- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: TT tax on line Form 1099-r Box wants distrib code from list but its not on list and tt won't ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT tax on line Form 1099-r Box wants distrib code from list but its not on list and tt won't let me proceed What to do?I

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT tax on line Form 1099-r Box wants distrib code from list but its not on list and tt won't let me proceed What to do?I

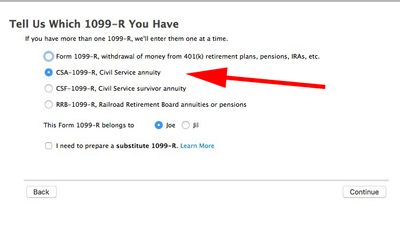

That is probably a CSA 1099-R from OPM.

OPM violates the 1099-R rules by writing "helpful" information in the box rather than just the value or code like they are supposed to. OPM has done that for years and it causes more confusion than help. They put UNKNOWN in box 2a when it should be blank, and put "7 NONDISABILITY" in box 7 when is should only be "7", "1" or "2".

The taxable amount in box 2a is usually the box 1 amount unless you have after-tax contributions in the retirement plan and use the simplified method. If this is NOT the first year of receiving payments, then you should use the same method that was used last year - either the box 1 amount of the simplified method, using the carry forward simplified information from last year.

If box 2a is blank or UNKNOWN then there should be amount in box 9b to use with the simplified method. If no amount in 9b then contact OPM to find the account "basis".

Enter a 1099-R here:

Federal Taxes,

Wages & Income

I’ll choose what I work on (if that screen comes up),

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "1099-R" which will take you to the same place.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return.

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R.

[NOTE: When you get to the "Your 1099-R Entries" screen where you can add another 1099-R, use "continue" to keep going as there are additional interview questions after that screen in most cases. You can always return as shown above.]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT tax on line Form 1099-r Box wants distrib code from list but its not on list and tt won't let me proceed What to do?I

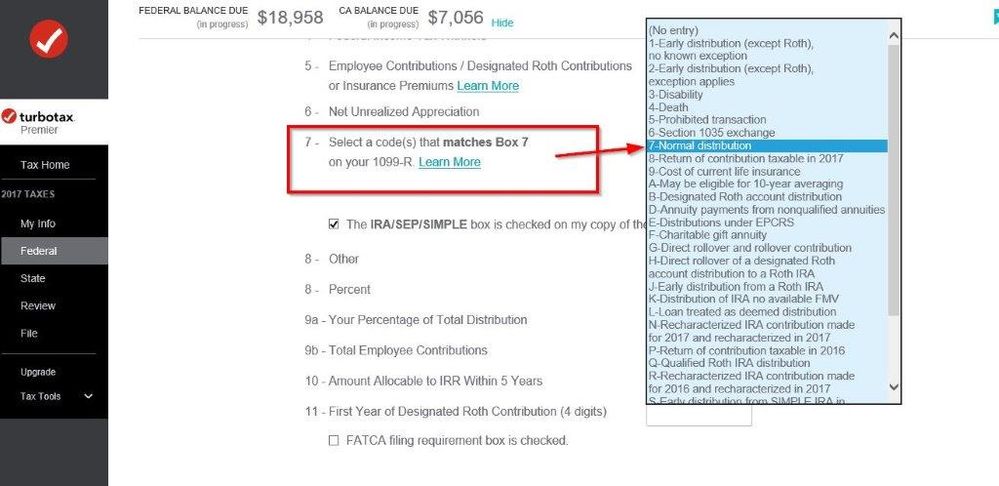

I suggest that you post the code 7 in box 7. A code 7 – Normal distribution is very common unless there is something unusual..

The code(s) in Box 7 of your 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

The description you had for code 7 above (Nondisability) is not a standard code. I suggest you contact you broker or plan administrator for that specific question.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT tax on line Form 1099-r Box wants distrib code from list but its not on list and tt won't let me proceed What to do?I

Thanks for your reply. Unfortunately, tt online version just will not allow me to proceed. I am unable to proceed. I'm thinking I may have to abandon tt on line for doing my 2019 (2020) return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT tax on line Form 1099-r Box wants distrib code from list but its not on list and tt won't let me proceed What to do?I

@anacostxx1 wrote:

Thanks for your reply. Unfortunately, tt online version just will not allow me to proceed. I am unable to proceed. I'm thinking I may have to abandon tt on line for doing my 2019 (2020) return.

Did you read my post.

Enter the "7" only in box 7. If this is a CSA 1099-R be sure that you choose the CSA 1099-R type.

If you did not then delete the 1099-R and re-enter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT tax on line Form 1099-r Box wants distrib code from list but its not on list and tt won't let me proceed What to do?I

1099R box 7 code 7 for non disability means it is a normal distribution. Pick 7

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT tax on line Form 1099-r Box wants distrib code from list but its not on list and tt won't let me proceed What to do?I

CSA 1099R box 7

#7 nondisability is not a selection, whatn do I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT tax on line Form 1099-r Box wants distrib code from list but its not on list and tt won't let me proceed What to do?I

Can't you just pick code 7? Don't worry about the description. The code for box 7 is usually a 7 (same as the box #). Nondisability means normal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT tax on line Form 1099-r Box wants distrib code from list but its not on list and tt won't let me proceed What to do?I

That is probably a CSA 1099-R from OPM.

OPM violates the 1099-R rules by writing "helpful" information in the box rather than just the value or code like they are supposed to. OPM has done that for years and it causes more confusion than help. They put UNKNOWN in box 2a when it should be blank, and put "7 NONDISABILITY" in box 7 when is should only be "7", "1" or "2".

The taxable amount in box 2a is usually the box 1 amount unless you have after-tax contributions in the retirement plan and use the simplified method. If this is NOT the first year of receiving payments, then you should use the same method that was used last year - either the box 1 amount or the simplified method, using the carry forward simplified information from last year.

If box 2a is blank or UNKNOWN then there should be amount in box 9b to use with the simplified method. If no amount in 9b then contact OPM to find the account "basis".

Enter a 1099-R here:

Federal Taxes,

Wages & Income

I’ll choose what I work on (if that screen comes up),

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "1099-R" which will take you to the same place.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return.

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R.

[NOTE: When you get to the "Your 1099-R Entries" screen where you can add another 1099-R, use "continue" to keep going as there are additional interview questions after that screen in most cases. You can always return as shown above.]

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

bfordmn

New Member

irs2018ttax

New Member

d4jesus2017

New Member

bettydom74

New Member

db82e1acdf5b

New Member