- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Not a bug. Under the new Federal tax law, the State/Local...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There is a bug in TurboTax. It is subtracting the amount shown on the Deduction line "State & Local taxes greater than $10,000. It's not supposed to do this.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There is a bug in TurboTax. It is subtracting the amount shown on the Deduction line "State & Local taxes greater than $10,000. It's not supposed to do this.

Not a bug.

Under the new Federal tax law, the State/Local/Sales/Property tax deduction is capped at $10,000 total.

The program subtracts any excess that you claimed over this amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There is a bug in TurboTax. It is subtracting the amount shown on the Deduction line "State & Local taxes greater than $10,000. It's not supposed to do this.

Not a bug.

Under the new Federal tax law, the State/Local/Sales/Property tax deduction is capped at $10,000 total.

The program subtracts any excess that you claimed over this amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There is a bug in TurboTax. It is subtracting the amount shown on the Deduction line "State & Local taxes greater than $10,000. It's not supposed to do this.

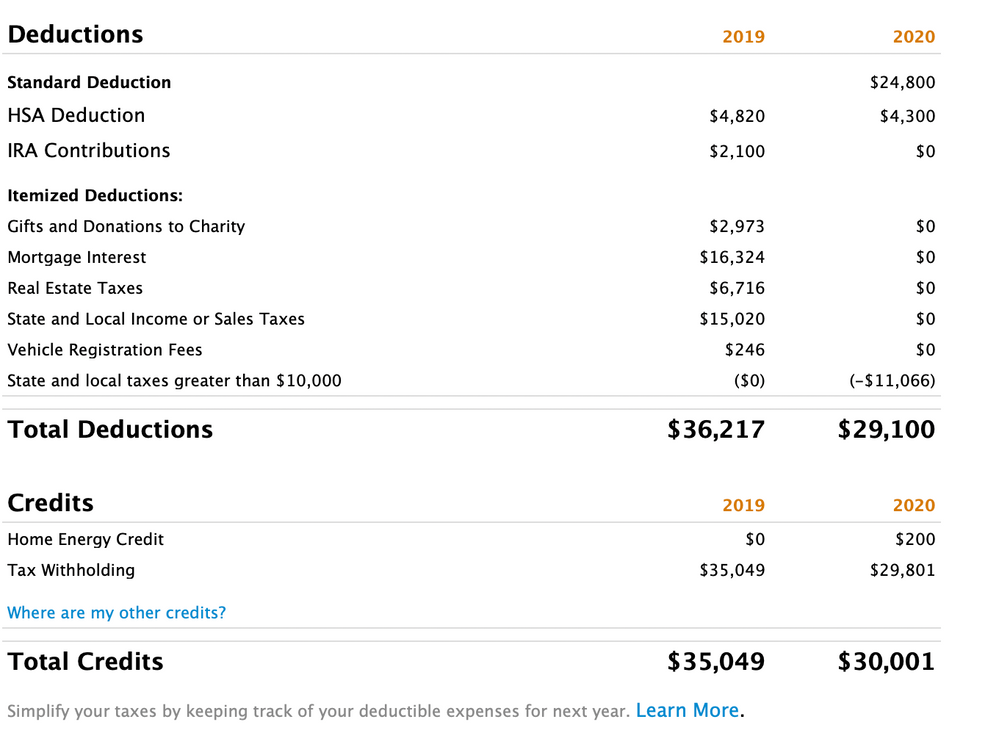

I don't understand this answer. Nothing has been deducted yet. Shouldn't it use the $10,000 as a deduction instead of subtracting the overage from your deductions? My total state and property taxes is $21,120 and they're subtracting $11,066. Why wouldn't it just add the $10,000 maximum to my deductions?

SryaninCalif

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There is a bug in TurboTax. It is subtracting the amount shown on the Deduction line "State & Local taxes greater than $10,000. It's not supposed to do this.

It's just showing you that you couldn't use the $11,066. It's the same as adding the 10,000. You entered the full 21,120 so it has to subtract 11,066. But something is off. It should be subtracting 11,120 to give you the 10,000 max.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There is a bug in TurboTax. It is subtracting the amount shown on the Deduction line "State & Local taxes greater than $10,000. It's not supposed to do this.

Look at this and see how it differed from last year. Last year I had more state taxes. Didn't this new limit go into effect a few years ago.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There is a bug in TurboTax. It is subtracting the amount shown on the Deduction line "State & Local taxes greater than $10,000. It's not supposed to do this.

I dont know why it's showing that. But it doesn't matter. You are getting the Standard Deduction this year. Some of the review and summary screens are hard to understand. They try to show you everything and too much. Just make sure your actual 1040 is right.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There is a bug in TurboTax. It is subtracting the amount shown on the Deduction line "State & Local taxes greater than $10,000. It's not supposed to do this.

Even with the $10,000 max on state taxes, my itemized deductions are higher than the standard. I'll keep working on it. I see that it also reduced my mortgage interest by almost $5,000. Thank you anyway.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There is a bug in TurboTax. It is subtracting the amount shown on the Deduction line "State & Local taxes greater than $10,000. It's not supposed to do this.

There is a question or two you have to answer to get the mortgage interest deduction. Like maybe put in your ending balance. Make sure you answer that the loan is secured by the property. Go back through that section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

There is a bug in TurboTax. It is subtracting the amount shown on the Deduction line "State & Local taxes greater than $10,000. It's not supposed to do this.

Thank you for your help. I did find something in my mortgage interest and it corrected everything. I don't know why it would've affected it the way it did. We refinanced our loan in 2020 and then the loan was transferred to another company. We had 3 1098's. I found a note for "multiple" 1098s that says add them all together and enter them. It seems weird, but I did and it fixed everything. Thank you again for your answers, because they did lead me to investigate further.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

xxzero8---

New Member

dixieblossom@com

New Member

Paulhassell336

Returning Member

mal03281

New Member

hgtaber

Level 1