- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: The Federal Tax program doesn't allow another 1099r entry without asking for my banks name or URL. How can I enter another 1099r?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The Federal Tax program doesn't allow another 1099r entry without asking for my banks name or URL. How can I enter another 1099r?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The Federal Tax program doesn't allow another 1099r entry without asking for my banks name or URL. How can I enter another 1099r?

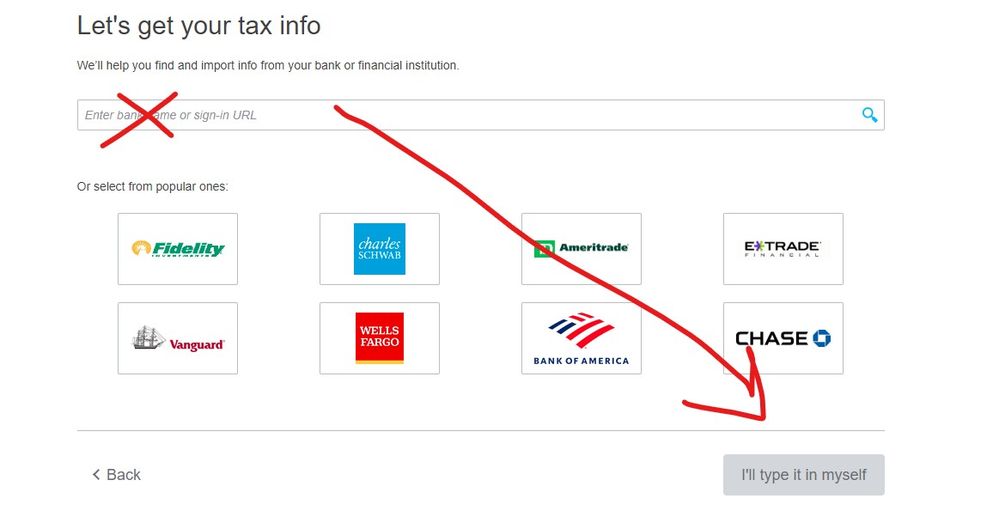

Did you try the option to enter the name yourself at the bottom of the screen ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The Federal Tax program doesn't allow another 1099r entry without asking for my banks name or URL. How can I enter another 1099r?

Yes, I attempted this step but I was advised my bank was not available to provide necessary information until January 31st. Therefore I am at a standstill until then

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The Federal Tax program doesn't allow another 1099r entry without asking for my banks name or URL. How can I enter another 1099r?

That is correct for that specific 1099-R from that bank. If the bank has not made it available for you (paper or online or import) then you cannot enter it yet. However, If you need to enter another 1099-R from a different bank for which you have a paper copy or is available online or importable you can advance with these steps:

1. Click Federal on left hand menu

2. Click Income & Expenses tab at top of the page

3. Scroll down to IRA, 401K, Pension Plan Withdrawals (1099-R) section

4. Click Edit/Add

5. Click Add another 1099-R

6. Answer the PDF question and click Continue

7. If no PDF then select Import or I'll Type it Myself as applicable

8 If you have PDF, then follow instructions to upload.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

javierpz

New Member

albaprecious09

New Member

utahdog

New Member

user674027142

New Member

needtaxhelp808

New Member