- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Roth back door conversion, but the taxable amount on 1040-4b still shows non-zero

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth back door conversion, but the taxable amount on 1040-4b still shows non-zero

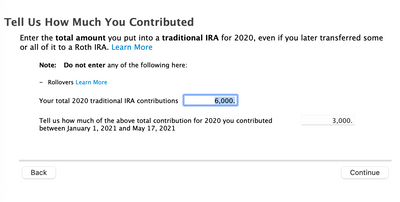

I did a $6000 Roth back door conversion for 2020. $3000 was contributed in 2020 and $3000 was contributed in March/2021. After following the instruction here - https://ttlc.intuit.com/community/entering-importing/help/how-do-i-enter-a-backdoor-roth-ira-convers...

The taxable amount on 1040-4b is $3000 instead of $0 from the instruction. How can I fix it? Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth back door conversion, but the taxable amount on 1040-4b still shows non-zero

The screenshot you shared appears correct. You entered that you contributed $6000 in total to the Traditional IRA. As you continue through that section, be sure that you have indicated that you wish to make the entire contribution non-deductible.

Since a portion of the Traditional IRA contribution was made during the calendar year 2021, but designated for 2020, that is causing the issue with $3000 of the conversion being taxable.

If the actual conversion from the Traditional IRA to the Roth IRA took place in 2020 so that you received a Form 1099-R reporting the $6000 distribution from your Traditional IRA, you must have had some basis (non-deductible contributions) in that Traditional IRA from earlier years for the entire amount converted to be $0. If you did not have any prior basis in the Traditional IRA, then $3000 of the distribution will be taxable when it is converted to the Roth IRA.

The $3000 non-deductible contribution made during 2021 cannot be considered because it was not in the account when the distribution was made. That $3000 can be converted to the Roth IRA during 2021 and be reported on your 2021 return.

If you did have some basis in the Traditional IRA, then be sure to enter that information as you go through the follow-up questions after including the Form 1099-R in your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth back door conversion, but the taxable amount on 1040-4b still shows non-zero

The problem is most likely in the section where you indicated that you made a non-deductible contribution to your Traditional IRA. There will be two $3000 entries in that section, one for the contribution that was made in 2020 for 2020 and one for the contribution made in 2021 for 2020. Try going back through the first series of steps in the instructions to double-check your entries.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth back door conversion, but the taxable amount on 1040-4b still shows non-zero

Thanks for the reply. Yes, I did put $3000 in the section, is it incorrect?

Or is it expected to see $3000 in 1040-4b?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth back door conversion, but the taxable amount on 1040-4b still shows non-zero

The screenshot you shared appears correct. You entered that you contributed $6000 in total to the Traditional IRA. As you continue through that section, be sure that you have indicated that you wish to make the entire contribution non-deductible.

Since a portion of the Traditional IRA contribution was made during the calendar year 2021, but designated for 2020, that is causing the issue with $3000 of the conversion being taxable.

If the actual conversion from the Traditional IRA to the Roth IRA took place in 2020 so that you received a Form 1099-R reporting the $6000 distribution from your Traditional IRA, you must have had some basis (non-deductible contributions) in that Traditional IRA from earlier years for the entire amount converted to be $0. If you did not have any prior basis in the Traditional IRA, then $3000 of the distribution will be taxable when it is converted to the Roth IRA.

The $3000 non-deductible contribution made during 2021 cannot be considered because it was not in the account when the distribution was made. That $3000 can be converted to the Roth IRA during 2021 and be reported on your 2021 return.

If you did have some basis in the Traditional IRA, then be sure to enter that information as you go through the follow-up questions after including the Form 1099-R in your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth back door conversion, but the taxable amount on 1040-4b still shows non-zero

@AnnetteB6 Thank you so much. You are absolutely right, the problem was the distribution part in the 1099R. I have to put $3000 instead of $6000 since that was done in 2021 and needs to be part of the tax return next year.

I have another question. If I do the same $6000 Roth backdoor again this year, the distribution will be $9000 in the tax return next year. Will that be a problem or causing me to pay more tax since that's over the $6000 limit?

Thanks in advance!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth back door conversion, but the taxable amount on 1040-4b still shows non-zero

Just to be clear, you did contribute $6000 for 2020 and if your Form 1099-R shows a distribution of $6000 that was converted to a Roth IRA, then you should report the $6000 distribution.

The $3000 portion of the distribution that was converted to the Roth IRA is showing as taxable because your Traditional IRA account must have had more funds available in the account than you had contributed during 2020. If that other $3000 was a deductible contribution from years' past, then it will be taxable on your return because it was converted to the Roth IRA.

If you had previous years' non-deductible contributions in that Traditional IRA (other than the total $6000 that you reported on your 2020 tax return), then you need to enter the total of those contributions in the follow-up questions after entering your Form 1099-R. Other non-deductible contributions from years' past are considered to be part of your basis and would make the $3000 at least partially non-taxable on your 2020 return.

You can convert any amount of Traditional IRA to a Roth IRA. There is not a dollar limit because this is not considered to be a 'contribution' to the Roth IRA, it is a conversion. The key is whether there is a basis (after-tax or non-deductible) in the Traditional IRA when the conversion is done.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

VAer

Level 4

Tax_payer03

Level 1

frankiestylez

Returning Member

Questionasker

Level 4

FreakingTax

Level 1