- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: I got a 1099R for withdrawing early from my Roth IRA to pay for my wife's tuition. Where can I report this to avoid the penalty for withdrawing early?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a 1099R for withdrawing early from my Roth IRA to pay for my wife's tuition. Where can I report this to avoid the penalty for withdrawing early?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a 1099R for withdrawing early from my Roth IRA to pay for my wife's tuition. Where can I report this to avoid the penalty for withdrawing early?

Once you enter the distribution information from your 1099-R form, TurboTax will guide you through any exceptions that could reduce the tax.

Unless you qualify for an exception, you’ll pay a 10% additional tax penalty on the taxable amount of early distributions from an IRA (traditional or Roth) before reaching age 59 1/2.

There are exceptions to the 10% tax penalty for early distributions:

- Death or total and permanent disability

- Series of substantially equal periodic payments based on life expectancy

- Qualified first-time homebuyer distributions up to $10,000

- Qualified higher-education expenses

- Certain medical insurance premiums paid while unemployed

- Unreimbursed medical expenses that are more than a certain amount of your adjusted gross income

- IRS levy

- Certain distributions to qualified military reservists called to active duty

- COVID-19 coronavirus-related distributions of up to $100,000 from January 1 to December 30, 2020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a 1099R for withdrawing early from my Roth IRA to pay for my wife's tuition. Where can I report this to avoid the penalty for withdrawing early?

First withdrawing you own Roth contributions and not taxable or subject to penalty, only if earnings were distributed would they be. You can exclude up to $10,000 of the earnings if it was for education. TurboTax will ask "If you can lower your tax bill" and give you a list of exceptions. Enter up to $10,000 of earnings distributed only, not your own contributions distributed.

You can always withdraw your own Roth contributions tax and penalty free.

Enter a 1099-R here:

Federal Taxes,

Wages & Income

I’ll choose what I work on (if that screen comes up),

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "1099-R" which will take you to the same place.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return.

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R.

[NOTE: When you get to the "Your 1099-R Entries" screen where you can add another 1099-R, use "continue" to keep going as there are additional interview questions after that screen in most cases. You can always return as shown above.]

One of the followup questions will ask for your prior year** contributions not previously withdrawn. Those contributions that still remain in the Roth will not be taxed or subject to a early withdrawal penalty. That will add a 8606 form to your tax return with the Roth contribution and tax calculation in part III.

Note: **Prior year - any current year Roth contributions should be entered into the IRA contributions section. They will not show up in the prior years contributions but will be accounted for on the 8606 form that calculates the taxable amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a 1099R for withdrawing early from my Roth IRA to pay for my wife's tuition. Where can I report this to avoid the penalty for withdrawing early?

Thank you for the advice. Unfortunately, even after sifting through all the options that I could, I was unable to find those boxes that you described and couldn't show that the withdrawal went towards tuition.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a 1099R for withdrawing early from my Roth IRA to pay for my wife's tuition. Where can I report this to avoid the penalty for withdrawing early?

One more try! I don't want to see you pay more tax than required. The 10% penalty does not apply to you. It is a long way through the program! You must edit the 1099-R.

- Return to personal income,

- scroll down to Retirement

- Locate 1099-R

- Edit/update

- Box 7 code J for early Roth distribution, is this what you have? Maybe you have a different code?

- continue

- About the money, continue

- Did you inherit? continue

- What did you do? something else, continue

- Buy a home? no, continue

- back to 1099-R entries screen, continue

- Disaster distribution? no, continue

- Owned any Roth for 5 years? no, continue

- Withdraw before 2020? no

- Prior Year Contributions, enter amount

- Conversions?

- Excess Roth Contributions

- Tell us value of Roth, enter amount

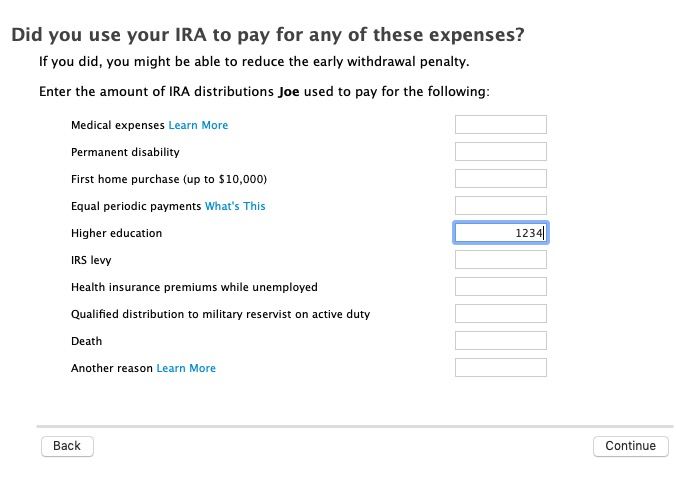

- Let's see if we can reduce your penalty, continue

- Identify the plan, qualified, continue

- These situations may lower your tax bill, enter the amount paid for tuition. You may need to use the Other box if qualified tuition is not showing for you.

- Good news, your tax bill got lower

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ualdriver

Level 3

ALIKA027

Level 1

thomasshay

New Member

Kinta1

New Member

rogerjbos

Level 2