- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: I forgot to file my taxes for 2019. All I have is a rrb-1099-r.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I forgot to file my taxes for 2019. All I have is a rrb-1099-r.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I forgot to file my taxes for 2019. All I have is a rrb-1099-r.

Yes? You can still efile a 2019 return until Oct. 15, 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I forgot to file my taxes for 2019. All I have is a rrb-1099-r.

Go to Federal> Wages & Income>>Retirement Plans and Social Security (SSA1099 and 1099RRB) to enter your SSA1099 or RRB1099

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I forgot to file my taxes for 2019. All I have is a rrb-1099-r.

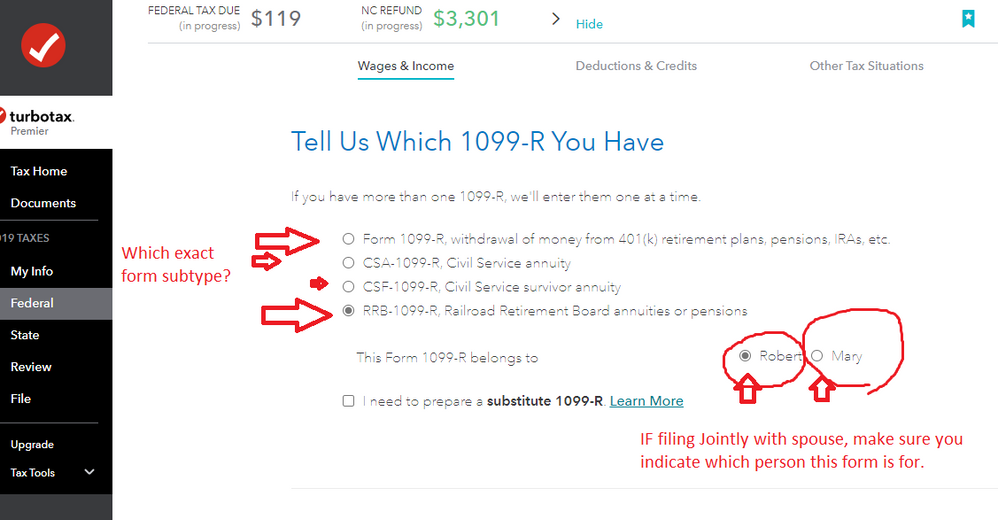

Careful though....the RRB-1099 and RRB-1099-R are different forms.

1) The RRB-1099 goes in at the same spot as an SSA-1099

2) The RRB-1099-R goes in with the other 1099-R forms, and when you start into that section, you will select the RRB-1099-R as a sub-selection.

_____________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I forgot to file my taxes for 2019. All I have is a rrb-1099-r.

Don’t wait. File your taxes ASAP. Just follow the instructions in TurboTax.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Ver13-boten

New Member

harrybb15

New Member

rjpm65

New Member

Bholden229

New Member

glh-georgeharris

New Member