- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: I definitely qualify for the retirement savings contribution credit (saver's credit), but when I click through that section it says I'm ineligible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I definitely qualify for the retirement savings contribution credit (saver's credit), but when I click through that section it says I'm ineligible.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I definitely qualify for the retirement savings contribution credit (saver's credit), but when I click through that section it says I'm ineligible.

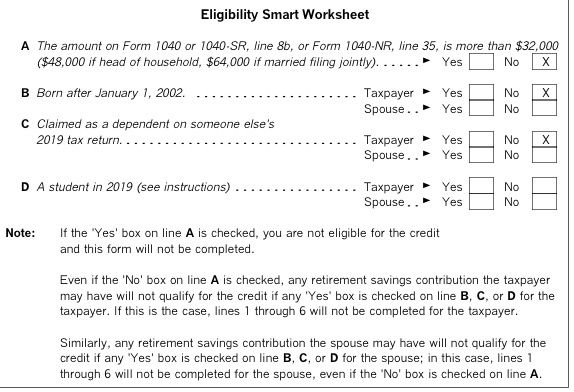

It should tell you the reason.

These are the basis checks that are made.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I definitely qualify for the retirement savings contribution credit (saver's credit), but when I click through that section it says I'm ineligible.

It does not tell me why. I was just on the phone with a turbotax person for 46 minutes and they couldn't figure it out - they think its a glitch in the system. Should hear back from them tomorrow about it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I definitely qualify for the retirement savings contribution credit (saver's credit), but when I click through that section it says I'm ineligible.

Unless a bug was introduced recently, it's doubtful that TurboTax is misbehaving. Many times when someone thinks that they qualify for the credit they actually don't, often because they have no income tax against which to apply the credit for which they would otherwise qualify. The credit is a nonrefundable credit which can only be applied to reduce income tax, but not below zero, not to any other taxes such as self-employment tax or penalties on early retirement distributions.

If the TurboTax rep could not identify a specific problem in a short amount of time by simply examining Form 8880, they probably didn't have the familiarity with this credit needed to understand the problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I definitely qualify for the retirement savings contribution credit (saver's credit), but when I click through that section it says I'm ineligible.

I do owe federal tax and the savers credit should be taking care of about half of it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I definitely qualify for the retirement savings contribution credit (saver's credit), but when I click through that section it says I'm ineligible.

Your post indicates that you are using TurboTax Self Employed, so I assume that you are reporting income from self employment. Your federal tax is comprised of the sum of income tax and self-employment tax, but this credit can only be applied against income tax. If your income tax on Form 1040 line 12b minus any credits on Schedule 3 lines 1 through 3 is zero, you do not qualify for the credit. All of the calculations are done on Form 8880 with the help of the Line 11 Credit Limit Smart Worksheet used to determine if you have income tax against which to apply this credit.

If you think that there is a calculation error on Form 8880, what line has the erroneous amount?

If the amount on line 12 of Form 8880 is nonzero, indicating that you qualify for this credit, is this amount propagating to Schedule 3 line 4?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I definitely qualify for the retirement savings contribution credit (saver's credit), but when I click through that section it says I'm ineligible.

Thanks for the response. I can’t find anything online describing the savers credit that differentiates self employed income from non self employed income. Can you?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I definitely qualify for the retirement savings contribution credit (saver's credit), but when I click through that section it says I'm ineligible.

For instance I’m reading an article on Microsoft.com by Stephen fishman called tax credits the self employed should know about that has a paragraph about the savers credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I definitely qualify for the retirement savings contribution credit (saver's credit), but when I click through that section it says I'm ineligible.

@hattymarris wrote:

Thanks for the response. I can’t find anything online describing the savers credit that differentiates self employed income from non self employed income. Can you?

The Savers Credit itself it not any different. For both types of income it is a credit that is applied to the tax on the 1040 line 13b. It is how that tax on line 13b is arrived at that is different for Self Employed Income. And the credit can be limited by the 1040 line 8b (AGI) that can be different for SE income.

The IRS rules for the 1040, 8880 and schedule 3 show how it is handled differently as user dmertz pointed out.

You can print all forms and schedules and see the 8880 and 1040 calculations yourself. We do not know what is limited your credit since we cannot see your tax return - only you can see that. We can only offer possibilities.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I definitely qualify for the retirement savings contribution credit (saver's credit), but when I click through that section it says I'm ineligible.

Income from self-employment is subject to two different taxes, income taxes and self-employment taxes, both of which are assessed on your federal tax return. Self-employment taxes are the self employment equivalent of FICA (Social Security and Medicare taxes) and are not permitted to be reduced by the Retirement Savings Contributions Credit. Only income taxes can be reduced by this credit.

