- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- What is the south carolina state tax exemption for military retirement pay. Turbotax shows $3000, but I think the state increased the amount to $8800

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the south carolina state tax exemption for military retirement pay. Turbotax shows $3000, but I think the state increased the amount to $8800

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the south carolina state tax exemption for military retirement pay. Turbotax shows $3000, but I think the state increased the amount to $8800

Read the examples, in column 1, on page 5 of: https://dor.sc.gov/forms-site/Forms/IITPacket_2017.pdf

_________________

1) Your military retirement deduction may be limited to $3000, if you are under age 65, and you have no other earned income (wages or self-employment). Of course, if you are waiting for a W-2 form, and just haven't entered it yet, then that number will change as you complete the federal section.

2) OR , if #1 doesn't seem to fit yet...maybe you didn't tag that 1099-R as a military retirement yet. Edit that 1099-R form in the Federal interview and step thru the followup questions again. The "Where is This Distribution From?" page has to be marked as "Military Retirement Distribution" and the two boxes below it filled in with the box 1 and 2a $$ amounts (likely the full amount). Then the next page....it is from a "NON-Qualified Plan"..................then continue to the main page and go to the SC section and work thru the Income section again...revisit the "Retirement Income Deduction" again...if necessary.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the south carolina state tax exemption for military retirement pay. Turbotax shows $3000, but I think the state increased the amount to $8800

Read the examples, in column 1, on page 5 of: https://dor.sc.gov/forms-site/Forms/IITPacket_2017.pdf

_________________

1) Your military retirement deduction may be limited to $3000, if you are under age 65, and you have no other earned income (wages or self-employment). Of course, if you are waiting for a W-2 form, and just haven't entered it yet, then that number will change as you complete the federal section.

2) OR , if #1 doesn't seem to fit yet...maybe you didn't tag that 1099-R as a military retirement yet. Edit that 1099-R form in the Federal interview and step thru the followup questions again. The "Where is This Distribution From?" page has to be marked as "Military Retirement Distribution" and the two boxes below it filled in with the box 1 and 2a $$ amounts (likely the full amount). Then the next page....it is from a "NON-Qualified Plan"..................then continue to the main page and go to the SC section and work thru the Income section again...revisit the "Retirement Income Deduction" again...if necessary.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the south carolina state tax exemption for military retirement pay. Turbotax shows $3000, but I think the state increased the amount to $8800

Where is turbo take would I select "Where is this distribution from," to mark Military Retirement Distribution?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the south carolina state tax exemption for military retirement pay. Turbotax shows $3000, but I think the state increased the amount to $8800

Depends on what state you are dealing with.

For the Majority of states that I know of, that selection is made when you enter the 1099-R in the Federal section retirement income...and as you step thru the pages after the main entries there, that's where you indicate it.

For PA, you enter your 1099-R in the Federal section, but once you are fully done entering all your data in the Federal section, and start thru on the PA taxes section, the PA tax software asks about it.

For IA, that also is done once everything has been entered in the Federal section, and you start thru the IA Interview, that IA software will ask about it, and allow you to indicate how much of the retirement income was from a Military pension.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the south carolina state tax exemption for military retirement pay. Turbotax shows $3000, but I think the state increased the amount to $8800

I have the same issue, but ....

I cant' seem to edit the Retirement income in the SC 2019 return.

When I click the edit button nothing happens. That is the only button that is highlighted yellow.

The edit buttons on the Out of State Gains and Other Subtructions work, but those entries are correct .

If it works will 2018 and 2017 have the same process.

May have to amnmend those 2 SC returns.

Any assistance would be welcome.

AB

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the south carolina state tax exemption for military retirement pay. Turbotax shows $3000, but I think the state increased the amount to $8800

You may want to log out, clear your cookies and cache, and then log back in to see if that helps.

Here's how:

Each browser has a slightly different method for deleting cookies. Choose the browser you're using:

- Internet Explorer

- Mozilla Firefox

- Google Chrome

- Safari

- Safari for iOS (mobile devices)

A full or corrupted cache can cause problems in TurboTax, so sometimes you need to clear your cache (that is, remove these temporary files).

Here are the official instructions for the most popular browsers:

- Google Chrome

- Mozilla Firefox

- Microsoft Internet Explorer 11 (use the drop-down on the upper right corner of that page for earlier versions)

- Microsoft Edge

Apple's official support site doesn't appear to contain instructions for clearing the cache in Safari. Your best bet is to search the Internet for clear Safari cache or similar search terms.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the south carolina state tax exemption for military retirement pay. Turbotax shows $3000, but I think the state increased the amount to $8800

Thanks I tried your suggestion ( twice). It did not work for me.

This is for the SC tax form

Has this happened for anyone with SC tax form for 2018 & 2019?

Same issue with both. Worked with 2017.

Can't seem to edit the Retirement income in the SC 2019 return. When I click the edit button nothing happens. That is the only button that is highlighted yellow.

The edit buttons on the Out of State Gains and Other Subtructions work, but those entries are correct .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the south carolina state tax exemption for military retirement pay. Turbotax shows $3000, but I think the state increased the amount to $8800

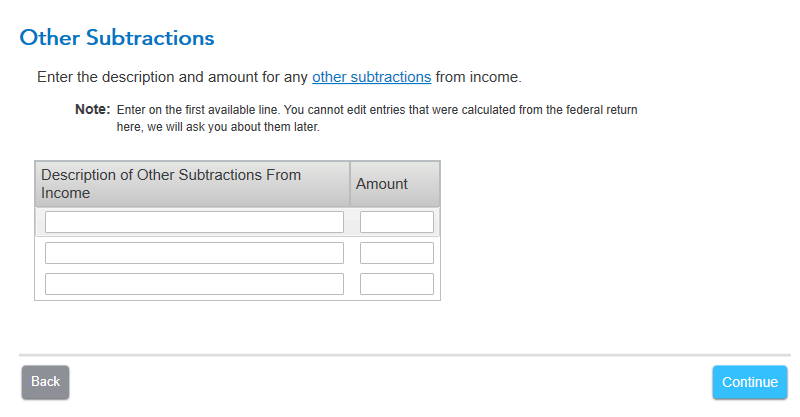

You could enter it under Other Subtractions with the description and amount being inputted by you. A workaround for you:

- Go to Here's the income that South Carolina handles differently.

- Scroll to the bottom

- Other Subtractions, click Start/ Revisit/Edit

- Enter the Description and Amount

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the south carolina state tax exemption for military retirement pay. Turbotax shows $3000, but I think the state increased the amount to $8800

Thanks ,

to be honest , not a fan of doing workarounds for financial software I have purchased.

Not issue in 2017 but in 2018 & 2019 an issue. Did not notice on 2018 return.

This is what I have....

Can change Out of state Gains and Other Subtractions ( those calcs are accurate) but not Retirement income Dedcution

I could just do a manual SC1040X for 2018 , then file 2019 and then complete a manual SC1040X for 2019 30 days later. Just changing about 2 or 3 lines. But does not fix the issue ( only rectifies my tax return).

What is the best way to forward this issue to turbo tax tech support. Propably have a lot of my fellow military retired citizens in SC that does not realize that this is an issue.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

mccaslin4

New Member

dthomp1027

New Member

findvickinow

New Member

cenapsys16

New Member

mj306

New Member