overseen by the MA State Retirement Board.

It was the Examples part of the question that confused me and made it seem specific to the ones listed.

Many Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife left her job with MA state, decided to be paid out From retirement board. Received 1099-R, states “non taxable” in box 12. How should I enter this 1099-r?

Thanks for your response. I will pass your comment along.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

hynrel53

New Member

valleybuy

Level 3

calderad07

New Member

Tax_payer03

New Member

scotttiger

Level 4