If your deductions and any other tax credits have already resulted in your income taxes being reduced to zero, there is nothing left to which to apply the credit, so you don't get any of the credit, even though you may still owe self-employment taxes (which is not an income tax). If line 12b of Form 1040 minus any amounts on Schedule 3 lines 1 though 3 is zero or less, you do not qualify for the Retirement Savings Contributions Credit. Simply look at these forms to see if this is what is happening, which seems likely.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I definitely qualify for the retirement savings contribution credit (saver's credit), but when I click through that section it says I'm ineligible.

The savers credit is a non refundable credit. Which means it can only reduce your regular income tax liability to zero but not create a refund. It is only applied to your personal income tax not your self employment tax.

Look at the 1040. The credit is on schedule 3 which goes to 1040 line 13b. It is subtracted from your tax on line 14. Line 14 can only go down to zero. THEN the self employment tax is added on line 15 after line 14.

The kind of income doesn't matter. It is the kind of TAX you are paying. You can reduce your income tax to zero but not the self employment tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I definitely qualify for the retirement savings contribution credit (saver's credit), but when I click through that section it says I'm ineligible.

Got it, thanks everyone. I was misled into contributing to an IRA to try to reduce my self employment taxes. So now I basically need to withdraw the IRA to pay my taxes. Is it true that this doesn't count as an early withdrawal of an IRA since I won't be deducting those contributions anywhere on my taxes (they were contributions for 2019)? Or how does that work?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I definitely qualify for the retirement savings contribution credit (saver's credit), but when I click through that section it says I'm ineligible.

Presumably you have not yet filed your 2019 tax return. By July 15, 2019 did you request a filing extension?

Is this money (and any investment gains on this money) the only money you have in traditional IRAs?

The answers to these questions are needed to determine your options and tax consequences for taking out some or all of the contribution.

Had you been eligible for the credit, the maximum possible credit would have been 50% of the amount that you contributed. Since the amount that you expected to be your credit is less than the amount that you contributed, to have sufficient funds to pay your balance due you should not have to obtain a distribution of any more than 50% of what you contributed, perhaps less. For the amount that you don't need to take out to fund your balance due, it would be beneficial to recharacterize that portion to be a Roth IRA contribution instead, if possible.

Note that if you have a balance due you'll probably also owe a late-payment penalty and interest on the late payment. (The due date of the payment of the balance was July 15, 2020.) The IRS will bill for that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I definitely qualify for the retirement savings contribution credit (saver's credit), but when I click through that section it says I'm ineligible.

Yes I filed an extension and know about the late fees etc. I was planning on the saver's credit wiping out a little over half of my tax bill. Yes 2019 was the first year I put money in an IRA and have contributed a tiny bit to it for 2020 as well. Thanks for the help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I definitely qualify for the retirement savings contribution credit (saver's credit), but when I click through that section it says I'm ineligible.

In my earlier comments I have assumed that the contribution was to a traditional IRA. Assuming that that is the case, perhaps a better approach would be to recharacterize some or all of your 2019 contribution to be a Roth IRA contribution instead (perhaps retaining as a traditional IRA contribution whatever amount of your 2019 contribution minimizes your tax liability), then take a regular distribution (not a return of contribution) from the Roth IRA of the amount needed to pay the taxes. A regular distribution from the Roth IRA comes first from your contributions tax and penalty free, so the attributable earnings could remain in the Roth IRA account and not be subject to tax or penalty.

If the original contribution was to a Roth IRA, you could simply obtain a regular distribution from that account.

The downside of obtaining a regular distribution from a Roth IRA is that for several years it reduces the amount of contributions that can be considered for the Retirement Savings Contributions Credit. Obtaining a return of your 2019 contribution would only reduce the amount of contribution considered for this credit for 2019.

Whether you recharacterize or obtain a return of some portion of your contribution, since you have contributed some for 2020 to the same account, the calculation of the earnings attributable to the 2019 contribution being returned is a bit more complicated that it otherwise would have been and may be further complicated if you made multiple contributions for 2019 on different dates and you are not obtaining a return of the entire amount contributed for 2019. The calculation is described in detail in CFR 1.408-11:

https://www.law.cornell.edu/cfr/text/26/1.408-11

Generally, the IRA custodian will perform the calculation of attributable earnings when you tell them the amount of your original 2019 contribution that you want returned or recharacterized.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

simplyquigley

New Member

VAer

Level 4

hynrel53

New Member

valleybuy

Level 3

bethfly

New Member